What Is IRS Form 1120-S?

IRS Form 1120-S is the annual tax return every S corporation must file. It explains the company’s income, deductions, credits, and distributions for the year. You still have to file it even if your S corporation had no activity in 2025.

Shareholders receive a Schedule K-1 based on that return. It outlines their share of the income or loss, which they then report on their personal tax filings.

Who Needs to File IRS Form 1120-S?

Any domestic corporation with an approved S-election must file IRS Form 1120-S each year. The election comes from Form 2553, and once it’s in place, you file annually to keep your S-status active.

To qualify as an S corporation, you must meet a few rules. The business can have no more than 100 shareholders. It must issue only one class of stock. All shareholders must be individuals, estates, or certain qualifying trusts. Partnerships and non-resident aliens cannot be shareholders.

When Is IRS Form 1120-S Due?

Form 1120-S is due on the 15th day of the third month after the tax year ends. For calendar-year S corporations, the 2025 return is due March 16, 2026. You can request a six-month extension with Form 7004. To make it valid, you must:

- Submit Form 7004 before the deadline.

- Pay any tax by the original due date.

The extension gives you more time to file, but it doesn’t delay payment. Once the form is submitted, you can finish your return without rushing.

Changes for the 2025 Tax Year

The IRS introduced several updates for the 2025 tax year. Some affect how shareholders request information, and others change what smaller S corps must file. There are also new rules for tracking basis. Here’s what to know.

Shareholders Now Have to Request Schedule K-3 Every Year

Shareholders must request a Schedule K-3 each year if they want one, but once they make that first request, they can choose automatic delivery going forward. These rules apply to S corps using the domestic filing exception. Even when a shareholder switches to automatic delivery, the S corporation still has to send the required notices each year to keep the process compliant.

Some Small S Corps Don’t Need to File K-2 and K-3

Some small S corps no longer need to file Schedules K-2 and K-3. The rule began with 2024 returns filed in 2025 and remains in effect for 2025. If the corporation answered “Yes” to Schedule B, Question 11, it only files these schedules when a shareholder asks for them. Filing is required only when a request comes in, but the corporation still has to meet the notice requirements each year.

Shareholders Must Report Basis Changes on Form 7203

Shareholders must now report K-1 Box 13 (Code H) on Form 7203. This amount reduces their stock basis and appears in Part III, Line 45. The basis reduction tied to Code H is recorded directly on that line.

The proposed One Big Beautiful Bill may change how certain deductions and credits appear on your S-corp return. These shifts may change your 2025 totals and what flows through to shareholders.How the One Big Beautiful Bill Could Affect Your 2025 Form 1120-S

Other Forms You May Need

You may need one or more of the following, depending on your activities:

| Form or Schedule | Purpose / When It Applies |

|---|---|

| Schedule K-1 (International Items) | Shareholder-level reporting for international tax items. |

| Schedule K-2 & K-3 (Form 1120-S) | Required if the corporation has international tax items. |

| Schedule D (Form 1120-S) | Reports capital gains, losses, and built-in gains. |

| Form 4797 | Reports sales of business property. |

| Form 8949 | Reports sales and dispositions of capital assets. |

How to Fill Out IRS Form 1120-S

Form 1120-S looks dense at first glance, but you can work through it once you know what each section asks for. The steps below walk you through the core pieces.

1. Enter Basic Business Information

Start with your corporation’s details. Add the business name, address, and EIN. If this is your first year as an S corporation, make sure Form 2553 is filed or attach it now. Enter your incorporation date and your total assets at year-end.

If you haven’t applied for an EIN yet, you can file Form SS-4 to get your EIN.

2. Report Your Business Income

Move to the Income section. Enter your gross receipts or sales, then subtract any returns or allowances. If you sell products, list your cost of goods sold. Add any other income, such as rental income or capital gains, and total everything to find your business income.

3. List Business Expenses and Deductions

Record your business expenses. Include salaries, rent, utilities, taxes, insurance, depreciation, advertising, and employee benefits. Subtract these deductions from your income to get your ordinary business income or loss.

