Can You Force Debt Collectors to Stop Calling You?

Yes. Under the FDCPA, you have the right to tell a debt collector to stop contacting you. Once they receive your cease and desist letter, they must stop calling, texting, or emailing—except to inform you about legal action.

However, sending this letter does not erase the debt. The collector can still pursue legal action or sell the debt to another agency.

When to Send a Cease and Desist Letter to a Debt Collector

If debt collectors are harassing you or violating your rights, sending a cease and desist letter can stop their contact immediately. Send a letter when:

- You’re experiencing harassment or threats through repeated calls, intimidation, or abusive language.

- You don’t owe the debt and the collector refuses to provide verification.

- The debt is past the statute of limitations and they can no longer sue you.

- Your request for debt validation was ignored, and they continue collection attempts.

- You want all communication to stop, understanding they may still pursue legal action.

If you’re facing threats, intimidation, or repeated harassment, a cease and desist harassment letter may better address your situation.

Is a Cease and Desist Letter to a Collection Agency Legally Enforceable?

A cease and desist letter is not a legally binding document, but it is a powerful tool under the FDCPA. Once the agency receives your letter, they are legally required to stop all further communication except to:

- Confirm they received your request

- Notify you of legal action, such as a lawsuit

If they continue to harass you after receiving your letter, you may be able to sue them for violating federal law.

How to Stop Debt Collectors from Contacting You

If you’re tired of collection agencies calling you, here are effective ways to make them stop:

1. Send a Cease and Desist Letter

This formally demands they stop contacting you. It’s your strongest legal tool under the FDCPA.

2. Request Debt Validation

If you don’t recognize the debt, request a debt validation letter within 30 days of first being contacted. If they can’t prove you owe it, they must stop collection efforts.

3. Report Violations

If a debt collector is violating the FDCPA, file a complaint with:

- The Consumer Financial Protection Bureau (CFPB)

- The Federal Trade Commission (FTC)

- Your state’s attorney general’s office

4. Check the Statute of Limitations

Each state has a time limit for debt collection lawsuits. If the debt is too old, the collector can’t sue you, and you may not have to pay.

5. Add Your Number to the National Do Not Call Registry

While this doesn’t stop all collection calls, it can reduce the number of unwanted calls.

Before sending a cease and desist letter, ensure the debt is valid. A debt validation letter forces collectors to prove you owe the debt before they can continue collection efforts.

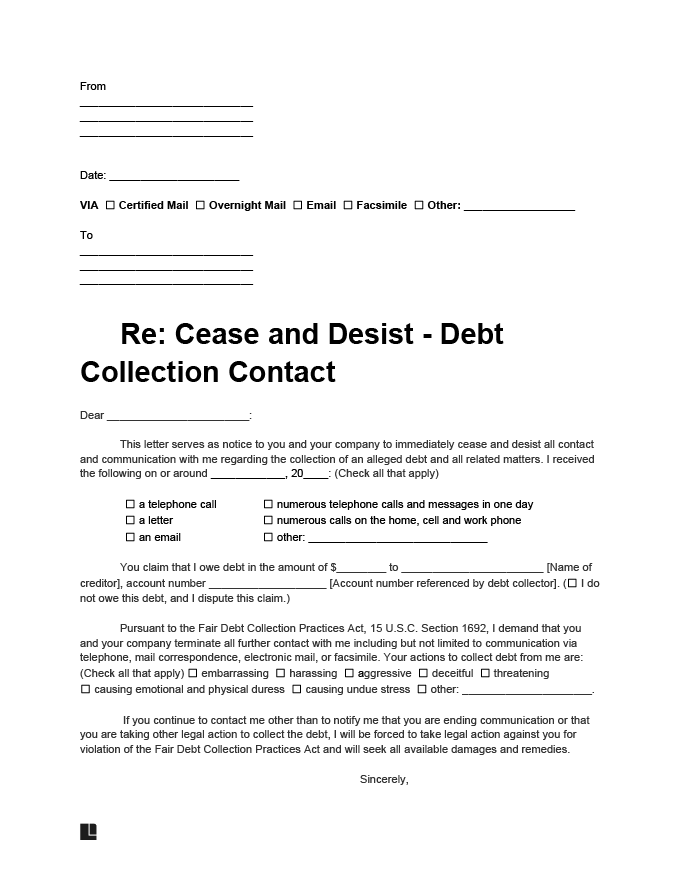

How to Write a Cease and Desist Letter to a Debt Collector

Your cease and desist letter must be clear, direct, and legally sound to effectively stop debt collectors from contacting you. Follow these steps to draft a letter that enforces your rights under the FDCPA.

