A Florida durable power of attorney form grants someone (the “agent”) the authority to act on behalf of another person (the “principal”) in certain financial matters, even if the principal becomes incapacitated and unable to make their own decisions.

Sometimes called a durable power of attorney for finances, this form gives someone authority over your financial and business affairs. To grant durable power over health care decisions, you need a medical power of attorney.

Laws

Power of attorney forms can be made durable by including either the following statement or similar language:

“This durable power of attorney is not terminated by subsequent incapacity of the principal except as provided in chapter 709, Florida Statutes.”

- Statute: Title XL, Chapter 709, Part II (Powers of Attorney).

- Presumed Durable: No. Durability language required (§ 709.2104).

- Signing Requirements: Requires signatures of the principal and two witnesses.

- Notarization: Requires notarization (§ 709.2105).

- Statutory Form: No.

Definitions

Durable – A “durable” POA is not terminated by the principal’s incapacity (§ 709.2102(4)).

Power of Attorney – A “power of attorney” doesn’t have to be called that to be a legal document giving someone else the authority to act on the principal’s behalf (§ 709.2102(9)).

Specific Powers and Limitations

Restrictions on Gifts and Transfers

A DPOA can restrict gifts and transfers made by the agent. By default, the document doesn’t automatically grant the agent broad power to make gifts. But if it allows gifts, the agent must follow the “fiduciary duty” standard. This means they can only make gifts that are reasonable and in the principal’s best interests, considering factors like their financial situation and future needs.

An agent cannot use their power to make gifts to themselves or close relatives unless the DPOA specifically allows it.

Considerations:

- The agent should try to understand the principal’s past gift-giving habits and preferences.

- The gift shouldn’t significantly impact the principal’s ability to afford future care or living expenses.

- Large gifts might have tax consequences, so the agent should consult a financial advisor if needed.

Agent’s Authority Limitations

The powers granted to the agent have specific limitations under § 709.2114.

- The agent can only do what the document explicitly allows.

- The agent must consider the principal’s known expectations and act in their best interest whenever possible. This includes trying to preserve their estate plan if known.

- The agents cannot put themselves in situations where their personal interests might clash with the principal’s best interest.

- The agent must act honestly and with reasonable care, similar to how a responsible person would handle their own affairs.

- The agent cannot generally delegate their authority to someone else except in specific situations allowed by law or the DPOA document itself.

Revocation and Termination

A DPOA terminates, and the agent’s authority ends in several situations based on § 709.2109:

- When the principal passes away.

- If the principal becomes unable to make decisions for themselves.

- A court judgment of partial or total incapacity can revoke the document unless the court allows specific powers to remain exercisable by the agent.

- The principal has the right to cancel it at any time.

- If the DPOA was created for a specific purpose (like selling a house), the document terminates once that purpose is achieved.

- If the form doesn’t name a successor agent and the current agent’s authority ends (see below), then it terminates.

An agent’s marriage or legal separation from the principal can terminate their authority unless the DPOA allows them to continue acting. If the agent is a parent, spouse, child, or grandchild, their authority isn’t automatically suspended during legal proceedings to determine the principal’s incapacity.

A principal can revoke a power of attorney by including the revocation in a subsequent document or another signed writing. They can also notify an agent who accepted authority under the revoked power. However, simply executing a new power of attorney doesn’t automatically revoke a previously executed one.

Safekeeping and Registration

Registering a DPOA with any state entity is not mandated. While there’s no central registry for DPOAs, some institutions (like banks or financial entities) might have their own internal recording procedures. It’s always best to check with specific institutions about their requirements.

The principal should keep the original document in a safe place and provide a copy to the agent. They may also want to give copies to trusted family members or advisors for safekeeping.

