What Is a Last Will and Testament?

A last will and testament is a legal document that defines where your property, like money and personal items, will go after your death. In this form, you name a trusted executor to fulfill your wishes. You can also leave items to certain people or charities and ensure your children have legal guardians.

This document becomes effective upon your death and must go through probate to be validated. While it doesn’t avoid probate altogether, having a legally valid will can speed up the process and reduce stress. You can also prevent family conflict, as it spells out your wishes clearly.

Without a last will, your estate will be divided according to your state’s intestate succession laws. Avoid default procedures by creating a last will with Legal Templates. We help you outline your preferences so your family can benefit from your estate as you intend.

Who Should Create a Last Will?

Any adult with assets or dependents can benefit from creating a last will form.

How to Write a Simple Will

Creating a last will and testament online is simple with Legal Templates’ structured form. It helps you cover all essential details efficiently. Follow these steps to ensure your will is legally sound.

- Add basic details: Include your name, date, location, and family status.

- Choose an executor: Name a trusted person to manage your estate.

- List beneficiaries: Specify who will receive your assets and in what proportion.

- Appoint guardians: Select caretakers for minor children and pets.

- Outline asset distribution: Decide how money, property, and heirlooms are divided.

- Include special instructions: Add specific directives about heirlooms, traditions, or other requests.

- Meet legal requirements: Sign with witnesses and follow state laws.

Now, let’s break down each step in more detail.

1. Name Yourself as the Testator

The person writing the last will is called the testator. Identify yourself as the testator and give important details, like your city and state of residency.

You must also specify if you’re married. If you have a spouse, they may be entitled to receive some of your property, even if you leave them out of your will. Most states protect spousal rights by state statute, preventing you from disinheriting them unless they sign a waiver of their rights in a prenup or postnup.

You should also clarify if you have children or stepchildren. When you indicate that you have children in our document editor, we’ll help you name legal guardians and account for them in your will.

2. Decide Who Will Manage Your Last Will

Choose someone you trust to manage your will. They will be your executor, which means they will be responsible for distributing your assets according to your instructions. You can also select a successor executor if your primary one dies or becomes unable to fulfill their role. While you don’t have to compensate your executor, some people choose to do so to show their gratitude.

Explain whether your executor must pay for a bond using your estate funds. A bond protects your beneficiaries if the executor acts dishonestly or mismanages your property. In most cases, the probate court will require a bond unless you waive it.

Finally, describe how your executor should settle your debts and expenses. Our document editor lists two common options: let the executor decide or use funds from your estate before assets are distributed. Alternatively, you can specify another method. While it’s on your mind, you can also assign any special instructions to your executor.

3. List Your Beneficiaries

List your beneficiaries, who are the individuals who will receive part of your estate. If you’re disinheriting someone who would usually inherit under your state’s laws (like a spouse, child, or close relative), make sure to state that you’re intentionally excluding them. You should also consider including alternate beneficiaries if one of your named beneficiaries dies before you.

Use our questionnaire to name each beneficiary and the percentage of your estate they’ll receive. For example, if you want to distribute your estate to your four children, you can name each and specify that they’ll all get 25% of your estate.

Your beneficiaries will receive what’s left in your estate after specific gifts, debts, and other costs are handled. The remaining amount is called your residuary estate. It includes assets you own solely in your name, like your car, home, or bank account without a co-owner. It doesn’t include things like life insurance, 401(k)s, or joint accounts that already have a named beneficiary. These are distributed separately and aren’t covered by your will.

Ensure Your Affairs Are in Order

Review our estate planning checklist to handle your affairs not covered in your last will form.

What Happens If a Beneficiary Dies Before You?

It’s essential to plan for what happens if a beneficiary dies before you or shortly after you. Without a clear plan, their inheritance could become tied up in legal issues.

To avoid confusion when distributing your estate, you can include a survivorship clause in your will. This clause requires a beneficiary to outlive you by a certain number of days to receive their inheritance.

If you don’t include this rule, state law will determine what happens if you and a beneficiary die around the same time. Without a survivorship clause, if a beneficiary dies before or at the same time as you, their share may go to someone else, such as a backup beneficiary or their heirs. Including this rule keeps things simple and ensures your estate is distributed as you intended.

4. Explain Any Donations or Gift-Giving

Your beneficiaries will get your residual estate in the percentages you assign to them. If you want a specific person, charity, or organization to get a personal item or a set amount of cash, you can specify them in your will. Your executor will know to handle these deliveries before distributing the rest of your estate to your beneficiaries.

