What Is a Mechanic’s Lien?

A mechanic’s lien (or a construction lien) is a formal notice indicating a financial interest in a property. A contractor fills it out when a customer fails to pay for the services or materials provided. It’s most common in construction projects, but can be used in other instances of unpaid work.

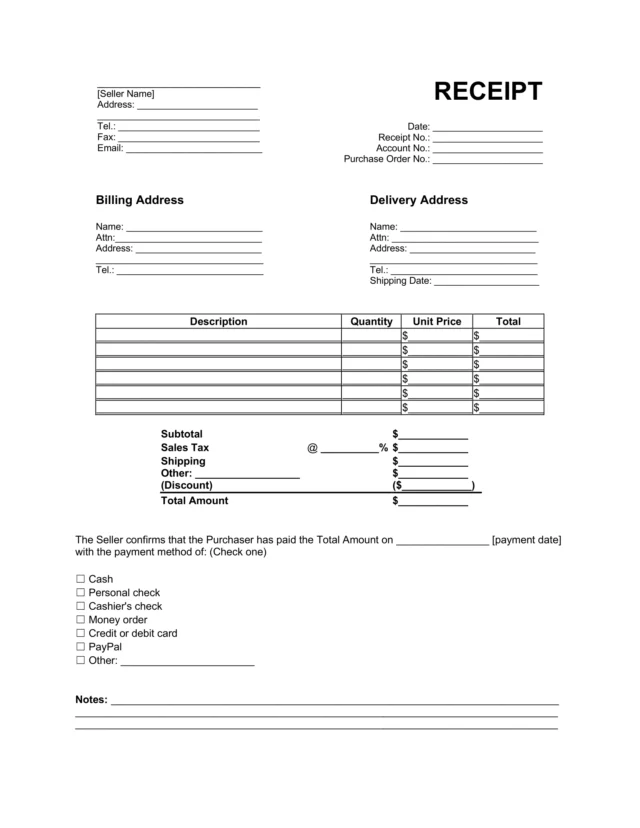

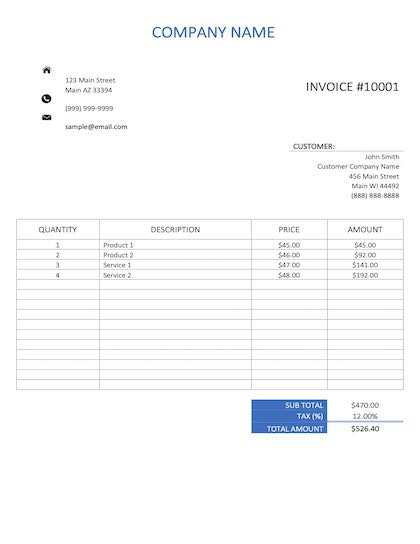

Before filing a mechanic’s lien, a contractor may try sending an invoice or a demand for payment letter. If the customer ignores it or refuses to pay, the contractor can use a mechanic’s lien. They fill out the details, stating a claim amount and declaring their hold on the property. Then, they file it with their county recorder’s office and provide notice to the property owner within a specific time frame.

Property owners can’t easily sell or refinance their properties without paying the amount owed to resolve the lien. So, if you’re a contractor who hasn’t received payment, filing a construction lien can give you leverage and increase your chances of getting paid.

Payment Bond vs. Mechanic's Lien

A payment bond is a surety bond on public projects that guarantees contractors and suppliers get paid, since liens can’t be filed against government property. A mechanic’s lien, by contrast, is a legal claim filed against private property to secure payment.

When to Use a Mechanic’s Lien

You can write and file a mechanic’s lien when you provided goods or services to construct or improve real estate property and didn’t receive payment. States have different rules for filing deadlines and what constitutes appropriate work. Generally speaking, the following work, if gone unpaid, may qualify for a construction lien:

- The provision of goods, such as lumber, plumbing supplies, or electrical equipment

- Carpentry, plumbing, electrical, and HVAC services

- Civil engineering, design, and architectural work

- The fabrication of specialty items that were later incorporated into construction projects

What Happens Without a Mechanic’s Lien?

