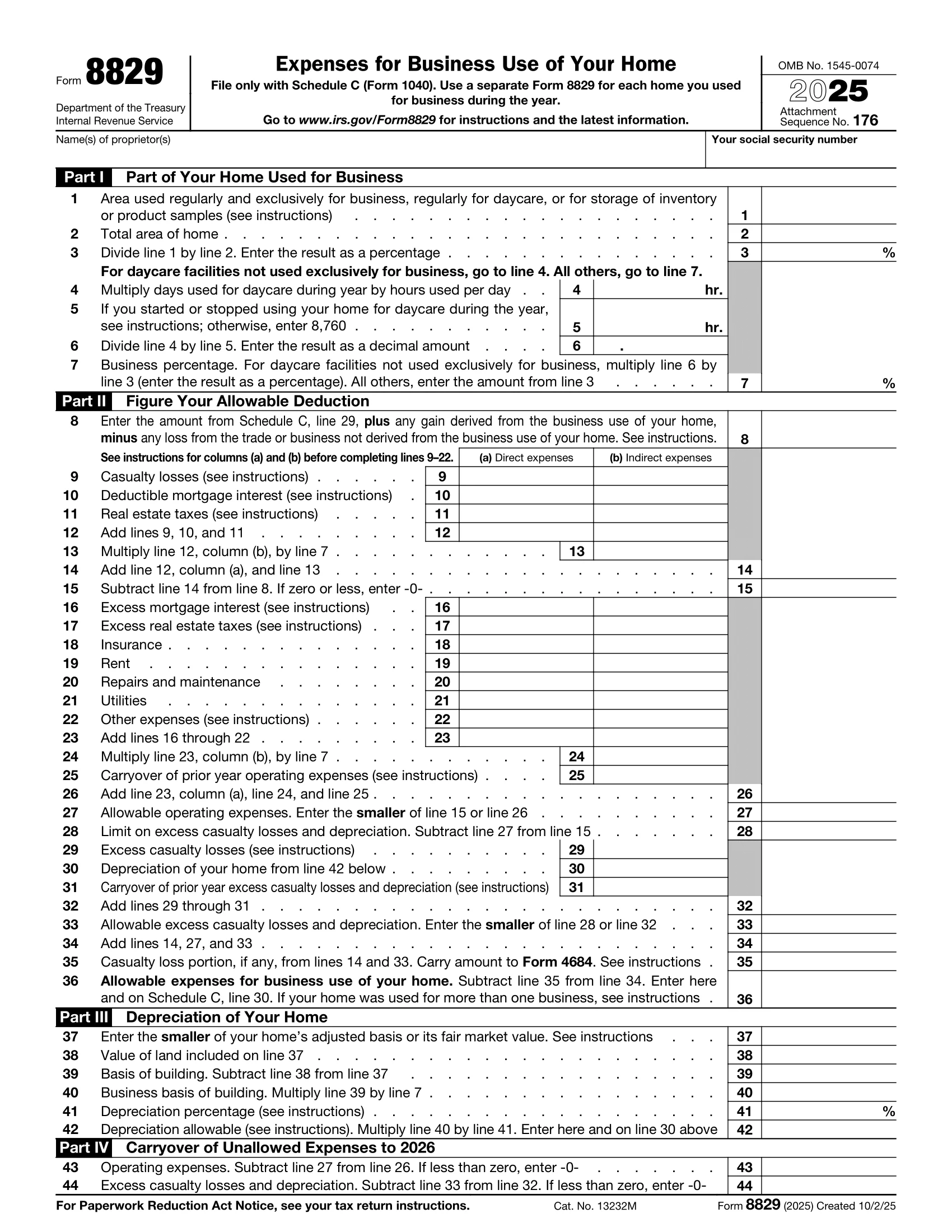

What Is Form 8829?

Form 8829, Expenses for Business Use of Your Home, is an Internal Revenue Service (IRS) tax form that helps self-employed individuals deduct home business expenses. It considers the portion of your home used for business and the associated costs to calculate your deduction.

Form 8829 is only for sole proprietors, independent contractors, and freelancers who file Schedule C on Form 1040. It’s not for employees who work from home, including fully remote employees.

