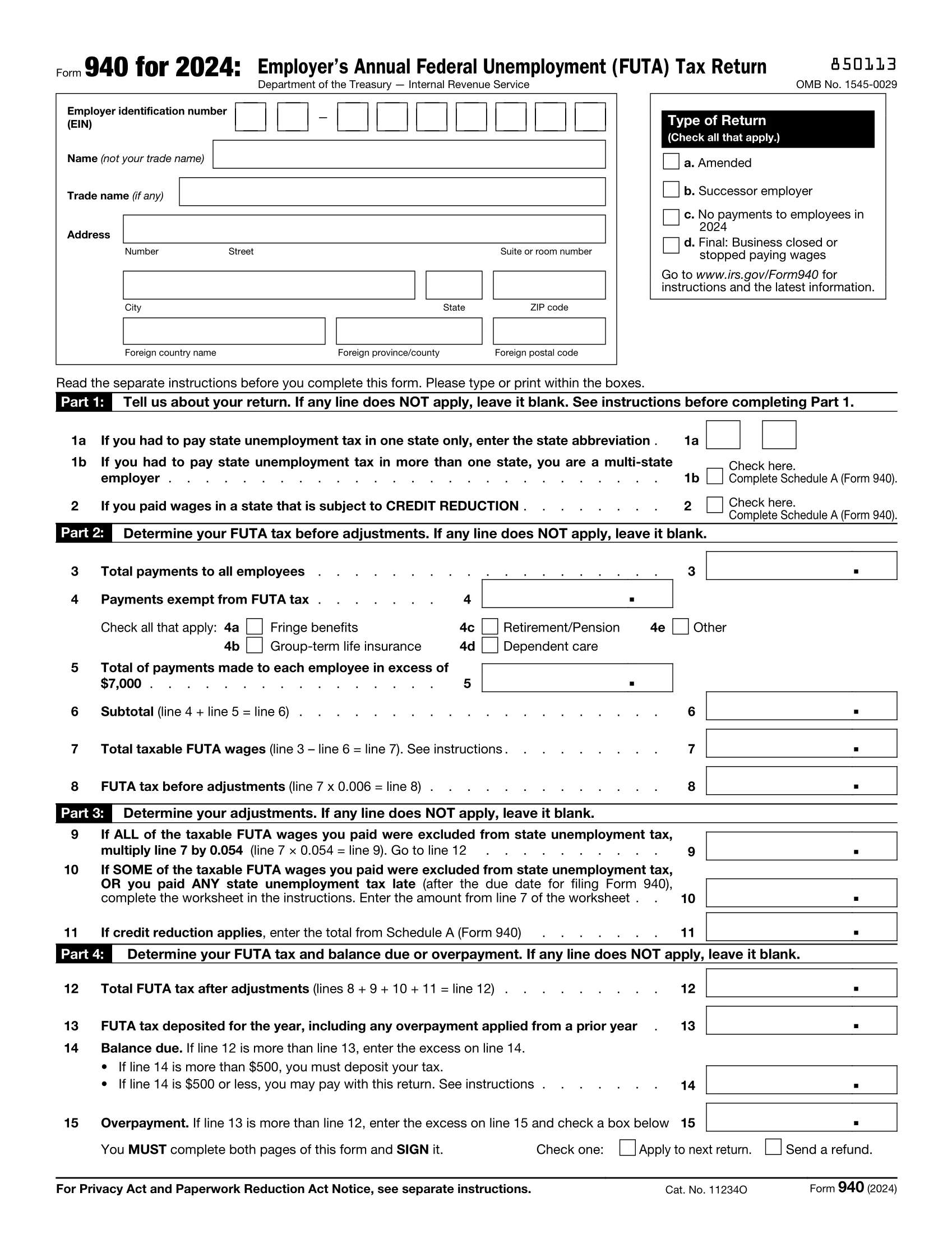

What Is Form 940?

Form 940, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is an IRS form that lets employers report their annual federal unemployment tax liability. Employers complete this form each calendar year to comply with federal law and assist eligible workers who’ve lost their jobs in receiving unemployment pay.

Form 940 is typically due on January 31 of the following year. However, the due date for Form 940 for tax year 2025 is February 2, 2026, because January 31, 2026, falls on a Saturday.

Even though Form 940 is filed annually, employers may need to deposit FUTA taxes quarterly. If your FUTA tax liability is more than $500, you must deposit it by the last day of the month after the quarter ends. If you have a FUTA tax liability of $500 or less, you can carry it over to the next quarter until it equals more than $500.