If you don’t file a mechanic’s lien, you may decrease your chances of recovering the amount owed. The following consequences may occur:

- You may only rely on invoices, contracts, and other collection efforts, which the property owner may ignore.

- Property owners may sell or refinance without addressing the unpaid invoice.

- You might have to sue directly, which can be costlier.

- You may fall behind other creditors if the customer files for bankruptcy.

You can mitigate these risks by filling out Legal Templates’s mechanic’s lien form and filing it with the appropriate office for your jurisdiction.

Other Mechanic’s Lien Documents

Once the customer pays, you can fill out a release of mechanic’s lien. This form shows that the lien has been satisfied and removes it from the property, giving the property owner a clear title if they don’t have other encumbrances.

A lien waiver states that the contractor, subcontractor, or supplier cannot file a lien on the property. It protects the property owner and allows the project to continue forward. A lien waiver can be conditional on payment or unconditional, depending on the terms the parties agree to.

How to Fill Out a Mechanic’s Lien Form

When you know how to write a mechanic’s lien form, you can prepare it for filing with your local recorder’s office. This way, you’ll establish a clear record and encourage the property owner to pay their bill. Review the steps below for filling out a mechanic’s lien.

Step 1 – Provide Parties’ Information

Clarify that you’re the claimant, the party completing the contractor’s lien. Provide your name, address, and license number.

Filing a Mechanic's Lien on Someone Else's Behalf

You may file a mechanic’s lien on someone else’s behalf if you have the authority to do so in a power of attorney.

You should also provide the owner’s name of the property where you performed work. Give the street and legal addresses.

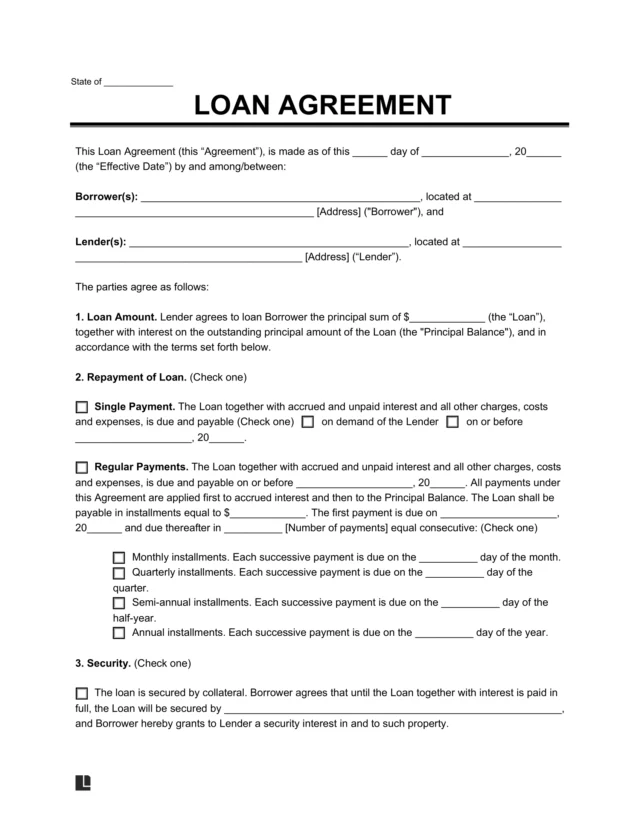

Step 2 – Reference the Original Contract

Reference the original contract, including:

- Who you (the claimant) entered the contract with

- The date you entered the contract

- The labor/services performed

- The contract price of the work completed

- The last date you performed work on the property

- A copy of the contract (optional)