You will calculate your home office deduction on Form 8829, line 36, and enter that amount on line 30 of Schedule C, Profit or Loss From Business. Schedule C then feeds into Form 1040, helping lower your business income and the amount of tax you owe.

What Deduction Method Does Form 8829 Use?

Form 8829 is a calculation worksheet that uses the actual expenses method. It accounts for your true costs, such as mortgage interest and real estate taxes.

If you don’t use Form 8829, you can use the simplified home office deduction method. This method lets you deduct $5 per square foot, up to $1,500. It’s easier to calculate, but it may result in you leaving money on the table since it doesn’t account for your actual expenses.

Only consider using the simplified method if you:

- Have a small home office

- Incur very few business-related expenses

- Want a quicker process with less paperwork

Changes for Form 8829 for the 2025 Tax Year

There are two major changes associated with Form 8829 for the 2025 tax year:

- State and local tax deduction limit: You can deduct up to $40,000 in total state and local taxes ($20,000 if married filing separately). Any amount above this limit isn’t deductible.

- Special depreciation for qualified production property: You may elect to take a 100% depreciation allowance on qualified production property used for your home business if you meet the requirements under Section 168(n). Refer to Publication 946 for more details.

What Expenses Can I Deduct on Form 8829?

You can deduct two main types of expenses associated with your home office on Form 8829:

-

Direct expenses: Costs that apply only to your home office space. Examples include the following:

- Painting or repairing your home office

- Installing new carpet or lighting in the office

- Office-specific pest control

- Replacing a window or door in your office

-

Indirect expenses: Costs that apply to your entire home (not just your office). These costs are partially deductible based on the percentage of your home used for business. Examples include the following:

- Mortgage interest or rent

- Utilities (electricity, gas, water, internet)

- Property taxes

- Homeowners or renters insurance

- General home repairs (roof, HVAC, plumbing)

- Cleaning services

Deductions Based on Business Loss vs. Business Gain

The deductions you can claim for your home office depend on whether your business has a net profit or loss for the year.

The IRS limits the home office deduction so it cannot exceed your net business income (gross income minus business expenses, excluding the home office deduction). You can usually carry over any unused deductions due to a loss to future tax years.

| Expense Type | Business Loss | Business Gain |

|---|---|---|

| Mortgage Interest & Taxes | Deductible on Schedule A (Form 1040) as personal itemized deductions; cannot exceed business income if claimed through Form 8829 | Fully deductible on Form 8829, prorated by business-use percentage |

| Utilities | Limited to net business income; unused portion carried forward | Fully deductible, prorated by business-use percentage |

| Depreciation | Limited to net business income; unused portion carried forward | Fully deductible, prorated by business-use percentage |

| Direct Repairs | Fully deductible (100% if solely for the office) | Fully deductible (100% if solely for the office) |

| Indirect Repairs | Limited to net business income; unused portion carried forward | Fully deductible, prorated by business-use percentage |

| Operating Expenses | Limited to net business income; unused portion carried forward | Fully deductible, prorated by business-use percentage |

What Are the IRS Rules for a Home Office Deduction?

Per the IRS, a space only counts as a home office if the following two conditions apply:

- You use the space exclusively and regularly for business purposes.

- The space is your principal place of business, meaning you:

- Use the space for managerial and administrative tasks and don’t have any other fixed location for these tasks; or

- Meet with clients or customers regularly in your home office.

A home office is often a designated area within a taxpayer’s home, as most taxpayers with a home office live and work in their own residence. Examples of home offices could be the following:

- A desk area in a spare bedroom that’s exclusively used for work

- A partitioned section of your living room dedicated solely to business activities

- A separate room where you only conduct meetings with clients

If you use any of these spaces for other purposes, you won’t be able to count them as your home office. For example, if you use a spare bedroom to conduct meetings with clients but also use it as a place to work out in your free time, the space won’t qualify as a home office.

Example of Calculating a Home Office

Imagine you use part of a spare bedroom as your home office. The room has a bed for guests and a desk for your work. You can only count the portion of the room you use exclusively for work—the desk area.

If the desk area is 100 square feet and your entire home is 2,000 square feet, the office represents 5% of your home. Below, you can explore examples of calculating your deductions based on the actual expenses method and the simplified deduction method.