Employers who deposited all their FUTA tax liabilities have a due date extended by 10 calendar days. For the 2025 tax year, the extended due date for Form 940 is February 12, 2026.

Calculating FUTA Tax

The FUTA tax rate has been 6% since 2011. It is subject to change by the IRS, so be sure to stay informed about important updates.

The tax only applies to the first $7,000 of each worker’s yearly earnings. After the first $7,000, the employer isn’t responsible for paying more FUTA tax. For example, imagine you pay $20,000 to an employee in 2025. The FUTA tax will be $7,000 times 6%, equaling $420 in FUTA tax. Even though you paid $20,000 to the employee for the entire year, you only have to pay FUTA tax for their first $7,000.

The federal government refers to this $7,000 figure as the FUTA wage base, but the wage base for your state may differ depending on its guidelines.

Tax Credits to Reduce Your Liability

You may be eligible for a tax credit of up to 5.4% if you paid wages subject to state unemployment tax. This credit can reduce the effective FUTA tax rate to just 0.6% because the 6% tax rate minus the 5.4% credit equals 0.6%.

Form 940 vs Form 941

Form 940 and Form 941 (Employer’s Quarterly Federal Tax Return) are both tax forms for employers, but they serve different purposes. Form 940 allows for reporting of FUTA taxes, while Form 941 allows for reporting of quarterly federal payroll taxes. Review the key differences between these forms below.

| Difference | Form 940 | Form 941 |

|---|---|---|

| Purpose | Report FUTA taxes | Report quarterly federal payroll taxes; these include income, Social Security, and Medicare taxes (FICA) |

| Filing Frequency | Annually | Quarterly |

| Due Date(s) | February 2, 2026 | Quarter 1: April 30 2026 Quarter 2: July 31, 2026 Quarter 3: November 2, 2026 Quarter 4: February 1, 2027 |

| Tax Responsibility | Tax is only paid by the employer | Taxes are paid by both the employer (employer's share of FICA) and the employee (withheld from wages) |

| Wages Covered | Only wages up to FUTA wage base ($7,000 per employee in 2025) | All taxable wages for Social Security, Medicare, and federal withholding |

Who Needs to File Form 940?

As an employer, you must file IRS Form 940 if either of the following scenarios applies to you:

- You paid wages of at least $1,500 or more to employees in any calendar quarter during 2024 or 2025.

- You had at least one employee work any part of a day for 20 or more weeks in 2024 or 2025. If this scenario applies, you must account for all temporary, part-time, and full-time employees. Don’t count partners if your business is a partnership.

Exceptions to Filing Form 940

The following employers are exempt from paying FUTA tax, and therefore do not need to file Form 940:

- State or local government employers

- Tax-exempt non-profit organizations (they might be charitable, scientific, educational, or religious organizations)

- Indian tribal governments (if they comply with applicable state unemployment laws and participate in their state unemployment system for the full calendar year)

- Agricultural employers (unless they employed 10 or more farmworkers or paid more than $20,000 in cash wages during any calendar quarter)

- Household employers (unless they paid private home or local college club employees $10,000 or more during any calendar quarter)

How to Fill Out Form 940

Filling out Form 940 helps you report your FUTA tax liability and ensure compliance. To begin, you’ll need to provide your business’s information, including the following:

- Employer identification name (EIN)

- Trade name (if your business has one)

- Legal business name

- Business address

You should also specify what type of return you’re completing (Amended, Successor Employer, No Payments to Employees in 2025, or Final).

Once you fill out this initial information, you can follow the Form 940 instructions below to complete Parts 1-7.

Part 1 – Return Details

Use these lines in Part 1 to tell the IRS about your tax return:

- Line 1a: Enter the state abbreviation of the state where you had to pay state unemployment tax. Only complete this line if you had to pay state unemployment tax in one state only. If you had to pay in more than one state, leave this line blank.

- Line 1b: Check the box in Line 1b if you had to pay state unemployment tax in more than one state. You will also need to complete Schedule A (Form 940).

- Line 2: Check the box in Line 2 if you paid wages in a state that’s subject to credit reduction. You will also need to complete Schedule A (Form 940).

Part 2 – FUTA Tax Before Adjustments

Fill out part 2 to determine your FUTA tax before adjustments. If any line does not apply to your business, you may leave it blank:

- Line 3: Enter your total payments to all employees.