Step 3 – State the Unpaid Balance

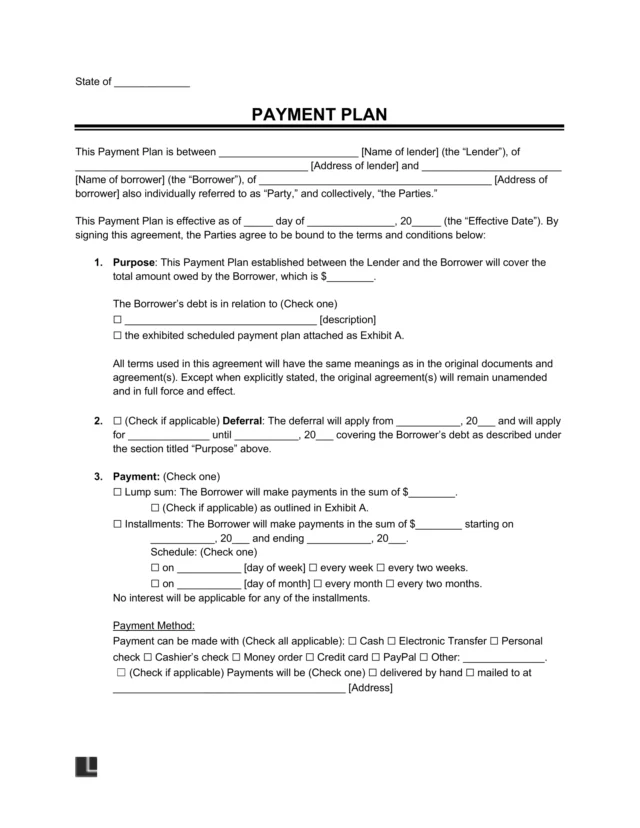

State the amount of the unpaid balance. If the property owner has paid you any portion of the amount due, account for this so you don’t seek more than you’re owed. Write the percentage of interest the property owner owes on the balance (if applicable).

Step 4 – Name the Claim’s Assignee

This may not be applicable if you’re the original owner of the claim. In most cases, the original claim owner is a contractor, subcontractor, or supplier who didn’t get paid.

However, claimants can sell or transfer their right to collect payment to another person or a collections agency. If you are pursuing the lien because you bought or received the lien as a transfer, you can include this specification in Legal Templates’s form.

Step 5 – Clarify the Notice Given

Sometimes, states make claimants issue notice before filing a contractor’s lien. Clarify whether you gave notice. If yes, state when you issued the notice, and attach a copy of the notice of intent to lien as an exhibit.

Step 6 – Give Verification Details

Like the notice requirements, some states mandate that you have a third party verify the form. This third party ascertains that the contents are true to the best of their knowledge. Even if verification isn’t required in your state, you can still consider including it to increase the enforceability of your document.

Step 7 – Sign & Notarize

Sign the construction lien to swear that its contents are accurate. Verification of your lien may be sufficient, but you may also need to get it notarized. Follow the requirements in your county and state to ensure your lien will be enforceable.

Step 8 – Ensure Adherence to State Laws

States have different requirements for various aspects of mechanic’s liens, including:

- Filing deadlines

- The specific parties allowed to file liens

- Lien content requirements and formatting

- Priority and enforcement

Below, you can explore the state laws for mechanic’s liens. Our table also outlines the time limits for recording liens by state, so you can submit your document on time and ensure it maintains its validity.

| State | General Laws | Time Limit to Record the Lien (With Statute) |

|---|---|---|

| Alabama | AL Code Title 35, Ch. 11, Art. 5, Div. 8 | 30 days for day laborers and journeymen 120 days for subcontractors 180 days for original contractors AL Code § 35-11-215 |

| Alaska | AK Stat Title 34, Ch. 35, Art. 2 | 120 days in normal situations 15 days if the property owner files a "Notice of Completion," indicating the project is finished AK Stat § 34-35-068 |

| Arizona | AZ Rev Stat Title 33, Ch. 7, Art. 6 | 120 days after project completion if not recorded If a notice of completion has been recorded, within sixty days (60) after recordation of such notice AZ Rev Stat § 33-993 |

| Arkansas | AR Code Title 18, Subtitle 4, Ch. 44, Subch. 1 | 120 days AR Code § 18-44-117 |

| California | CA Civ Code Div. 4, Part 6, Title 2, Ch. 4 | 90 days after recording the lien If the owner and claimant agree to extend credit, and notice is recorded within 90 days after recording the claim, then an action may be pursued, within 90 days after the expiration of credit and one year after project completion CA Civ Code § 8460 |

Mechanic’s Lien Sample

View our free mechanic lien letter sample below to understand how to word your claim. Then, create your own using our guided questionnaire. Download it as a PDF or Word file and prepare to send it to your local recorder’s office for filing.