Actual Expenses Method

Let’s say your total home expenses for the year are the following:

- Mortgage interest: $10,000

- Utilities: $2,400

- Home insurance: $1,200

- General repairs: $400

- TOTAL EXPENSES: $14,000

Since your home office makes up 5% of your home, you can deduct 5% of your indirect expenses:

$14,000 × 5% = $700 deduction

If you also spent $300 painting just the office (a direct expense), you can add that amount in full.

Total deduction: $700 + $300 = $1,000

You’d calculate this on Form 8829, then enter the total deduction ($1,000) on Schedule C, Line 30 of Form 1040.

Simplified Deduction Method

The simplified method lets you deduct $5 per square foot of your home office, up to 300 square feet.

In this case:

100 square feet × $5 = $500 deduction

You don’t need to track actual expenses or file Form 8829. Instead, just claim the $500 directly on Schedule C, Line 30 of Form 1040.

Do Home Daycare Centers Qualify for the Home Office Deduction?

If you run a daycare center in your home, it also qualifies for the home office deduction. The tax guidelines for this situation are more flexible than those for other business types because the “exclusive use” test doesn’t apply. For example, if you use your living room during the day for your business, the space still counts as an office deduction even if your family uses it in the evening.

The IRS requires daycare providers to account for the square footage used and the time the area is used for work when calculating their deductible home expenses.

For example, if you run a daycare for 40 hours a week in a space in your home that makes up 50% of your home, you would use these percentages to determine your deductible expenses.

Licenses & Certifications

Daycare providers must have the proper licenses and certifications to conduct their business and qualify for home office deductions.

How to Fill Out Form 8829

Form 8829 may look a little more intimidating than other IRS tax forms, but it’s pretty straightforward if you work through it according to its four parts.

- Part of your home used for business: Calculate the percentage of your home used for business (Lines 1-7).

- Figure your allowable deduction: Enter business income and deductible home expenses (Lines 8-36).

- Account for the depreciation of your home: Compute depreciation based on your home’s value and business use (Lines 37-42).

- Record the carryover of unallowed expenses to 2026: Record excess expenses to deduct in the next tax year (Lines 43-44).

Part I: Part of Your Home Used for Business

In this section, you’ll calculate the percentage of your home used for business activities. Here are the steps to implement:

- Find the square footage of your home office and enter it in Line 1.

- Find the total square footage of your entire home and enter it in Line 2.

- Divide the square footage from Line 1 by the square footage in Line 2.

- Enter the result in Line 3.

Example: If your home office is 300 sq. ft. and your home is 1,800 sq. ft., divide 300 by 1,800 to get 16.67%. Enter 16.67% in Line 3.

If you run a home daycare, you must implement some additional yet simple steps:

- Complete Lines 4-6 to adjust your calculation.

- Multiply the amount in Line 6 by the percentage from Line 3.

- Enter the result in Line 7.

If you don’t run a home daycare, simply enter the percentage from Line 3 directly into Line 7.

Part II: Figure Your Allowable Deduction

In Part II, you’ll calculate your home business deduction. Start by entering the total income from your home business on Line 8. You can use the amount from Schedule C, line 29. Adjust this amount if you have gains or losses from using your home for business or if some business income comes from a location outside your home.

Calculate Expenses

Next, you’ll tally your expenses associated with using your home for business. The costs fall into two categories: direct and indirect. Direct expenses include costs used solely for the company, such as modifications to convert a room into an office. Indirect expenses are those related to both personal and business uses, like electricity.

Here’s how to fill out the next portion of Part II by lines:

- Lines 9-11: Enter direct or indirect expenses for casualty losses, mortgage interest, and real estate taxes.

- Line 12: Add Lines 9-11 together for each column.

- Line 13: Multiply Line 12, column (b), by Line 7.

- Line 14: Add Line 12, column (a), and Line 13.

- Line 15: Even if you don’t have casualty losses, real estate taxes, or mortgage interest to claim on Form 8829, make sure to enter the appropriate amount on Line 15. You’ll calculate this by subtracting the total of Line 14 from Line 8.

- Lines 16-17: Enter any excess mortgage interest and real estate taxes. These expenses are fairly unusual for the average taxpayer because they’re claimable as an itemized personal deduction on Form 1040.

