What Is a Triple Net Lease (NNN)?

A triple net lease, or NNN lease, is a commercial lease agreement where the tenant pays more than just rent. They cover several major expenses, including:

- Property taxes

- Building insurance

- Maintenance

- Utilities

This setup lowers the landlord’s day-to-day costs and gives the tenant more say in how the property is cared for. Since the tenant takes on the largest share of costs, triple net leases sit at the top of the net-lease ladder:

- N lease: Tenant pays property taxes

- NN lease: Tenant pays taxes and insurance

- NNN lease: Tenant pays taxes, insurance, and maintenance

Most NNN leases are long-term agreements used in commercial spaces like retail, industrial buildings, and standalone properties. They work well when both sides want stability and predictable responsibilities.

How a Triple Net Lease Works

In a triple net lease, rent reflects only the landlord’s return, while the rest of the financial activity shifts to the tenant. This structure shapes how the lease is priced and how both sides view the long-term arrangement. Base rent is usually lower because of this setup, since the tenant takes on more of the financial load. It isn’t a discount, but simply the result of dividing the financial duties in a different way. In an NNN lease, that means:

-

The landlord receives steady, predictable income, since base rent stays the same each month.

The tenant covers and budgets for the ongoing costs, including taxes, insurance, and upkeep tied to using the space.

Rent also ties into the property’s cap rate. The tenant’s credit strength influences that rate, since stronger credit lowers the landlord’s risk and can lead to better terms. All of this affects how each party measures value. The landlord focuses on stable income, and the tenant looks at long-term cost control.

What Does a Landlord Pay in a Triple Net Lease?

A triple net lease leaves the landlord with only a few key responsibilities. Their focus shifts from daily costs to long-term oversight and risk control.

| What Landlords Handle | What That Means |

|---|---|

| Tenant Stability | Review the tenant's financial strength to confirm they can manage the lease. |

| Vacancy Risk | Absorb the loss when the space sits empty and no rent comes in. |

| Major Structural Needs | Pay for big items like the roof, foundation, or other core components if the agreement assigns it to them. |

| Big-Picture Decisions | Stay involved in major building decisions, but not daily upkeep unless the lease says otherwise. |

This structure keeps the landlord focused on long-term stability while the tenant handles the operational side.

Screen Your Commercial Tenant

Landlords still need to confirm the tenant’s financial strength before signing an NNN lease. For help evaluating a business tenant, see our guide on Commercial Tenant Screening: How to Choose the Right Business Tenant

What Tenants Pay in a Triple Net Lease

Tenants handle most of the financial activity in an NNN lease. They manage the costs that keep the property running day to day.

| What Tenants Cover | What That Means |

|---|---|

| Operating Costs | Pay property taxes, insurance, maintenance, repairs, utilities, and other ongoing expenses. |

| Surprise Bills | Handle unexpected repairs or changes in tax or insurance amounts. |

| Insurance & Taxes | Choose their insurance provider and challenge property tax assessments. |

| CAM Charges | Cover shared-area costs like parking lots, landscaping, and exterior upkeep. |

This structure gives tenants more control but also places more financial responsibility on their side of the lease.

Triple Net Lease vs. Gross Lease

A triple net lease and a gross lease split costs in different ways. A gross lease wraps expenses into one fixed payment. A triple net lease separates them, so the tenant pays each cost directly. That difference changes who deals with cost changes over time. In a gross lease, the landlord handles those shifts. In an NNN lease, the tenant does. As a result:

- Gross lease: steady, predictable payments

- Triple net lease: more control over operating costs

These setups also fit different building types. Gross leases appear more often in multi-tenant spaces, while triple net leases are common in standalone properties. Both structures work, but they support different priorities.

When to Use a Triple Net Lease

A triple net lease works well for commercial, income-producing properties where long-term stability matters. It appears often in places where one tenant can manage the building day to day. Common examples include:

- Single-tenant retail

- Banks and pharmacies

- Restaurants

- Industrial parks

- Office buildings

This structure fits landlords who want predictable income with minimal involvement. It also suits tenants who want control over the building’s appearance and daily operational decisions.

NNN leases are usually chosen for long-term arrangements, especially when one tenant expects to stay in the property for many years. Some investors call this the “single tenant triple net lease game.” It’s their way of describing the strategy behind leasing an entire property to one long-term tenant.

Use an NNN lease when:

- You want a long-term arrangement

- The tenant is ready to manage the building’s day-to-day condition

- You prefer the tenant to make key financial and operational decisions

Avoid an NNN lease when:

- The tenant’s financial stability is uncertain

- You need more control over daily operations

- The lease depends heavily on consistent performance over time

What Is Included in a Triple Net Lease?

