A divorce settlement agreement (or a marital settlement agreement) helps two divorcing spouses by detailing the division of assets and spousal support. Before the spouses write the agreement, they must fully disclose all their assets to ensure a fair writing process. Once they agree, a judge must approve the final document to ensure it’s fair to both parties.

What Does It Cover?

A divorce agreement can cover the following information:

- Alimony

- The division of debt and assets

- Child custody and support

What Is a Divorce Settlement Agreement?

A divorce settlement agreement is a written document between separating spouses that outlines, with specificity, all their agreements concerning the division of their property, assets, and debts. It also describes their arrangements for alimony and child support, if applicable, once their divorce becomes final.

You can’t initiate or finalize a divorce with just a divorce agreement. Once you and your former partner write this agreement, you can merge it with a proposed divorce decree. Then, a judge can legally execute and enforce it through your local court.

Using a divorce settlement checklist can help you understand what you need to plan for before you start writing your agreement.

Divorce Laws

Here are some divorce laws to help guide you through the process of legally dissolving your marriage:

Division of Property

A couple can decide on the division of property without involving a third party if they can reach a mutual agreement. If a couple has a prenuptial agreement, this document will override property distribution laws if written according to their state’s laws.

If you and your spouse can’t agree on how to divide property or don’t have a prenup, the court can divide marriage property via one of two laws depending on where you live:

1. Equitable Distribution Law

Under equitable distribution law, the court divides the assets of a marriage equitably but not necessarily equally. It considers multiple factors, including the length of the marriage, each spouse’s financial contributions during the marriage, who has primary custody of the children, and each spouse’s financial needs, when deciding on an equitable distribution.

The following 41 states implement the equitable distribution law in divorce courts:

- Alabama

- Alaska *

- Arkansas

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota *

- Tennessee *

- Utah

- Vermont

- Virginia

- West Virginia

- Wyoming

* In these states, couples can choose if they want to make their property community property.

Relevant Laws: Uniform Marriage & Divorce Act § 307

2. Community Property Law

Community property law divides the assets and debts of a divorce between the two spouses equally.

Only nine states implement community property laws in divorce court, which are the following:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Relevant Laws: IRM 25.18.1.2.2 ( Community Property Law)

Alimony

Alimony is an amount the higher-earning former spouse makes to the other individual for a specific period after the marriage.

The parties can calculate an alimony amount through mutual discussion of their incomes, the length of the marriage, and the number of dependents each individual has. The judge can review the alimony in the divorce agreement and decide whether to approve it.

Four types of alimony include the following:

- Temporary alimony: The supporting party has to pay the recipient until they’re officially divorced.

- Permanent alimony: The supporting party has to pay the recipient until the recipient gets remarried or either party passes away.

- Rehabilitative alimony: The supporting party has to pay the recipient until the recipient can seek employment and become more financially independent.

- Reimbursement alimony: The supporting party has to pay the recipient back for expenses they accumulated while married.

Child Support

Child support consists of the not-tax-deductible payments a non-custodial parent makes to the parent with custody of the children. It helps the custodial parent provide the proper care and support for the children, and it may include enough money to cover the children’s education costs or health/dental insurance.

States usually implement one of three models to decide how much child support the non-custodial parent should pay:

- Income Shares Model: This model is designed so the child receives the same percentage of their parents’ combined incomes as if they still lived together.

- Percentage of Income Model: This model is designed so the child support the non-custodial parent pays is only a percentage of their income.

- Melson Formula: This model is a more complex version of the Income Shares model because it considers multiple public policy judgments to meet the children’s and parents’ basic needs.

Explore each state’s guidelines for child support below:

| State | Child Support Guidelines | Guideline Model |

|---|---|---|

| Alabama | Rule 32. Child Support Guidelines | Income Shares |

| Alaska | Alaska R. Civ. P. 90.3 | Percentage of Obligor's Income |

| Arizona | ARS § 25-320 | Income Shares |

| Arkansas | AR Code § 9-12-312 | Income Shares |

| California | CA Fam Code § 3900 – § 3902 | Income Shares |

According to the Tax Cuts and Jobs Act, the parent with custody of the pair’s minor children is the automatic beneficiary for tax purposes. They can save up to $2,000 per dependent. However, you should note that only one former spouse can report the children as dependents for tax savings. Parties can come to a different decision within a divorce agreement.

Types of Divorce

There are two main types of divorce: at-fault and no-fault. At-fault requires one party to prove another party did something wrong, like committed adultery or cruelty toward their spouse. No-fault doesn’t require any proof that one party did something wrong.

All states offer no-fault divorces, but only 18 are true “no-fault” states, meaning that individuals can’t initiate a fault-based divorce. These 18 states are:

- California

- Colorado

- Florida

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Michigan

- Minnesota

- Missouri

- Montana

- Nebraska

- Nevada

- Oregon

- Washington

- Wisconsin

Only three states (Tennessee, Mississippi, and South Dakota) require mutual consent for a no-fault divorce.

Legal Separation

All U.S. states allow couples to legally separate before divorce, but legal separation laws differ between states.

No state requires couples to get legally separated before they divorce. However, legal separation might be a good idea so a couple can figure things out between them or maintain their marital benefits.

Waiting Period

Some states have minimum waiting period requirements for courts to issue final judgments regarding divorces:

| State | Waiting Period | Law |

|---|---|---|

| Alabama | 30 days | AL Code § 30-2-8.1 |

| Alaska | no waiting period | n/a |

| Arizona | 60 days | AZ Rev Stat § 25-329 |

| Arkansas | 30 days | AR Code § 9-12-310 |

| California | 6 months | CA Fam. Code § 2339 |

Residency

States have residency requirements for individuals before they can file for a divorce:

| State | Residency Requirement | Law |

|---|---|---|

| Alabama | 6 months if the defendant is a non-resident | AL Code § 30-2-5 |

| Alaska | Plaintiff must be an Alaskan resident; no minimum time requirement | AS § 25.24.08 |

| Arizona | One party must live in Arizona for 90 days | AZ Revised Stat. § 25-312 |

| Arkansas | Either spouse must reside in Arkansas for 60 days before filing; the filing spouse must live in the state for 3 months before the judge makes a decision | AR Code § 9-12-307 |

| California | One spouse must have lived in California for 6 months and in the county where the divorce was filed for 3 months | CA Fam. Code § 2320 |

Divorce Steps

If you’ve decided that you’d like to proceed with a divorce from your current partner, you can familiarize yourself with the steps involved in this process:

Step 1 – File the Divorce Petition

The first step in initiating the dissolution of your marriage is to file a divorce petition. You can fill out your divorce petition to indicate the grounds for your divorce, the involved parties, and the relief you seek.

File this document with the appropriate court in your jurisdiction. If you’re the one to file it, you become the petitioner. Your soon-to-be ex-spouse will be the respondent.

Step 2 – Notify Your Spouse of the Divorce

Notify your spouse of the divorce. They may discover when they’re served the divorce papers, but you can consider telling them sooner. Speak with your attorney for guidance on safely informing your spouse of an impending divorce.

Step 3 – Request Temporary Court Orders (If Necessary)

If you and your spouse disagree about matters like spousal support or the custody of your children, you can request temporary court orders. These orders will guide specific processes until your divorce is finalized.

Step 4 – Negotiate a Settlement

You and your spouse can have an open conversation to negotiate a settlement. If you agree on specific terms, you can save time and money that you’d otherwise spend in court. Come to a settlement via mediation with each other or negotiation through each of your attorneys.

Step 5 – Take the Divorce to a Final Trial

If you and your spouse can’t agree on some or all divorce-related matters, you may have to take the divorce to a final trial. Here, you can present your arguments, show your evidence, and have witnesses speak to support your case.

A mutual consent divorce can help you avoid going to court, but you and your partner may not be able to agree on everything. In this case, you can take some aspects to trial.

Step 6 – Receive a Final Judgment

A judge will make a final decision and release the terms of your divorce, including matters relating to child support, child custody, and property division. At this point, the divorce is finalized, and you and your spouse are no longer married to one another.

Divorce Agreement Sample

View our divorce agreement template below and download it in PDF or Word format to create your own.

How to Write a Divorce Settlement Agreement

Here’s a list of steps on how to write a divorce settlement agreement:

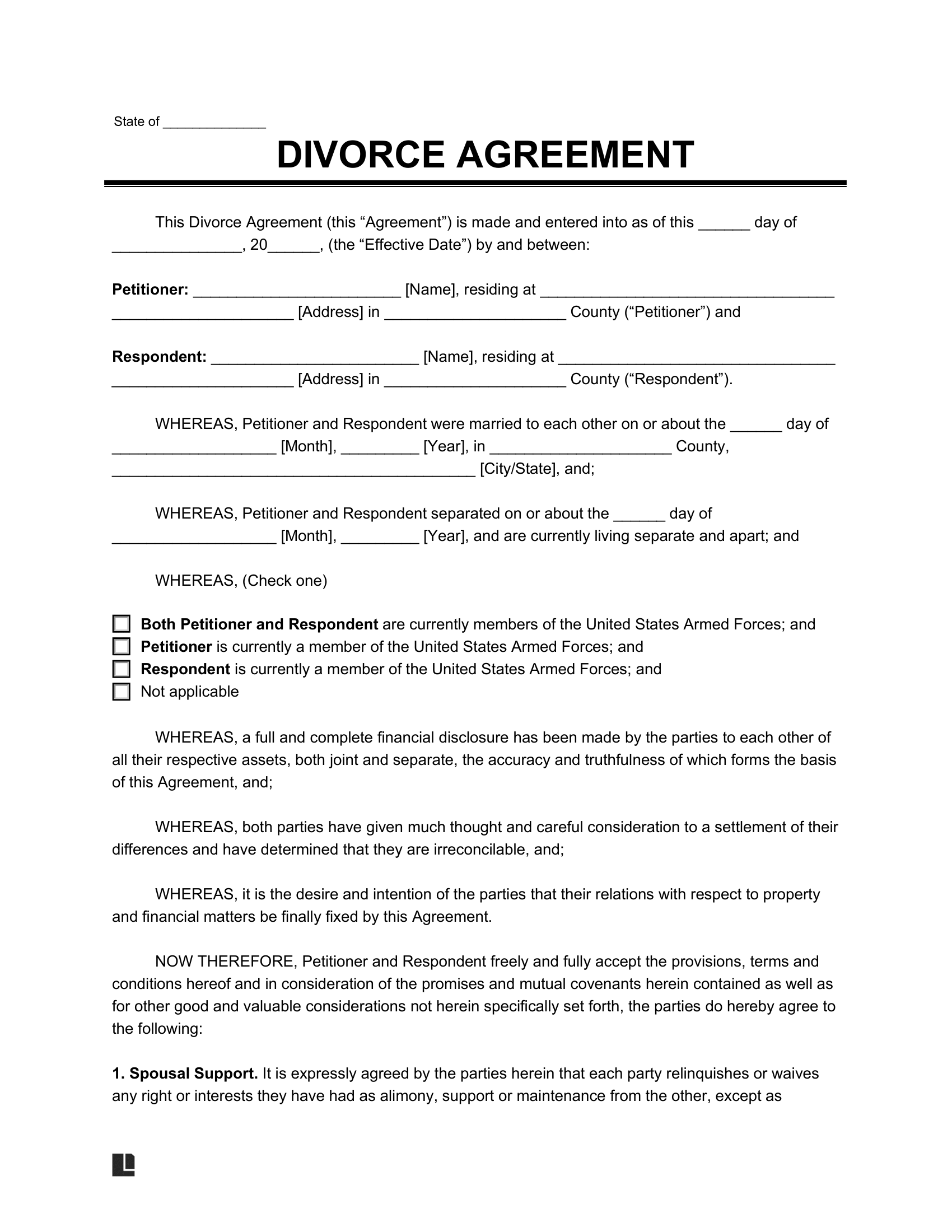

Step 1 – Provide Parties and Marriage Information

The first section of a marital settlement agreement should contain the details of both parties and their marriage.

Petitioner and Respondent Information

The petitioner is the spouse who filed the divorce petition. The respondent is the spouse who has been served the divorce petition. You should include the contact details of both the petitioner and the respondent. Each party should specify whether they’re a United States Armed Forces member.

If you’re a United States Army, Marine Corps, Navy, Air Force, or Coast Guard member, you will be covered under the Uniformed Services Former Spouses’ Act (USFSPA). The USFSPA discusses treating retirement pay, commissary, exchange, and health benefits. It also advises on issues such as child support and spousal support.

When deciding if the settlement is fair, a court would consider whether either spouse is an armed forces member.

Marriage Date and Location

You should specify when you and your spouse got married and the location.

Current Status

Note when you and your spouse began living “separate and apart.”

Remember that living “separate and apart” doesn’t necessarily mean the parties must live in different places. At its minimum, it means that they cannot be physically intimate.

Step 2 – Provide Spousal Support Information

Spousal support, or alimony, is payment from one spouse to another after a separation or divorce. Spousal support allows the receiving spouse to maintain the standard of living they had during the marriage.

Specify which party will receive spousal support, the amount, the date payments will begin and end, and whether they can modify it.

If one spouse must pay spousal support, it is common practice for the supporting spouse to carry a life insurance policy to guarantee payments if they die. The receiving spouse would be named the beneficiary, and the supportive spouse generally must maintain the insurance policy as long as spousal payments are required.

Step 3 – Decide on the Distribution of Real Property

Next, you can list whether you and your spouse own a marital home. If the answer is yes, you can dictate joint versus sole ownership and other elements (if applicable) like:

- The division of the net proceeds from the sale of the marital home

- Who will pay the mortgage of the marital home

- Who will be responsible for maintenance, minor repairs, and major repairs for the home

In this section, you can divide other real property that doesn’t include the marital home.

Step 4 – Divide Bank and Financial Accounts

You and your spouse can agree to divide joint bank and financial accounts, such as savings accounts, checking accounts, money market accounts, and certificates of deposit. It’s essential to disclose all accounts to facilitate a smooth marital settlement.

Step 5 – Divide Personal Property

If you and your spouse have personal property, like furniture or collectibles, you can divide it in the next section. Please list the item’s name, describe it thoroughly, and provide its value. Specify which items the respondent will receive, which items the petitioner will receive, and which items are being split among the two parties.

Step 6 – Assign Ownership of Vehicles

Dictate which vehicles the respondent and petitioner will receive. Provide accurate descriptions of each car, including their make, model, color, and year.

Step 7 – Outline Outstanding Debts, Charge Accounts, and Credits

Outline who will accept outstanding debts, charge accounts, and credits. If one person is assuming a debt, it’s important to note that they’re holding the other party harmless to avoid confusion in the future.

Step 8 – Settle Pension and Retirement Plans and Annuities

Decide whether you and your spouse will divide interests in pension and retirement plans. You can divide these plans equally or allocate a specific percentage to each party.

Step 9 – State When the Parties Will File Taxes Individually

List the year both parties will start filing taxes individually rather than as a married couple. Clarify who will pay any penalties or interest on prior joint income tax returns.

Step 10 – Restore Either Party’s Former Name

If either party wants to restore their former surname, you can notice this change in your divorce agreement.

Step 11 – State the Governing Law for Your Agreement

Specify which state’s laws will govern your marital settlement agreement.

Step 12 – Include Miscellaneous Details

Near the end of your divorce agreement, you can include any other information that applies to divorce. For example, if you and your spouse have children, you may outline details relating to:

- Child support

- Child custody

- Visitation arrangements

Step 13 – Sign the Document

Sign the document yourself and acquire your spouse’s signature. Have witnesses watch you sign the divorce agreement and have them confirm their presence with their signatures. You can also have the document notarized to prevent fraud.

Tips for Writing a Divorce Settlement Agreement

Here are some tips to implement when writing a divorce settlement agreement:

Consider Using a Mediator

As you write your divorce settlement agreement, consider whether mediation would be a suitable option for you. Discussing issues with an impartial third party can help resolve them quicker, and you can avoid having the divorce process drawn out in court.

Also, depending on the age of your children, mediation could help your kids have a say in their custody arrangements. Speaking frankly with either parent may be too difficult for them.

Using a mediator may result in more honest responses and ultimately lead to you creating an agreement that satisfies the entire family.

Fully Disclose All Information

When writing your divorce settlement agreement, listing all assets (including gifts, inheritances, and real estate property) is essential. Failure to disclose all of your assets could result in future litigation where you could receive fines or have to potentially transfer ownership of the asset to your spouse [1] .

For example, imagine one individual hides $20,000 in assets from their spouse. If a court discovers this hidden amount during the divorce process, it may order the individual to pay $10,000 to the other spouse. Sometimes, a court may order the deceitful spouse to pay the other spouse the total amount. Still, it may sentence the dishonest spouse to jail time.

Review Your Agreement Carefully

Review your agreement carefully to ensure you didn’t omit any sections or provide incomplete information. If you forget to address a topic in your divorce settlement agreement, it may be more challenging to handle once you and your former spouse are separated.

Frequently Asked Questions

Where do I go for a divorce?

Each jurisdiction handles divorces differently, so you may have to go to a different court depending on where you live. For example, a jurisdiction may dictate that a family court, domestic relations court, or another specialized court handles your divorce.

Once you determine the proper court for your jurisdiction, you can file your divorce papers in the court that has authority over divorce cases. You’ll typically file in the county where you or your partner reside.

How do I start a divorce case?

Start filing a divorce case by speaking with your lawyer. Work with them to fill out a divorce petition and alert your spouse of the impending divorce.

Do I need a lawyer to get divorced?

While you can technically file for divorce without a lawyer’s help, a lawyer can make the process more seamless. They can help you understand your rights in the case and navigate complex legal issues like child custody.