What Is Form 1065?

Form 1065, the US Return of Partnership Income, is the tax form partnerships use to report their income, gains, losses, deductions, and credits. It helps the IRS understand how the business operates and ensures the partnership meets its tax responsibilities.

Who Needs to Fill Out Form 1065?

Any domestic partnership must file Form 1065, even if it didn’t earn income during the year. The only exception applies when the partnership has no income and no deductible or creditable expenses. Limited partnerships and LLCs taxed as partnerships follow the same rule, and members of non-profit religious organizations classified as 501(d) may also need to file.

Foreign partnerships aren’t automatically exempt either. If the partnership earns income from US sources, Form 1065 is generally required, regardless of where the partners live.

When Is Form 1065 Due?

Form 1065 is due on the 15th day of the third month after the partnership’s tax year ends. For partnerships that follow a calendar year, this usually means March 15. If that date falls on a weekend or legal holiday, the deadline moves to the next business day. For the 2025 tax year, the due date becomes March 16, 2026, because March 15 lands on a Sunday.

Other Forms & Schedules for Form 1065

Depending on your partnership’s reporting needs, you may need to complete additional schedules and forms beyond Schedules K and K-1. Common add-ons include:

- Schedule K-2: Provides international tax information for partnerships with foreign income, deductions, or credits.

- Schedule K-3: Gives partners detailed international tax information that expands on what appears in Schedule K-1.

- Schedule L: Shows the partnership’s balance sheet at the beginning and end of the year.

- Schedule M-1: Reconciles differences between book income and tax income.

- Schedule M-2: Tracks changes in partners’ capital accounts during the year.

- Schedule M-3: Used by partnerships with more complex reporting needs to provide a detailed reconciliation of book and tax income.

- Form 8805: Reports a foreign partner’s share of US income and any withholding tax paid on their behalf.

Changes for the 2025 Tax Year

The IRS made several updates for the 2025 tax year. Some changes fix confusing instructions, while others adjust filing rules or expand online tools. These updates affect how partnerships complete Form 1065 and share information with partners.

Updated Instructions to Note

The IRS clarified several reporting points for 2025. Box 15, code BB now directs users to report the amount on Form 8994 or Form 3800. Schedule K-1 codes W, X, and AX now show the correct credit descriptions. The K-2 and K-3 instructions were corrected as well, and the Form 8990 reference now points to Schedule K-1, line 20, code AY.

New Filing Rules to Apply

Partners must request Schedule K-3 every year. After the first request, they can choose automatic delivery. A new small-partnership exception now applies, and partnerships that answer “Yes” to Schedule B, Question 4, no longer need to file Schedules K-2 or K-3.

Revised CAMT Steps to Follow

Partners must request AFSI information in writing and keep a copy. Partnerships must provide CAMT details when asked. If the information is missing, they must follow Form 8082 or amended-return rules.

Improved IRS Tools to Use

Direct Pay now handles federal tax deposits and balance-due payments. The Business Tax Account lets partnerships make deposits, send payments, check payment history, and view transcripts.

How to Fill Out Form 1065

Preparing Form 1065 takes some time, but the process becomes easier when you follow clear IRS Form 1065 instructions and move through the form in a steady order. Each section builds on the last, and the IRS expects partnerships to complete it accurately so partner information can flow to each Schedule K-1. Use the steps below to work through the form from start to finish.