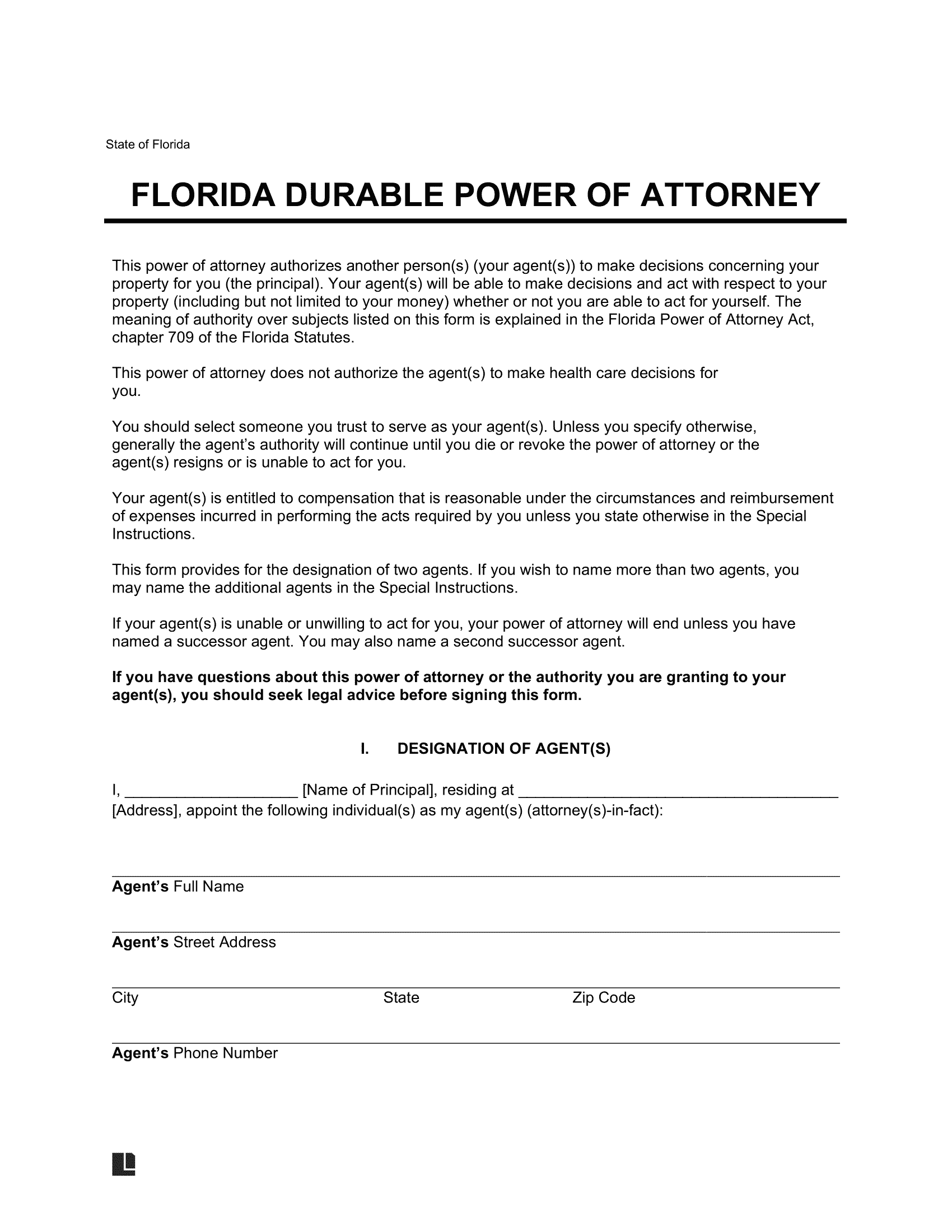

How to Write

Below is a detailed walkthrough to assist you in drafting your own DPOA:

Step 1: Gather Important Information

Before you begin drafting your DPOA, take some time to gather some key information. This will include your own details (name, address, contact information), as well as the information for the person you want to act on your behalf – your agent. You can choose one or more agents, and it’s also advisable to designate a successor agent in case your primary agent becomes unavailable for any reason.

The next step is to decide what powers you want your agent to have. This is an important decision, so consider carefully. You might want your agent to be able to manage your finances, handle real estate transactions, or a combination of these and other options.

Step 2: Carefully Fill Out the Form

Once you have your chosen document, take some time to carefully read through the instructions. Each form will have specific sections that need to be completed. Typically, these sections will include designated areas for you to enter your information and the information of your agent(s). You’ll also find sections where you can choose the specific powers you want to grant your agent by marking checkboxes or lines next to the corresponding options.

You may also find a designated section for any special instructions you want to provide for your agent. These instructions could be anything that clarifies your wishes or helps your agent understand your preferences when making decisions on your behalf.

Step 3: Sign and Have Your DPOA Witnessed

Once you’ve completed filling out the form, it’s time for the official signing. In order for your DPOA to be valid, you’ll need to sign it in the presence of two witnesses. They must be at least 18 years old and cannot be named as agents or beneficiaries.

When you sign, your witnesses should also be present to observe you signing and then sign the document themselves. The witness signature section will typically require them to provide their addresses as well.

Step 4: Notarize Your Document

Notarizing your DPOA adds an extra layer of verification and can make the document more readily accepted by institutions that may require you to use it.

A notary public is a person authorized by the state to witness signatures and verify identities. They will be able to witness your signature and confirm that you are the person signing the document.

Step 5: Secure and Share Your DPOA

Keeping the original document safe is important once your form is complete, signed, witnessed, and notarized. Choose a secure location where you can easily access it when needed.

It’s also essential to provide a copy to your agent(s) so they have it readily available. This can help ensure a smooth transition if you become incapacitated and your agent needs to start using your DPOA.

Additional Resources

- State Bar Association: Provides free information about DPOAs.

- Florida Legal Services Corporation: Provides legal assistance to low-income residents.

- Florida Department of Elder Affairs: Provides information, including the benefits, different types, and what to include.

Related Forms

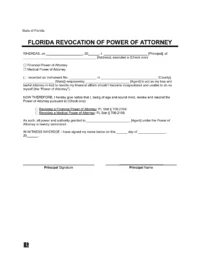

Revocation of Power of Attorney

Signing Requirements: Notary public and two witnesses.

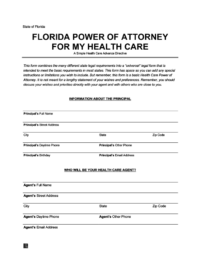

Medical Power of Attorney

Signing Requirements: Two witnesses.

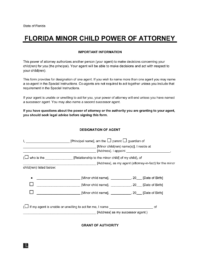

Minor (Child) Power of Attorney

Signing Requirements: Notary public and two witnesses.