- Line 4: Record any payments exempt from FUTA tax. Check applicable boxes, including fringe benefits, group life insurance, retirement/pension, and dependent care.

- Line 5: Dictate the total of payments made to each employee exceeding $7,000.

- Line 6: Calculate the subtotal, which will be Line 4 plus Line 5.

- Line 7: Determine the total taxable FUTA wages, which will be Line 3 minus Line 6.

- Line 8: Figure out the FUTA tax before adjustments, which will be Line 7 times 6%.

Part 3 – Your Adjustments

Part 3 helps you determine your adjustments, which were excluded from Part 2. Complete the following lines:

- Line 9: Only complete Line 9 if all of the taxable FUTA wages you paid were excluded from state unemployment tax. If this applies, multiply Line 7 by 5.4%. Then, move to Line 12 in Part 4.

- Line 10: Only complete Line 10 if some of the taxable FUTA wages you paid were excluded from state unemployment tax, or you paid any state unemployment tax late. If this applies, complete the worksheet in the Form 940 instructions. Enter the amount from Line 7 of the worksheet into Line 10 of Form 940.

- Line 11: Enter the total from Schedule A (Form 940) only if the credit reduction applies.

Part 4 – Your FUTA Tax & Balance Due (or Overpayment)

Next, you’ll calculate your FUTA tax and the balance due or overpayment you made. Complete the following lines:

- Line 12: Calculate the total FUTA tax after adjustments by finding the sum of Lines 8, 9,10, and 11.

- Line 13: Enter the FUTA tax you deposited for 2025, including any overpayment applied from a prior year.

- Line 14: Provide the balance due. This line is only applicable if Line 12 is more than Line 13.

- Line 15: Calculate how much you overpaid. This line is only applicable if Line 12 is less than Line 13.

Part 5 – Your FUTA Tax Liability by Quarter (If Applicable)

Lines 16a-d in Part 5 are for reporting the amount of your FUTA tax liability for each quarter (not the amount you deposited). If you had no liability for a quarter, leave the corresponding line blank:

- Line 16a: Enter the first quarter FUTA liability tax.

- Line 16b: Input the second quarter FUTA liability tax.

- Line 16c: Provide the third quarter FUTA liability tax.

- Line 16d: Supply the fourth quarter FUTA liability tax.

- Line 17: Write the sum of Lines 16a, 16b, 16c, and 16d to calculate your total FUTA tax liability for 2025.

Part 6 – Third-Party Designee

Indicate whether you grant the IRS permission to discuss your tax return with a third-party designee. If you choose, you can name a paid tax preparer, an employee, or someone else you trust as an authorized person. Provide the designee’s name and phone number, and assign them a five-digit personal identification number (PIN) to use when talking to the IRS.

Naming a third-party designee is optional, so you can select “No” if you don’t wish to have one.

Part 7 – Signature

Sign your name to indicate you’ve completed Form 940 as accurately and completely as your knowledge permits. You must also provide the date of signing, your printed name, your title, and a daytime phone number where the IRS can contact you.

What Is Form 940-V, Payment Voucher?

You must use Form 940-V when mailing a check or money order with Form 940. You can only use this voucher if your total FUTA tax for the year is $500 or less. If your FUTA tax for the year is more than $500, you must deposit your payments electronically through the Electronic Federal Tax Payment System (EFTPS) instead of mailing a payment.

Form 940 Example

View an example of Form 940 below to better understand how to complete your annual federal unemployment tax return. When you’re ready, you can complete a fillable form using Legal Templates’s intuitive online PDF editor. Then, download it in PDF, which you can send to the IRS following their instructions.

Where to Send Form 940

Legal Templates helps you fill out Form 940, but you must file it with the IRS. You can mail Form 940 to one of the following addresses, depending on where you live and whether you’re sending a payment:

| If You're In: | Without a Payment: | With a Payment: |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0046 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| Puerto Rico, U.S. Virgin Islands | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| If your place of business is not listed | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| EXCEPTION for tax-exempt organizations; federal, state, and local governments; and Indian tribal governments, regardless of your location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

You can file 940 electronically using IRS-approved software. It may be a quicker process, and you’ll receive acknowledgment within 24 hours. However, you may have to pay a fee to file online, while paper filing with the IRS is free.

Penalties for Failing to File Form 940

If you fail to file Form 940 on time, the IRS may assess a failure-to-file penalty of 5% per month (up to 25%) on the unpaid tax.

If you fail to pay the FUTA tax when it’s due, you may need to pay a failure-to-deposit penalty and other late fees.