Durable Power of Attorney – By State

Every state has its own rules for creating a durable power of attorney. Explore the state-specific templates below to ensure your document meets local standards.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

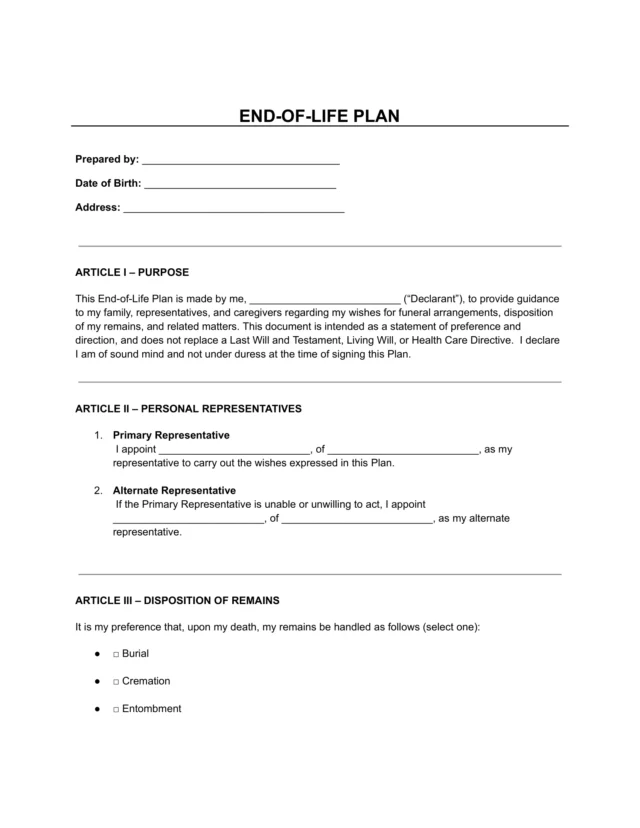

What Is a Durable Power of Attorney (DPOA)?

A durable power of attorney is a legal document that assigns someone decision-making powers over your legal and financial affairs. Because it’s durable, your chosen agent (“attorney-in-fact”) can still make decisions if you are incapacitated.

Per Section 102(4) of the Uniform Power of Attorney Act (UPOAA), “durable” means that the principal’s incapacity does not terminate the power of attorney (POA). Under this act, POAs are durable by default unless stated otherwise. However, just over half of the US states follow the UPOAA.

| State | Has Enacted the UPOAA? | Law That Enacted It | Year Enacted |

|---|---|---|---|

| Alabama | Yes | SB 53 | 2011 |

| Alaska | No | n/a | n/a |

| Arizona | No | n/a | n/a |

States that don’t adhere to this act have their own requirements. Many require the author of the document (the “principal”) to use specific language to make the document durable. Otherwise, the document is non-durable by default, meaning that it terminates when you become incapacitated.

Here at Legal Templates, we’ve crafted our forms to meet state requirements. When you choose the template for your state, rest assured that the language is accurate and up-to-date to reflect your desires.

Durable vs. Non-Durable POAs

A durable POA remains effective through incapacitation. If you become sick and unable to communicate, your agent keeps their authority. A non-durable POA is the opposite—it becomes ineffective when you become incapacitated. With a non-durable POA, the agent only has their authority while you’re competent.

When to Use a Durable Power of Attorney

When you write a durable POA, you allow a trusted individual to make important decisions on your behalf. You can create it if you anticipate circumstances that could prevent you from managing your legal and financial affairs. Consider setting up a DPOA in these situations:

- You’re a senior citizen planning your estate.

- You’re having surgery that may affect decision-making.

- You have or are at risk of a serious medical condition.

- You live or travel overseas long-term.

- You work in a high-risk or dangerous job.

- You’re in the military and facing deployment.

- You’re unmarried but want your partner to have legal authority.

A DPOA does not replace a last will or a trust, which determine the distribution of your assets. It only addresses legal and financial matters while the principal is alive.

Avoiding Guardianship

Having a DPOA can prevent the need for court-appointed guardianship, which makes it easier for family members to step in as needed.

How to Get a Durable Power of Attorney

If you want a DPOA as part of your estate plan, you can familiarize yourself with these steps to secure one:

- Find an agent: Ask a family member or close friend to be your agent. When choosing your agent, ensure they have the mental capacity to fulfill their role and that they can be trusted with your most important decisions.

- Discuss wishes: Talk about your wishes and what powers you want your attorney-in-fact to have.

- Draft your document: Use Legal Templates’ form to draft your DPOA.

- Check state requirements: Ensure you follow your state’s requirements for signing, witnesses, and notarization.

- Sign and store the document: Finalize the document with your signature and store it in a safe place. Provide relevant organizations with a copy so they know about your agent’s powers.