- Include your contact information: Your name, address, and phone number

- Add the debt collector’s details: Name, agency, and mailing address

- State your cease and desist request: Clearly demand they stop all communication

- Mention FDCPA protections: Reference the law that supports your request

- Specify any violations: If they’ve harassed or threatened you, document it

- Indicate acceptable contact methods (if any): State whether you allow written notices

- Sign and date the letter: Ensure it’s legally valid

- Send it via certified mail: Get proof that they received it

1. Include Your Contact Information

Your letter should begin with your full name, mailing address, and phone number (optional). This ensures the collector knows who the request is coming from and allows them to properly process it.

2. Add the Debt Collector’s Contact Information

Include the name of the collection agency, their address, and any account number related to the debt. This helps avoid confusion and ensures the correct account is flagged for ceased communication.

3. State Your Cease and Desist Request

Make it clear that you want all communication to stop immediately as permitted under the FDCPA (15 U.S.C. § 1692c(c)). The agency can only contact you again to confirm receipt of your request or notify you of legal action.

4. Mention FDCPA Protections

Cite your legal rights under the FDCPA, emphasizing that continued harassment or unlawful contact violates federal law. This strengthens your position and discourages further misconduct.

5. Specify Any Violations (If Applicable)

If the collector has threatened, harassed, or misrepresented information, briefly outline these violations. Mention any excessive calls, intimidation, or failure to validate the debt.

If a debt collector is making false claims about a person’s financial history, a defamation cease and desist letter may be an alternative option.

6. Indicate Acceptable Contact Methods (If Any)

If you only wish to receive written notices (such as debt validation or lawsuit updates), specify this in your letter. Otherwise, state that all communication must cease entirely.

7. Sign and Date the Letter

Your signature and date formally validate the request. Without this, the letter may not be processed correctly.

8. Send It via Certified Mail

For legal proof of delivery, send your letter via certified mail with a return receipt requested. This ensures you have documented evidence that the collection agency received your cease and desist request.

Keep a copy of your letter and mailing receipt in case the collector continues contacting you, as this may be grounds for legal action.

Debt Collector Cease and Desist Letter Sample

Below, you can see a debt collector cease and desist letter sample in PDF format. You can customize this template in our document editor.

What Happens After You Send a Cease and Desist Letter?

Once the debt collector receives your letter:

- They must stop contacting you immediately, except to notify you of legal action.

- They may sell your debt to another agency, restarting the process.

- If they continue to harass you, you can sue them for FDCPA violations.

If you receive written confirmation that they will no longer contact you, keep this for your records.

Take Control of Debt Collection Calls

A cease and desist letter to debt collectors is a powerful way to stop harassing debt collection calls and assert your rights under the FDCPA. While it won’t eliminate your debt, it legally requires collectors to stop contacting you unless they take legal action.

With our document editor, you can quickly create a legally valid cease and desist letter that protects you from unwanted communication. Customize, download, and send your letter with confidence today.

Frequently Asked Questions

Can I send a cease and desist letter to a debt collector?

Yes. Under the FDCPA, you have the legal right to demand that a debt collector stop contacting you. Once they receive your cease and desist letter, they can only contact you to confirm receipt or notify you of legal action.

Does sending a cease and desist letter stop a lawsuit?

No. A cease and desist letter only stops communication—it does not cancel your debt. If the collector wants to sue you, they still can. Always check if the debt is within the statute of limitations before sending your letter.

How do I send a cease and desist letter to a debt collector?

For proof of delivery, send your letter via certified mail with a return receipt requested. This ensures you have evidence that the collection agency received your request.