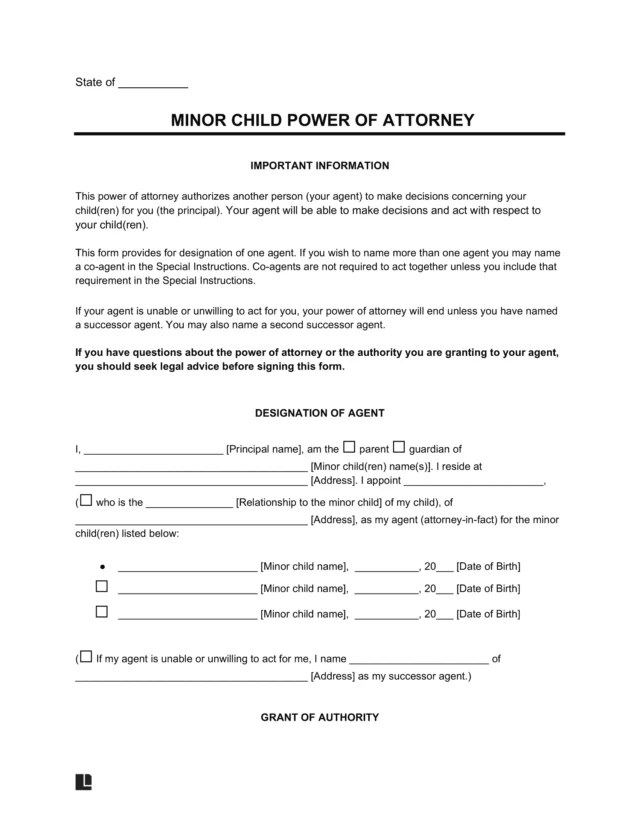

5. Appoint a Guardian for Minor Children

If you have children under 18, name a guardian who will care for them in the event of your passing. To ensure your children will be raised by someone you trust, you should also designate a backup guardian if your first choice cannot take responsibility. If your minor children are set to inherit your assets, you should also consider naming a trusted individual to manage the assets until they reach adulthood.

6. Give Instructions for Your Pets

If you have pets, you can plan for their care if they survive you. Consider the following:

- Name a guardian who will take full responsibility for their care.

- Provide clear instructions on their routine, diet, and medical needs.

- Set aside funds to cover food, vet visits, and other expenses.

- Consider a shelter or rescue if no trusted person is available.

7. Make Special Requests

Within our last will and testament template, you can include additional instructions for your executor to follow. These may not be legally required, but they help ensure your final wishes are respected. Common special requests include:

- Family traditions: Express hopes for how family heirlooms are passed down or how holidays are celebrated in your honor.

- Legacy projects: Request the creation or maintenance of legacy items like a scholarship fund or photo archive.

- Handling of sentimental items: Specify whether certain belongings should go to specific people, even if they don’t have high financial value.

These requests can help guide your loved ones, but some instructions—like funeral plans—are often better shared ahead of time in separate end-of-life documents, like an end-of-life plan. This is because a will is usually read after funeral arrangements have already taken place.

8. Create a Self-Proving Affidavit

A self-proving affidavit accompanies a last will to expedite the probate process. It contains sworn statements from you, as the testator, and the witnesses. These parties confirm that the testator willingly signed the will when they were of sound mind.

While a self-proving affidavit is optional, it can greatly help during probate. When this document is attached to the will, the witnesses won’t have to appear in court to verify the will’s validity. Instead, the probate court can accept the will without live witness testimony. This convenience can make a difficult time for your family a little easier and less stressful.

9. Sign Before Witnesses

Even without a self-proving affidavit, you still need to follow your state’s witnessing requirements. Most states require two witnesses to observe your signature, but it is important to confirm your state’s requirement to ensure that your will is valid.

A notary public must only be present if you add a self-proving affidavit. Otherwise, a notary public is not required. If the witnesses observe your signature with no one else around, they will likely have to testify in probate court that you signed the will while competent.