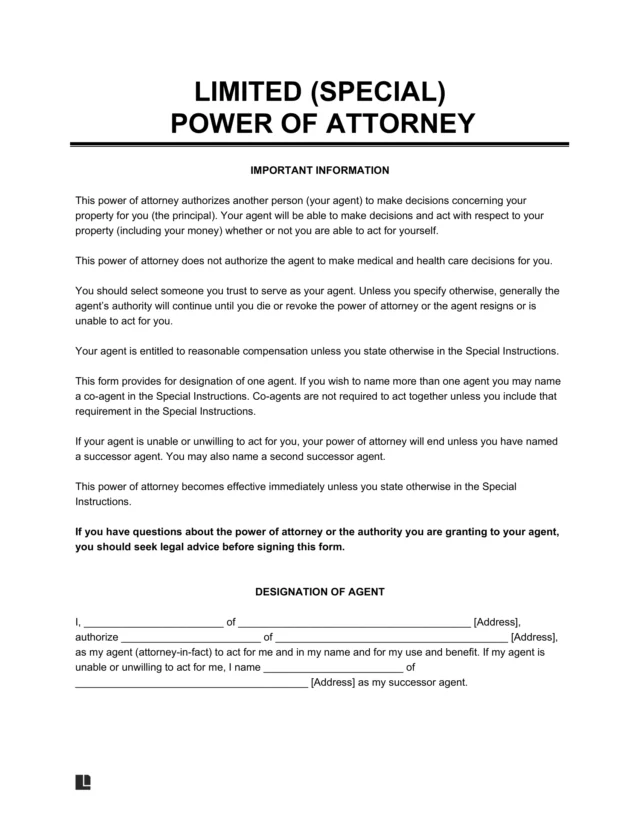

How to Fill Out a Durable Power of Attorney Form

If you’re wondering where to get a durable power of attorney form, you’ve come to the right place. Legal Templates offers a guided form that helps you complete your document step-by-step.

1. Name Yourself as the Principal

Provide your full name and address to identify yourself as the principal. Our form lets you specify if this is your first time creating one. If it isn’t, you can explain whether the new one will replace the existing one.

2. Designate Your Agent

Indicate who you would like to designate as your attorney-in-fact. Enter their full legal name and physical address, as well as the name and address of any co-agents. Our form gives space for two designated agents, but you can add others in the Special Instructions section. You may choose to designate the following individuals as agents:

- Reputable professionals, such as accountants or lawyers

- Your spouse

- Close family members or relatives

- Close friends

Discuss the matter with your agent before beginning the POA process. They should be willing and able to handle your financial and legal affairs according to your wishes. Consider whether they have the time and capacity to take on these matters in your absence.

Successor Agents

Consider appointing a successor agent who can intervene if your primary agent can’t act for you. A secondary successor agent provides even greater security, offering you peace of mind that someone will handle your affairs no matter what changes arise.

3. Grant General Authority

You may wonder what rights a durable power of attorney has. Ultimately, it’s up to you, as you can grant many financial authorities or only the authority that’s strictly necessary for your needs and goals.

List the areas where you want to give your agent authority. You may allow them to:

- Execute real property transactions

- Execute tangible personal property transactions

- Execute banking transactions

- Make investments

- Manage business operations

- Manage insurance and annuities

- Oversee personal and family maintenance

- Handle claims and litigation

- Manage estate, trust, and other beneficial interests

- Access government or civil/military benefits

- Execute retirement plan transactions

- Handle tax matters

Having an Agent Handle Your Taxes

To authorize an agent to represent you before the IRS and take care of your taxes, you must fill out IRS Form 2848.

4. Assign Specific Authority

When you grant general authority to your agent, some activities are automatically excluded from their powers unless you choose to include them. These exclusions protect your interests and make your elections purposeful.

Intentionally granting powers to your agent lets you give them flexibility to act in your best interests and preserve the integrity of your wishes. Our form lets you award particular powers to your agent, such as:

- Creating an inter vivos trust

- Amending, revoking, or terminating trusts

- Making gifts

- Creating or changing rights of survivorship

- Changing beneficiary designations

- Waiving annuity beneficiary rights

- Disclaiming property

Create your durable financial power of attorney form with confidence, knowing that you can easily define or restrict specific powers.

What About Medical Decisions?

If you want to grant someone medical decision-making authority, consider creating a medical power of attorney. This document tends to be durable and addresses healthcare-related powers.

5. State the Effectiveness

In states where powers of attorney are not durable by default, clarify that your POA will remain in effect if you become incapacitated. Use the specific language required by your local laws to ensure its effectiveness upon your incapacity.

Also, state when you want it to go into effect. Our form includes wording that makes the POA durable and ensures it becomes effective immediately upon signing. This way, your agent will be able to make decisions for you right away. The document typically has no end date unless you specify one.

6. Sign the DPOA

Meet the signing requirements for your DPOA. In most states, two disinterested witnesses must observe your signature, but you must check the requirements in your area. If you are mentally competent but can’t be present to sign the DPOA, you can appoint a representative to sign on your behalf.

7. Seek Notary Acknowledgment

In most states, a notary public must complete a notary acknowledgment. They can do so at the bottom of the durable POA form or complete a separate notary acknowledgment form.

Signing & Notarization Requirements for DPOAs

Most states have special requirements for signing and notarizing a document that grants a durable power of attorney. Follow your state’s requirements to ensure your document is legally valid:

| State | Requirements | Laws |

|---|---|---|

| Alabama | Notary Public | AL Code § 26-1A-105 |

| Alaska | Notary Public | AK Stat § 13.26.600 |

| Arizona | Notary Public and 1 Witness | AZ Rev Stat § 14-5501 |

Sample Durable Power of Attorney

View a free durable power of attorney sample to understand its format. Then, create your own with Legal Templates and download the final copy as a PDF or Word file.