- Lines 18-22: Enter costs associated with using your business for home use, including insurance, rent, maintenance and repairs, and utilities. Enter the full amount for each expense into the appropriate category—direct or indirect.

- Line 23: Add Lines 16-22 and enter the totals in Line 23.

- Line 24: Multiply the business percentage from Line 7 in Section 1 by Line 23, column (b), and enter it in Line 24.

- Line 25: If you have a carryover of operating expenses from the previous tax year, enter it in Line 25.

- Line 26: Input the result of adding Line 23, column (a), Line 24, and Line 25 together.

Determine Allowable Deduction for Home Expenses

Once you fill out Lines 9-26, you can determine your allowable expenses for the business use of your home. These are the costs you can deduct for maintaining and using part of your home only for business purposes.

Fill out the remainder of Part II line by line:

- Line 27: Enter the smaller amount from Lines 15 and 26, as this input will be your allowable operating expenses.

- Line 28: Input the result of subtracting Line 27 from Line 15. This is the maximum amount you can claim for home depreciation and casualty losses.

- Line 29: Only complete if you have excess casualty losses.

- Line 30: Enter your home depreciation, which you will calculate in Part III.

- Line 31: Only complete if you have a carryover of excess casualty losses or depreciation from the previous year.

- Line 32: Add Lines 29, 30, and 31, and enter the total.

- Line 33: Compare Lines 28 and 32, and enter the smaller number.

- Line 34: Add Lines 14, 27, and 33, and enter the total.

- Line 35: If any of your expenses from Lines 14 and 33 are casualty losses, enter the total.

- Line 36: Subtract Line 35 from Line 34 to get your Allowable Expenses for the Business Use of Your Home. Enter this number.

Once you finish these lines, you can transfer the total in Line 36 to Schedule C, Line 30, as a deduction.

Part III: Depreciation of Your Home

Depreciation allows you to account for the gradual wear and tear of your home used for business, offering a significant tax advantage under the standard method. While the process may seem complex, breaking it into manageable steps can simplify the calculations and ensure you’re maximizing your deduction.

You can only deduct depreciation if you own your home.

Calculate the depreciation of your home using these steps:

- Enter the smaller of the cost basis or fair market value of your home in Line 37. If you completed Form 8829 in a previous year, use the same cost basis.

- Enter the smaller of the cost basis or fair market value of your land in Line 38.

- Subtract Line 38 from Line 37 to get the depreciation basis for your home (excluding the land). Enter the result in Line 39.

- Multiply the business percentage from Part I by the number in Line 39. Enter the result in Line 40.

- Enter the depreciation percentage in Line 41.

If you started using your home for business between May 12, 1993, and December 31, 2023, the depreciation rate is typically 2.564%. If you started in 2024 or 2025, refer to the provided chart for the applicable rate.

| Month You Began Using Your Home for Business Purposes in 2024 | Depreciation Percentage Amount |

|---|---|

| January | 2.461% |

| February | 2.247% |

| March | 2.033% |

| April | 1.819% |

| May | 1.605% |

| June | 1.391% |

| July | 1.177% |

| August | 0.963% |

| September | 0.749% |

| October | 0.535% |

| November | 0.321% |

| December | 0.107% |

Finally, multiply the Line 41 depreciation percentage by Line 40, the business basis of your home. The result is the allowable depreciation, which you enter on Line 42 and again on Line 30.

Part IV: Carryover of Unallowed Expenses to 2026

Only fill out Part IV if you have an excess of home business expenses you can’t claim in 2025. You’ll know you have a carryover if Line 26 exceeds Line 15.

Calculate the amount by following these steps:

- Subtract Line 27 from Line 26 and enter it into Line 43.

- Subtract Line 33 from Line 32 to calculate any excess casualty losses or depreciation. Enter the amount on Line 44.

- Keep your carryover amounts available for the next tax year, as you can use them for a deduction.

Form 8829 Example

View a free Form 8829 example to understand how to calculate the home office deduction. When you’re ready, you can use our fillable form to complete the calculation worksheet. Then, download it as a PDF file to store in your records and use it to help you complete Schedule C on Form 1040.