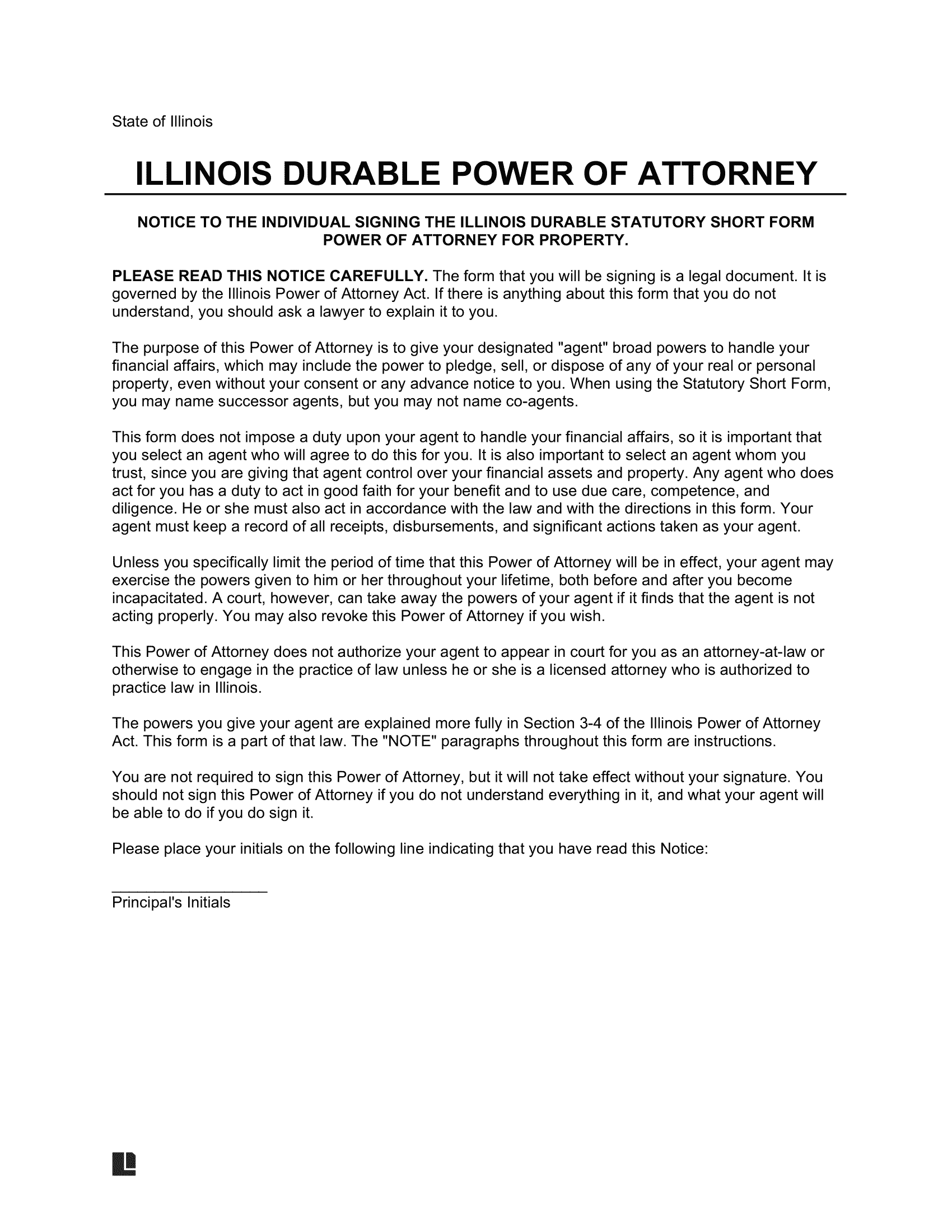

An Illinois durable power of attorney form is a legal document that allows an Illinois resident to grant another person (also known as “the agent”) power to act on their behalf in financial matters.

The power transferred can be general or specific (limited), enabling the agent to oversee the management of finances or simply complete one task. If a power of attorney is durable, the authority will remain intact if the principal becomes incapacitated.

