An Ohio Trailer Bill of Sale is a document that provides legal proof of the change of ownership for a carrying platform. It features essential information related to the transaction and covers the details of the trailer.

Regardless of trailer weight, Ohio residents must follow the registration requirements for legal use on public roads.

REQUIREMENTS

Bill of Sale: Not Required

Registration: Required

Title: Not Required

Insurance: Not Required

Signing: Buyer and seller

LAWS

Statutes: Chapter 4503

Registering a Trailer in Ohio

According to the Ohio Bureau of Motor Vehicles, trailer registration requirements vary depending on the trailer’s size, weight, and intended use. Noncommercial trailers must weigh less than 10,000 pounds, and those under 4,000 pounds need not register.

Commercial trailers must register for use on Ohio roads. If the commercial trailer weighs more than 4,000 pounds, it has different requirements than a commercial trailer that weighs 4,000 pounds or less.

You must complete your registration at your municipality’s Deputy Registrar License Agency (DR). Affidavit forms are only available at your local deputy registrar license agency.

What Paperwork Is Required To Register a Trailer in Ohio?

If you need to register a non-commercial trailer over 4,000 pounds and under 10,000 pounds, you will need your Ohio driver’s license or state ID and a copy of your Ohio trailer bill of sale. Ohio also requires proof of weight in the form of one of the following documents:

- Official Weight Slip

- Manufacturer’s Certificate of Origin (MCO)

- Manufacturer’s Statement of Origin (MSO)

- Notarized Affidavit of Original Weight

Commercial trailers over 4,000 pounds require an Ohio Certificate of Title or Memorandum of Title. For commercial trailers of 4,000 pounds or less, you must provide one of the following:

- North Dakota trailer bill of sale

- MSO

- Notarized Proof of Purchase Affidavit

You must also give your business tax ID or proof of your Social Security number. A verbal declaration of weight is sufficient for commercial trailers.

Trailer Registration Fees

Ohio calculates trailer registration fees based on weight. Non-commercial trailers have a specific registration fee schedule. Commercial trailer owners can choose one-year, multiple-year, or permanent registration, and costs are adjusted accordingly.

Other charges you may pay to register a trailer in Ohio include the following:

- Deputy Registrar fee

- Permissive tax

- Title fees

- Service fees

- Notary public fees

- Additional state taxes [1]

- County taxes [2]

- Temporary tag fee

- Plate mailing fee

Registration fees and taxes are subject to change, so it is best to speak with your local DR to determine the exact amount you owe for your trailer registration.

Exemptions

Some situations and uses exempt vehicles from registration or sales and use taxes in Ohio.

For example, disabled veterans, congressional medal of honor awardees, or prisoners of war (POWs) are exempt from boat trailer registration taxes and service fees [3] .

Specific farm equipment is also exempt from registration [4] .

O.R.C. § 5739.02 also lists exemptions to state sales tax. If you are unsure whether your trailer is exempt from sales and use tax or registration requirements, contact a DR near you.

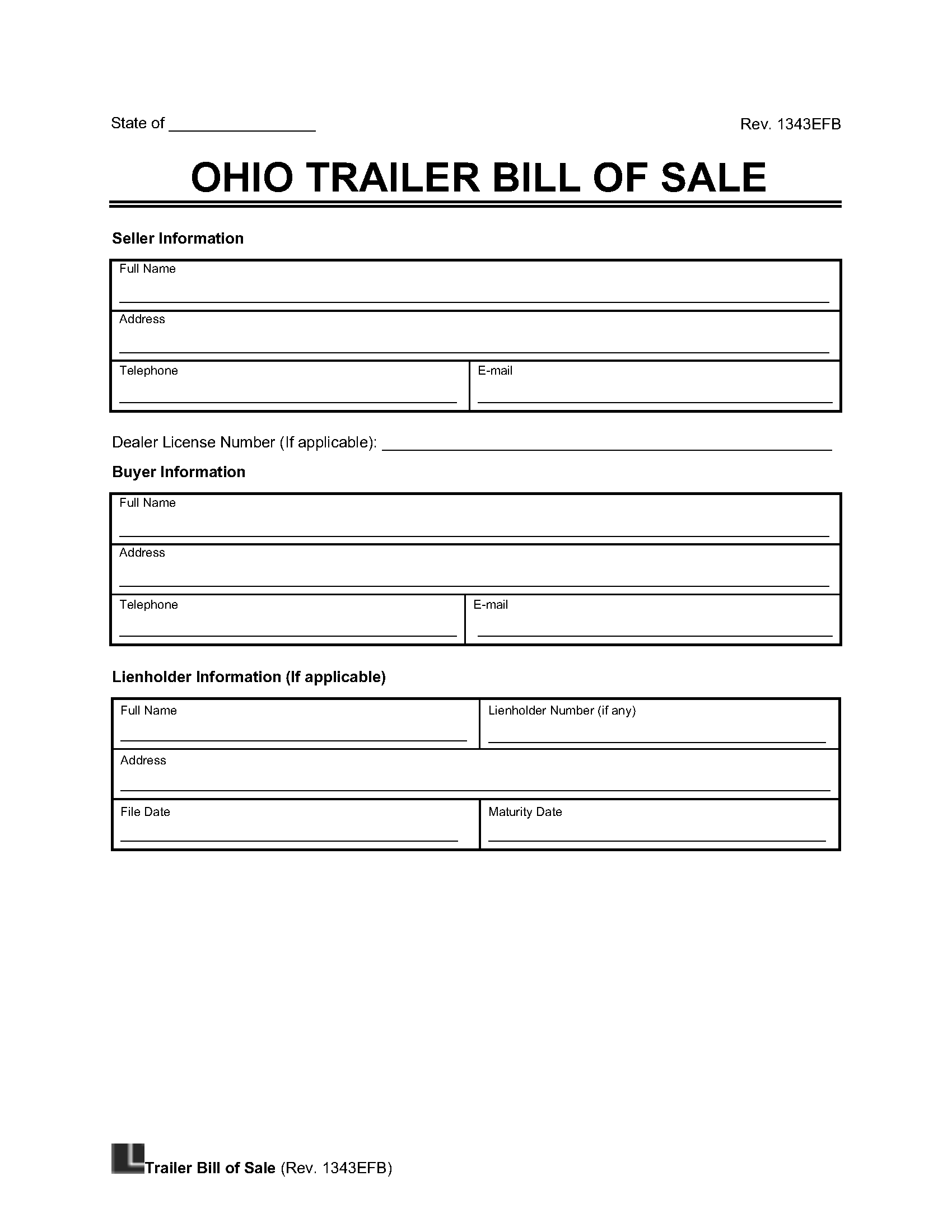

Ohio Trailer Bill of Sale Sample

Download an Ohio trailer bill of sale template below in PDF or Word format: