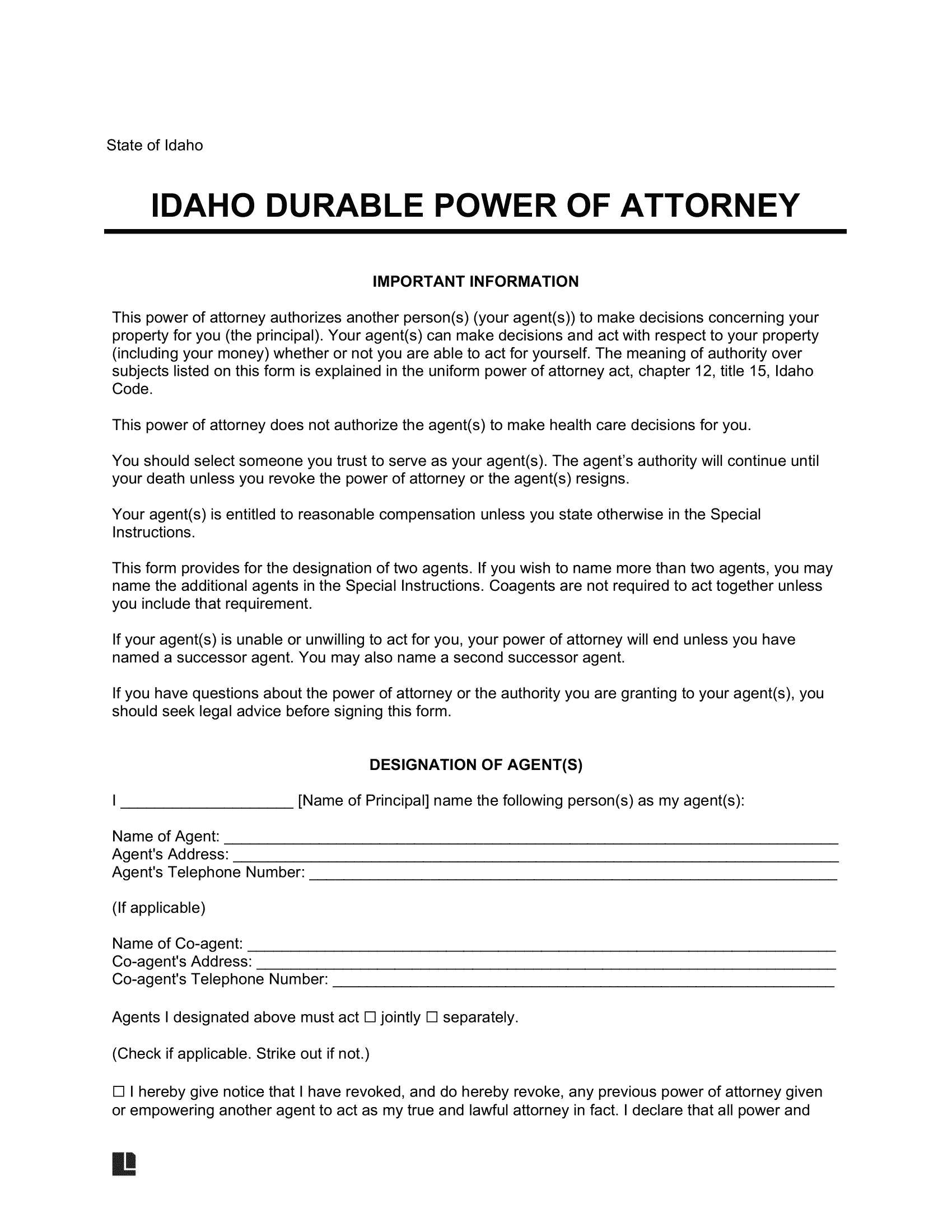

An Idaho durable statutory power of attorney form is a document that grants specific powers to someone you trust—called an “agent” to handle financial matters for you (the “principal”). The term “durable” means that the power of attorney stays in effect even if you become incapacitated.

Laws

Power of attorney forms in the state are durable by default.

- Statute: Title 15, Chapter 12 (Uniform Power of Attorney Act).

- Presumed Durable: Yes (§ 15-12-104).

- Signing Requirements: Signature required. No witnesses are required unless the principal is unable to sign the document due to a physical condition. In this case, the notary public may sign the document under the direction of the principal and before a witness.

- Notarization: The signature is presumed genuine if acknowledged before a notary public (§ 15-12-105).

- Statutory Form: Yes (§ 15-12-301).

Definitions

Durable – A power of attorney is considered “durable” if its authority remains valid in the event of the principal’s incapacitation (§ 15-12-102(2)).

Power of Attorney – A “power of attorney” is a legal document that gives the agent the authority to act on behalf of the principal, even if the document doesn’t use this exact term (§ 15-12-102(7)).

Specific Powers and Limitations

Restrictions on Gifts and Transfers

According to § 15-12-217 outlines restrictions and considerations for gifts made by an agent under a DPOA as follows:

Types of Gifts:

- Gifts “for the benefit of” a person: This includes transfers to trusts, accounts under the Uniform Transfers to Minors Act, and contributions to tuition savings accounts or prepaid tuition plans (as defined by Internal Revenue Code section 529).

- Outright gifts to individuals: The amount per person cannot exceed the annual IRS gift tax exclusion limit. This limit applies regardless of whether the gift actually qualifies for the exclusion.

- Consent to splitting gifts made by the principal’s spouse: In such cases, the agent can potentially double that limit per recipient.

Considerations:

- Consistency with the principal’s known objectives and best interest.

- The value and type of assets.

- The principal’s anticipated future needs and obligations.

- Past history of gift-giving.

- Minimization of taxes (income, estate, inheritance, etc.).

- Eligibility for government benefits.

Agent’s Authority Limitations

The DPOA must explicitly grant the agent permission to perform specific actions, which according to (§ 15-12-201), include:

- Creating, modifying, or revoking living trusts.

- Making gifts on the principal’s behalf.

- Changing ownership rights on assets to include survivorship rights.

- Designating or modifying beneficiaries for accounts or assets.

- Delegating their authority to someone else.

- Waiving the principal’s right to inherit certain benefits.

- Exercising any fiduciary powers that the principal has the right to delegate.

If the document contains overlapping or conflicting clauses regarding the scope of authority, the broadest grant of authority prevails.

Revocation and Termination

§ 15-12-110 explains how a DPOA and the agent’s authority under it can end:

- Upon the principal’s passing.

- Revocation by principal (at any time).

- A specific termination clause.

- Accomplishing its purpose.

- If the agent dies, becomes incapacitated, or resigns, and there’s no named successor agent in the document.

When the agent is the principal’s spouse, their authority might be revoked if they get divorced or legally separated, but the DPOA can be drafted to avoid this outcome.

Safekeeping and Registration

In Idaho, there is currently no central registry for durable powers of attorney. The original signed form should be kept in a secure location accessible to the agent but out of reach of anyone who might misuse it. You can consider a safe deposit box or a trusted individual for safekeeping.

It is also recommended to check directly with the specific financial institutions where the DPOA might be used to see if they have any registration requirements.

Additional Resources

- State Bar Website: Resources or links to resources that can be helpful for understanding DPOAs in the state.

- Attorney General’s Consumer Resource Center: May provide related consumer protection information.

Related Forms

Revocation of Power of Attorney

Signing Requirements: Notary public.

Medical Power of Attorney

Signing Requirements: Principal only (Notary public or witnesses recommended).

Minor (Child) Power of Attorney

Signing Requirements: Notary public.