A triple net lease sets the rules that guide the contract. It explains how the agreement is structured, how decisions are handled, and which terms apply throughout the relationship. Those details usually fall into a few key areas, including:

- Rent structure is defined by listing the base rent and any pass-through amounts.

- Operational rules guide how maintenance, insurance, and taxes must be handled.

- Term length is set in advance, often 10–15 years, sometimes with caps on specific costs.

- Tenant control appears when the lease allows updates or changes to the property.

- Administrative terms cover renewal options, default rules, adjustments, and dispute procedures.

Together, these pieces define the key parts of a triple net commercial lease. They show how costs are handled and how responsibilities are divided between both sides.

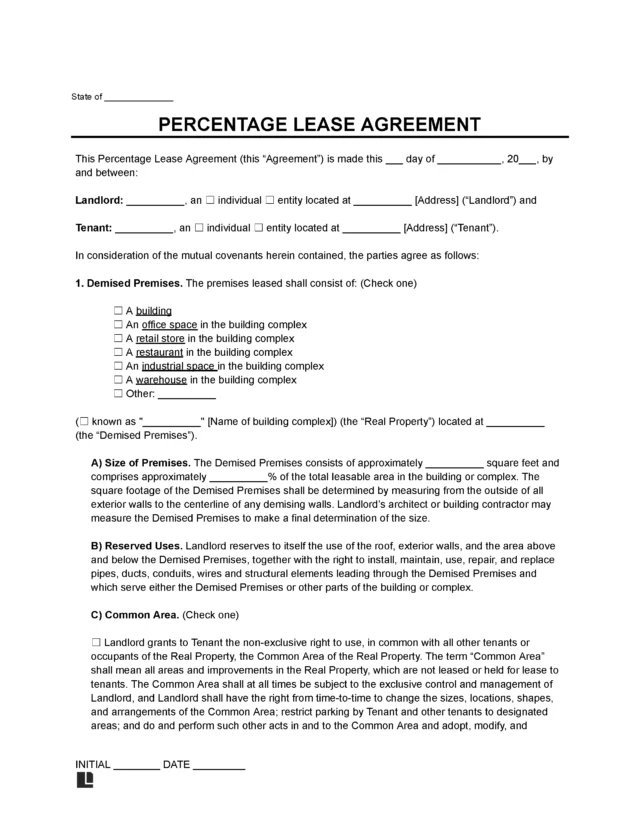

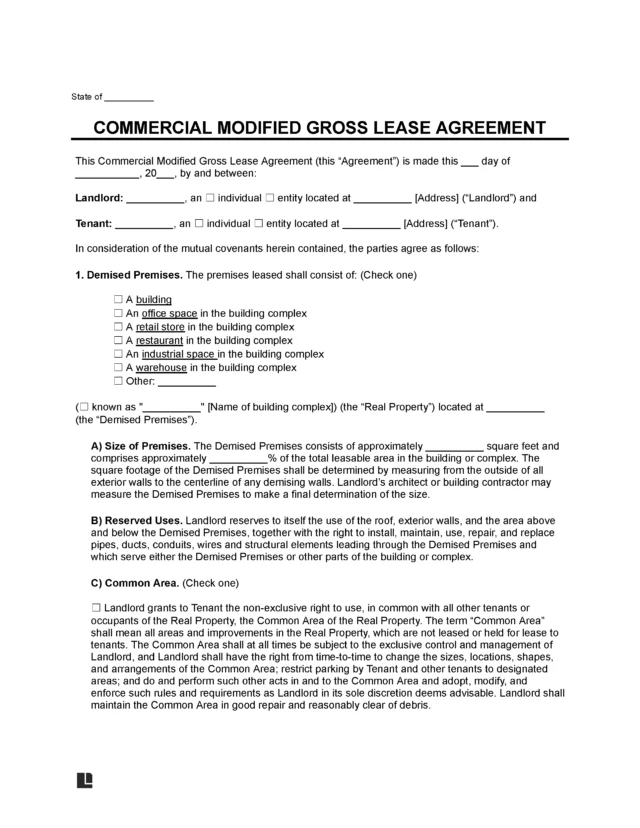

Triple Net Lease Sample

You can view a sample triple net lease agreement to see how the terms and costs are set up. It shows how responsibilities are split and what a complete contract looks like in practice. Look through the sample online, then customize it for your property before downloading the template in PDF or Word to suit your needs.