4. Calculate Taxes and Payments

Enter any special taxes your business owes, including those tied to capital gains. Add your estimated tax payments. This section shows whether you owe tax or qualify for a refund.

5. Sign, Attach Required Forms, and File

An officer must sign the form before filing. Attach any schedules you need, including Schedule K-1 for shareholder allocations. Submit your return by the deadline to avoid penalties.

If your S corporation files more than 60 days late, the minimum penalty equals the lesser of the tax due or $510. The IRS adjusts this amount annually, so refer to the latest Form 1120-S instructions. Filing Form 7004 can help you avoid penalties.

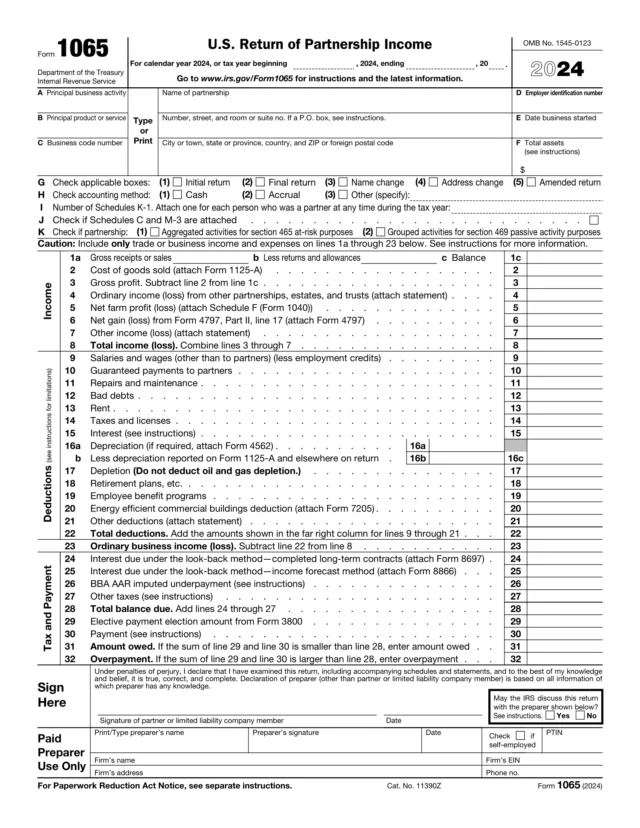

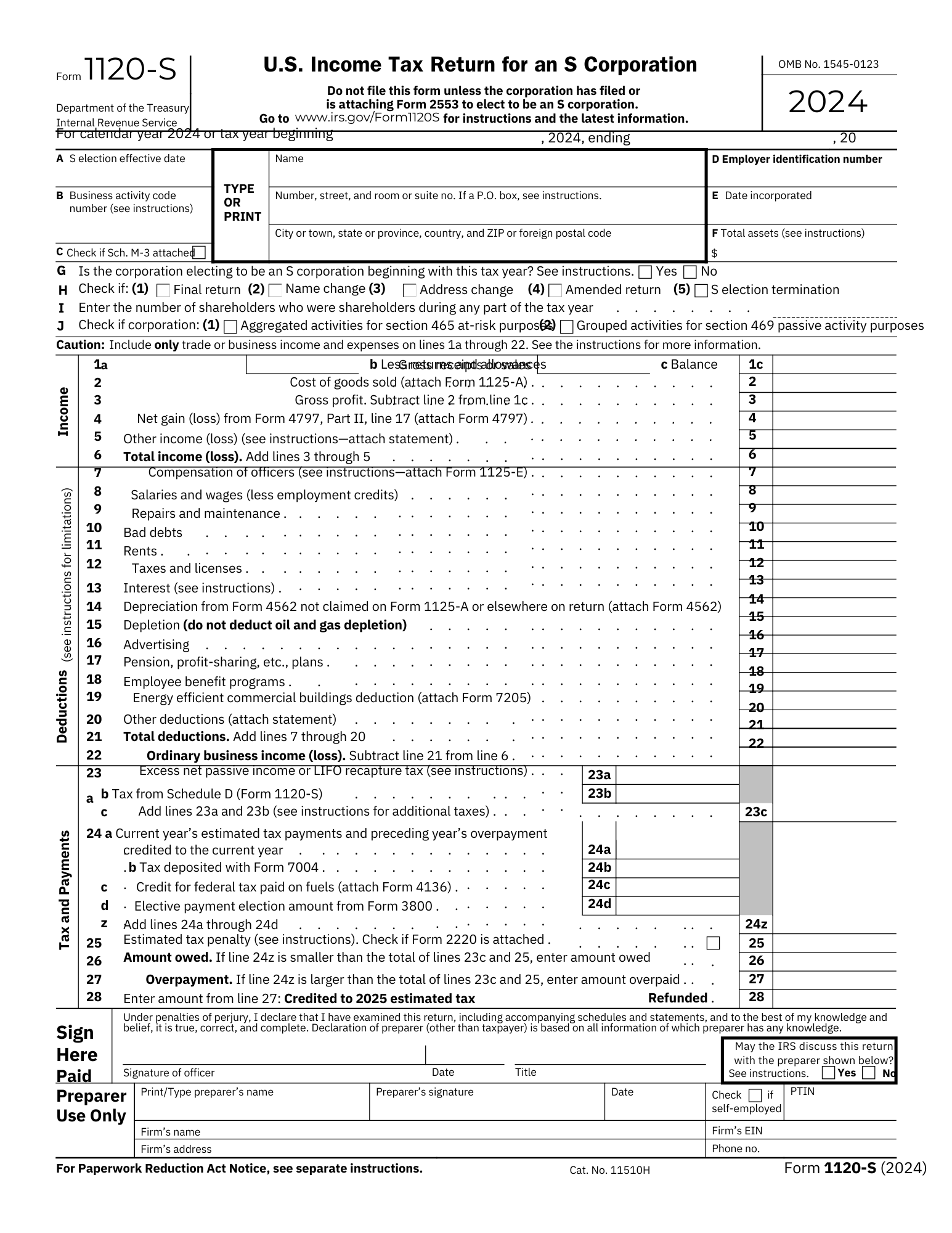

IRS Form 1120-S Sample

Here’s a sample of IRS Form 1120-S to show how the return is laid out and what information you’ll need to enter. It gives you a quick look at the main sections, including income, deductions, and shareholder details. When you’re ready, you can customize and download the sample as a PDF.

How to File IRS Form 1120-S

Before filing Form 1120-S, you need to know whether you’re required to e-file or eligible to mail a paper return. The IRS bases the e-file requirement on how many total returns your S corporation files in a calendar year, not on where you’re located. Your business location only affects the correct mailing address if you file a paper return.

1. E-Filing (Required for Many S Corporations)

Most S corporations must e-file Form 1120-S if they file 10 or more returns of any type during the calendar year. This includes income tax, employment tax, excise tax, and information returns. The rule applies to returns filed on or after January 1, 2024.

You can e-file:

-

Form 1120-S and schedules

-

Form 7004 (extension)

-

Form 1099 and other information returns

If you can’t e-file due to a hardship, you may request a waiver following the IRS’s written waiver process. A religious exemption also applies if e-filing conflicts with your beliefs.

2. Where to Mail Form 1120-S

If your corporation does not need to e-file, you can mail Form 1120-S to the correct IRS address based on your state and asset level.

States Using Kansas City or Ogden (Depending on Assets)

CT, DE, DC, GA, IL, IN, KY, ME, MD, MA, MI, NH, NJ, NY, NC, OH, PA, RI, SC, TN, VT, VA, WV, WI

Less than $10 million in assets AND not filing Schedule M-3:

Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0013

$10 million or more in assets OR filing Schedule M-3:

Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0013

States Using Ogden for All Returns:

AL, AK, AZ, AR, CA, CO, FL, HI, ID, IA, KS, LA, MN, MS, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WY

Any asset amount:

Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0013

Corporations Outside the United States:

Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409