Illinois durable power of attorney laws go beyond a patient’s death and allow agents to permit organ donations or decide on how the principal’s remains should be disposed of.

Laws

In Illinois, power of attorney forms are durable by default.

- Statute: 755 ILCS 45/1-1 (Illinois Power of Attorney Act).

- Presumed Durable: Yes — durability presumed (755 ILCS 45/2-5).

- Signing Requirements: The signature of the principal and one witness is required.

- Notarization: Notary acknowledgment is required.

- Statutory Form: Yes (755 ILCS 45/3-3).

Definitions

Durable – The Illinois Compiled Statutes do not define “durable” but refer to enduring through “incapacity” in the Act’s section on Durable Powers of Attorney. (755 ILCS 45/2-3(c-5))

Power of Attorney – The Illinois Compiled Statutes do not define “power of attorney.” However, the Act refers to an “agency” relationship in its section on Durable Powers of Attorney. (755 ILCS 45/2-3 (a))

Specific Powers and Limitations

When creating an Illinois durable power of attorney, it is essential to understand the specific powers you can grant to your agent and the limitations on those powers.

Restrictions on Gifts and Transfers

According to 755 ILCS 45/3-4 certain restrictions apply to the agent’s authority concerning gifts.

Types of Gifts:

Gifts to individuals: The agent has the authority to make gifts to an individual or to a trust for the benefit of an individual, but the permissible amount must not exceed the annual federal gift tax exclusion under Internal Revenue Code Section 2503(b), and the agent may not make any gifts in excess of the principal’s remaining estate after his or her death unless the DPOA specifically authorizes such gifts.

Gifts to charitable organizations: The agent may make gifts to charitable organizations if the DPOA specifically authorizes such gifts.

Transfers to trusts: The agent may transfer the principal’s property into a trust if the DPOA specifically authorizes such transfers, and the trust must be revocable by the principal unless the DPOA specifically authorizes an irrevocable trust.

Considerations:

- The agent’s authority to make gifts must be specifically authorized in the document.

- The agent must act in the best interests of the principal and follow the principal’s known desires and objectives.

- The agent must consider the following factors when making gifts (755 ILCS 45/2-9):

- The value and nature of the property

- The principal’s foreseeable obligations and maintenance needs

- The principal’s personal history of making or joining in making gifts

- The potential tax implications.

Agent’s Authority

The agent’s powers are limited to the scope defined by the principal at the time of execution. State law may impose additional restrictions on specific actions by the agent, such as altering the principal’s estate plan or making decisions contrary to the principal’s expressed wishes. (755 ILCS 45/2-8)

Safekeeping and Registration

Illinois does not have a statewide registry for durable powers of attorney. Therefore, the principal must keep the original document in a safe, accessible location and inform trusted individuals, such as family members or an attorney, of its location.

Additional Resources

- Illinois State Bar Association – A voluntary organization of lawyers in the state of Illinois that aims to promote the practice of law and improve the administration of justice.

- Illinois Legal Aid Online – Non-profit organization that provides free legal information and services to low-income individuals and families in the state of Illinois.

- Legal Assistance Foundation of Metropolitan Chicago – A non-profit organization that provides free legal services to low-income individuals and families in the Chicago area.

- Illinois Attorney General – Chief legal officer of the state and is responsible for providing legal advice and representation to the state government and its agencies.

Related Forms

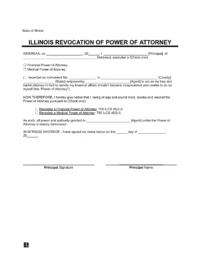

Revocation of Power of Attorney

Signing Requirements: Notary public (recommended).

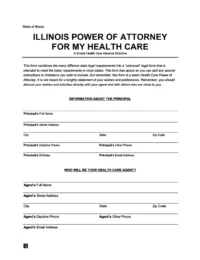

Medical Power of Attorney

Signing Requirements: One witness.

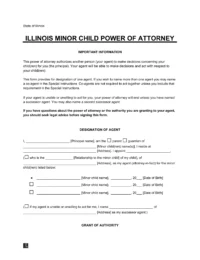

Minor (Child) Power of Attorney

Signing Requirements: Notary public and one witness.