1. Get Your Information Ready

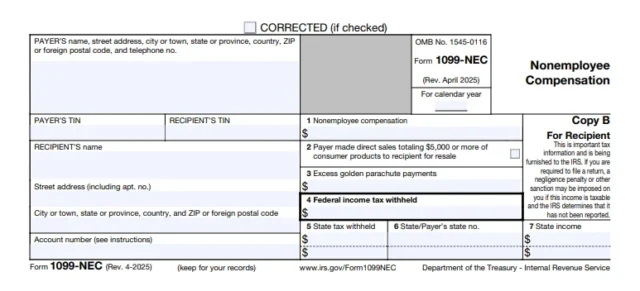

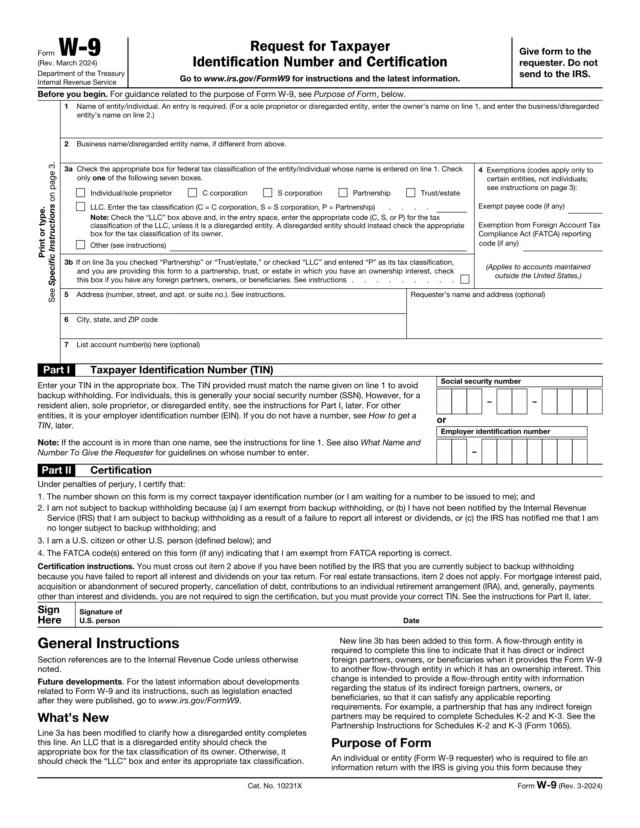

Collect the details you’ll need before you start. This keeps the process steady and avoids stopping midway. You’ll need your partnership’s EIN, business details, financial statements, partner contributions and distribution records, ownership percentages, payroll and expense data, and any Forms 1099 or W-2.

2. Complete the Top Section

Enter your partnership’s legal name, address, principal business activity, and code, EIN, accounting method, and total assets.

3. Report Income (Lines 1–8)

List gross receipts or sales on line 1a. Subtract returns and allowances and enter the balance on line 1c. Add your Cost of Goods Sold using Form 1125-A if needed. Include any other income and report the total on line 8.

4. Enter Business Deductions (Lines 9–22)

Add deductions such as salaries, guaranteed payments, depreciation, and employee benefits. Total them and subtract from income to find your ordinary business income or loss.

5. Finish the Tax & Payment Section (Lines 24–32)

Enter taxes, interest, and penalties on lines 24-27. Compare lines 28, 29, and 30 to see if you owe money or have an overpayment.

6. Complete Schedule B

Answer the Yes-or-No questions about elections, foreign activity, ownership, and information returns. Your answers also determine whether you must file Schedules K-2 and K-3. The new exceptions only apply when your Schedule B responses meet the IRS criteria.

7. Attach Schedules and Submit

Prepare a Schedule K-1 for each partner. K-1s must be delivered by the same date Form 1065 is due. Attach any other required schedules, such as Schedule L for balance sheets, Schedule M-1 for book-to-tax differences, and Schedule M-2 for changes in capital accounts.

IRS Form 1065 Sample

You can download a free IRS Form 1065 from Legal Templates and fill it out directly in our PDF editor. The sample shows you how each section works, including the main return, Schedule B, Schedule K, and the K-1s your partners receive. You can review the layout, check where key details go, and see how the form fits together before you start your own.

How to File Form 1065

Most partnerships need to e-file Form 1065. If your partnership files 10 or more returns of any type in a tax year, the IRS requires electronic filing. Partnerships with more than 100 partners must also e-file every Schedule K-1 and all related forms.

When You Can Request a Waiver

You can request a hardship waiver if e-filing isn’t possible. Send a written request to the Ogden Submission Processing Center. You can mail it, overnight it, or fax it to 877-477-0575.

When a Religious Exemption Applies

A religious exemption is available. If e-filing conflicts with a partner’s beliefs, you can file on paper. Write “Religious Exemption” at the top of page 1. If you want to claim the exemption for information returns, you can notify the IRS in advance using Form 8508.

Returns That Don’t Need to Be E-Filed

Some returns are not covered by the e-file rule:

- Bankruptcy returns

- Returns with pre-computed penalty and interest

Need Help?

The IRS e-Help Desk can answer questions at 866-255-0654. You can also visit IRS.gov/Filing for more guidance.