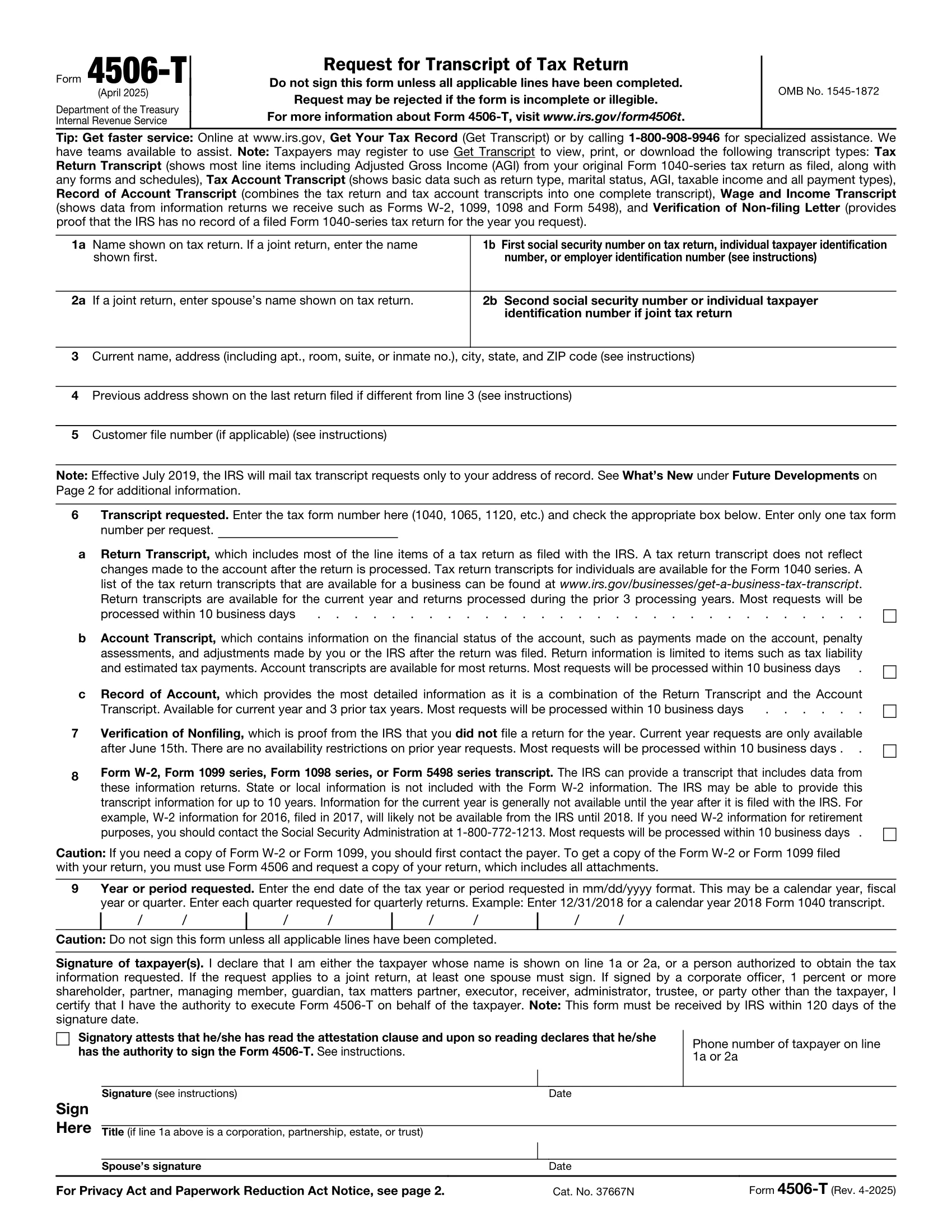

What Is IRS Form 4506-T?

Form 4506-T, also known as the Request for Transcript of Tax Return, is an IRS form that taxpayers use to request a summary of a filed tax return. For most individual tax returns, the return transcript is available for the current year and up to three prior processing years. You may also use Form 4506-T to request other transcript types (like a tax account or verification of non-filing), which may cover additional years.

Taxpayers, corporations, partnerships, and business entities use this form to request tax information. Form 4506-T is used when qualifying for loans, applying for federal aid, or completing IRS audits. It may also be used for citizenship and immigration status inquiries.

Legal Templates’s Form 4506-T template includes legally compliant formatting and terms. Use our form to input your information and download or save your completed document.

No Changes to Form 4506-T for 2025

The IRS reports that there are no changes to Form 4506-T for the 2025 tax year.

Who Is Eligible to Submit a Request for a Transcript of Tax Returns?

The IRS limits who can submit Form 4506-T. The following individuals can request transcripts:

- Individual Taxpayers: This includes any individual who has filed a personal income tax return (Form 1040). They can request a transcript of their own tax return.

- Authorized Representatives: An accountant, attorney, or tax preparer can file for another individual. The representative must have documented authorization, often through a power of attorney Form 2848.

- Businesses and Entities: Corporations, partnerships, and businesses can request their tax transcripts. An authorized person within the organization, such as an officer or owner, can submit the form.

- Estate Representatives: Estate executors or administrators can request transcripts for a decedent’s estate.

- Government Agencies: Under the law, government agencies can request transcripts for specific purposes.

- Individuals Requesting on Another’s Behalf: This is possible when a spouse requests a transcript. It requires specific authorization or meeting certain conditions (like a joint tax return).

- Financial Institutions: Lenders may request tax return information with the taxpayer’s consent for mortgage or loan applications.

Form 4506-T vs. Form 4506

Form 4506 is used to request a copy of a previously filed tax return, which includes the exact information provided on every line of the original document and file. This form is often used for more specific information, such as legal matters or complex tax disputes. Form 4506 may also take up to 75 days for you to get the copy, and it costs $30 per return.

On the other hand, Form 4506-T is used to request a tax transcript, which is a summary of the tax return information. The transcript may not include personal information, such as a Social Security number (SSN). This form is commonly used for income verification, such as for mortgage or student loan applications. Additionally, it takes about 5 to 10 business days to get the transcripts, and Form 4506-T requests are free.

How to Fill Out IRS Form 4506-T

Knowing how to fill out Form 4506-T ensures you get your requested transcripts and can help you avoid delays or complications. Follow the steps below to complete your request.

1. Provide Your Personal Information

Begin by providing your personal information to verify your identity. Include the name and SSN that would appear on the return you are requesting. If requesting a transcript for a joint filing, also include the spouse’s name and SSN. Also, state your current name and address, and provide the previous address listed on the return if it differs from your current one.

When applicable, record your Customer File Number. This allows the IRS to match the transcript to the taxpayer without displaying a full Taxpayer ID number.

2. Request Your Transcripts

Clearly communicate which form you want to request using your Form 4506-T. Define the filing dates and timeframes for the requested transcript. Write in the exact tax form number and check the boxes to describe the type of documentation you want to receive. Choose from the following options depending on your needs:

- Return Transcripts: Return transcripts show most of the line items on an original tax return. This is typically used to get documentation for mortgage and student loan applications.

- Account Transcripts: Account transcripts contain basic data, including the return type, marital status, adjusted gross income, and taxable income.

- Record of Account: A record of account combines information from both the tax return and tax account transcripts.

- Wage and Income Transcript: This document lists data from information returns, such as W-2s or 1099-MISCs.

- Verification of Non-filing Letter: A non-filing letter provides proof that the IRS has no record of a filed tax return for the year in question.

Enter the end date of the tax year, calendar year, fiscal year, or quarter for your requested transcripts in mm/dd/yyyy format. For example, enter 12/31/2023 for a calendar year 2023 Form 1040 transcript.

3. Sign and Date Documents

Once you’ve provided the necessary information and requests, the taxpayer or their representative should sign and date the request. Also, ensure that you or your representative checks the box stating that the signer holds the legal authority to submit their request.

4. File With the IRS

Send the completed Form 4506-T to the IRS at the mailing address provided on the form. You can also request your transcripts online via the IRS website. Note that your form must be received by the IRS within 120 days of signing.

The address for requests made via mail may vary depending on the taxpayer’s location and the specific forms they wish to receive. Refer to the table below to determine where to mail or fax your Form 4506-T when requesting individual transcripts, such as Form 1040, Form W-2, and Form 1099.

| Location of Individual Filing | Mailing or Faxing Address |

|---|---|

| Alabama, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kentucky, Maine, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Wisconsin | Internal Revenue Service RAIVS Team Stop 6705 S2 Kansas City, MO 64999 Fax # 855-821-0094 |

| Alaska, Arizona, California, Colorado, Connecticut, District of Columbia, Hawaii, Idaho, Kansas, Maryland, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, Washington, West Virginia, Wyoming | Internal Revenue Service RAIVS Team Post Office Box 9941 Mail Stop 6734 Ogden, UT 84409 Fax # 855-298-1145 |

| Florida, Louisiana, Mississippi, Texas, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or A.P.O. or F.P.O address | Internal Revenue Service RAIVS Team Stop 6716 AUSC Austin, TX 73301 Fax # 855-587-9604 |

All other transcript requests, such as those from businesses or representatives, go to a separate address. Use this table to find the correct destination for requests.

| Location of Tax Filing | Mailing or Faxing Address |

|---|---|

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma,Oregon, South Dakota, Texas, Utah, Washington, Wyoming, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or A.P.O. or F.P.O address | Internal Revenue Service RAIVS Team Post Office Box 9941 Mail Stop 6734 Ogden, UT 84409 Fax # 855-298-1145 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service RAIVS Team Stop 6705 S-2 Kansas City, MO 64999 Fax # 855-821-0094 |

IRS Form 4506-T Sample

Legal Templates offers a free and downloadable Form 4506-T that meets IRS requirements. Use our customizable form, available in PDF format, to fill out your document. Our PDF editor helps you complete the form so you can then independently file it with the IRS to get the transcripts you need.