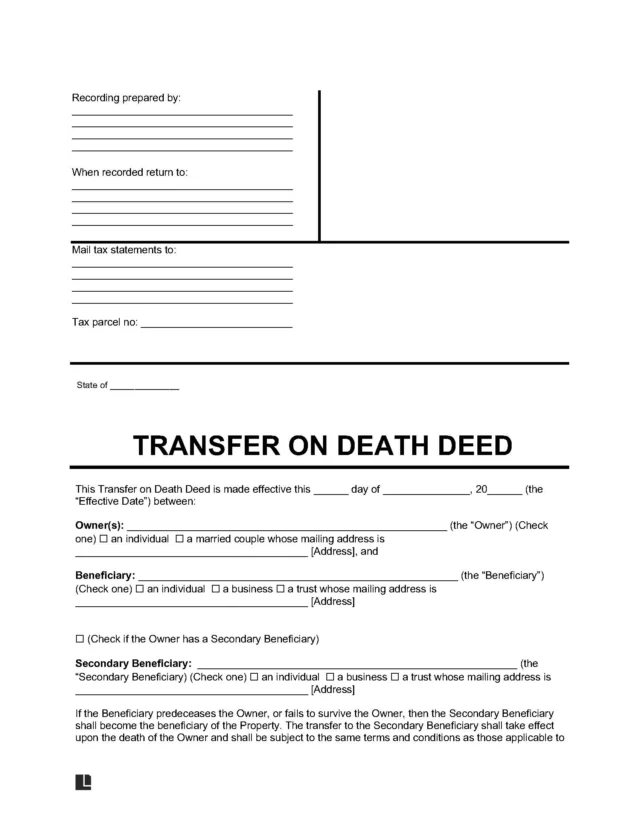

Last Will and Testament Sample

Below, you can see what a will looks like. Study our free last will and testament form to see how it comes together to communicate your wishes for property distribution. Once you’ve reviewed our last will and testament example, you can create your own using our document editor. Get a printable version as a PDF or Word file.

Legal Considerations for Last Wills

When writing a will, you must follow key legal requirements so the document holds up in court. From having the correct number of witnesses to understanding what makes a will valid in your state, these rules ensure your final wishes are honored.

Written Requirement for Wills

In most cases, a will must be written down, whether handwritten or typed. If the will is typed and contains handwritten edits made later, the edits are invalid unless they are re-witnessed by the witnesses and resigned by the testator.

In most states, wills made orally are not valid. These wills, called nuncupative wills, are not seen as reliable by courts, and they tend to be challenging to prove. Some states allow oral wills in specific cases, such as for individuals in combat.

Revisions to Wills

As life changes, you may need to make updates to your will. For example, you may want to add or remove a beneficiary or change the guardian for a minor child. You can use Legal Templates’ codicil to will template to make revisions.

If your will requires major changes, consider writing a new one instead of using a codicil. Our template contains language that clarifies the new will revokes all previous wills and codicils. Whether you create a new will or use a codicil, follow the same procedure and have your will or codicil witnessed and in writing to ensure its validity.

Review Your Will Regularly

Consider reviewing your last will every three to five years to ensure it still reflects your wishes. Look over it after major life events, too.

Invalidity of Wills

A will is invalid if it was signed under any of the following conditions:

- Fraud: The testator was deceived into signing.

- Duress or undue influence: The testator was pressured or forced into creating the will.

- Mistake: The will contains unclear language or errors in execution.

- Lack of capacity: The testator was not of sound mind, was a minor, or did not fully understand their actions.

- Improper execution: The will did not follow state laws for signing and witnessing.

Requirements for Testators

In most states, you must be at least 18 years old and have the mental capacity to understand what a will is, what you own, and who you leave your property to. Explore the requirements for testators in each state below.

| State | Requirements for the Testator | Testator Law |

|---|---|---|

| Alabama | • Be at least 18 years old and of sound mind | AL Code § 43-8-130 |

| Alaska | • Be at least 18 years old and of sound mind | AK Stat § 13.12.501 |

| Arizona | • Be 18 years old and of sound mind | AZ Rev Stat § 14-2501 |

Signing Requirements for Wills

Most states require two witnesses to observe a testator’s signature. Below, you can explore the specific signing conditions for a last will and testament form, as well as the statutes that support the requirements.

| State | Witness/Signing Requirements | Law |

|---|---|---|

| Alabama | Two witnesses must see the testator sign or acknowledge the will | AL Code § 43-8-131 |

| Alaska | Two witnesses must sign within a reasonable time after seeing the testator sign or acknowledge the will | AK Stat § 13.12.502 |

| Arizona | Two witnesses must sign after seeing the testator sign or acknowledge the will | AZ Rev Stat § 14-2502 |

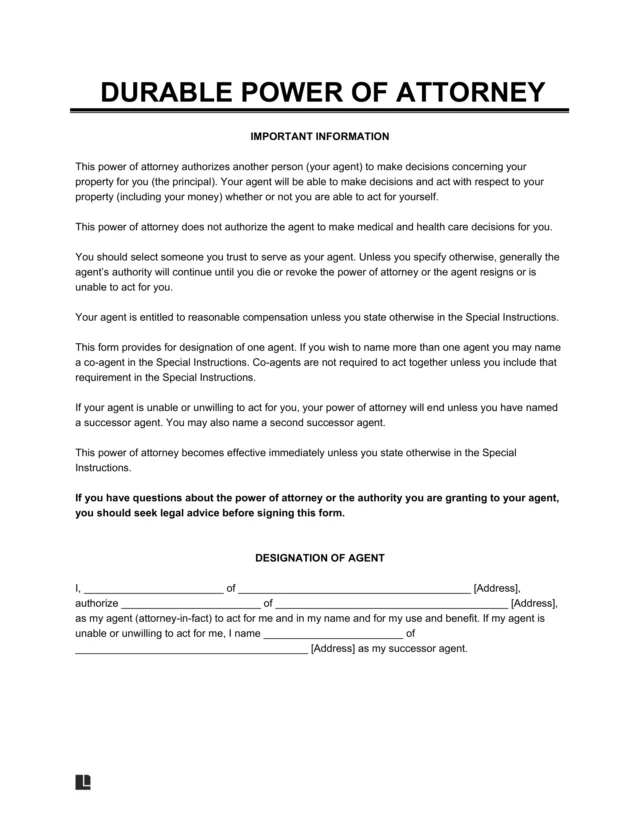

Last Will & Testament vs. Living Trust vs. Living Will

A last will and a living trust deal with how your property is distributed, but the timing is different. A last will takes effect only after your death and typically goes through probate.

A living trust is active during your lifetime and lets someone else manage your assets if needed. Unlike a will, a living trust does not go through probate. You can choose a revocable trust to keep control or an irrevocable trust to give up control for tax purposes or protection from creditors.

A living will is a separate document that deals with your health instead of your property. It outlines your preferences for medical treatment, like pain relief and decisions about end-of-life care. It takes effect if you’re alive but unable to communicate.

| Document | Purpose | Key Benefits |

|---|---|---|

| Last Will | Distributes assets after death | Ensures assets go to chosen beneficiaries, names a guardian for minor children |

| Living Trust | Manages assets during life and after death | Avoids probate, provides control over assets, can be updated |

| Living Will | Specifies medical care preferences | Clarifies end-of-life care, ensures medical wishes are followed |

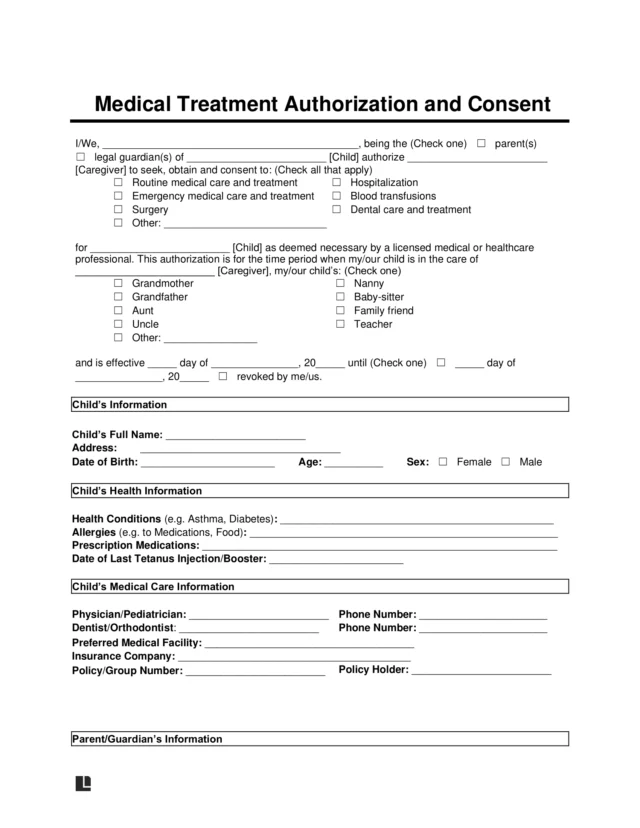

Handle Your Health Care Matters

While a living will lets you establish your health care wishes, it’s not the only document for medical planning. You can also create a medical power of attorney to appoint an agent to make healthcare decisions if you cannot do so yourself. Combine a medical POA and a living will into one document called an advance directive.