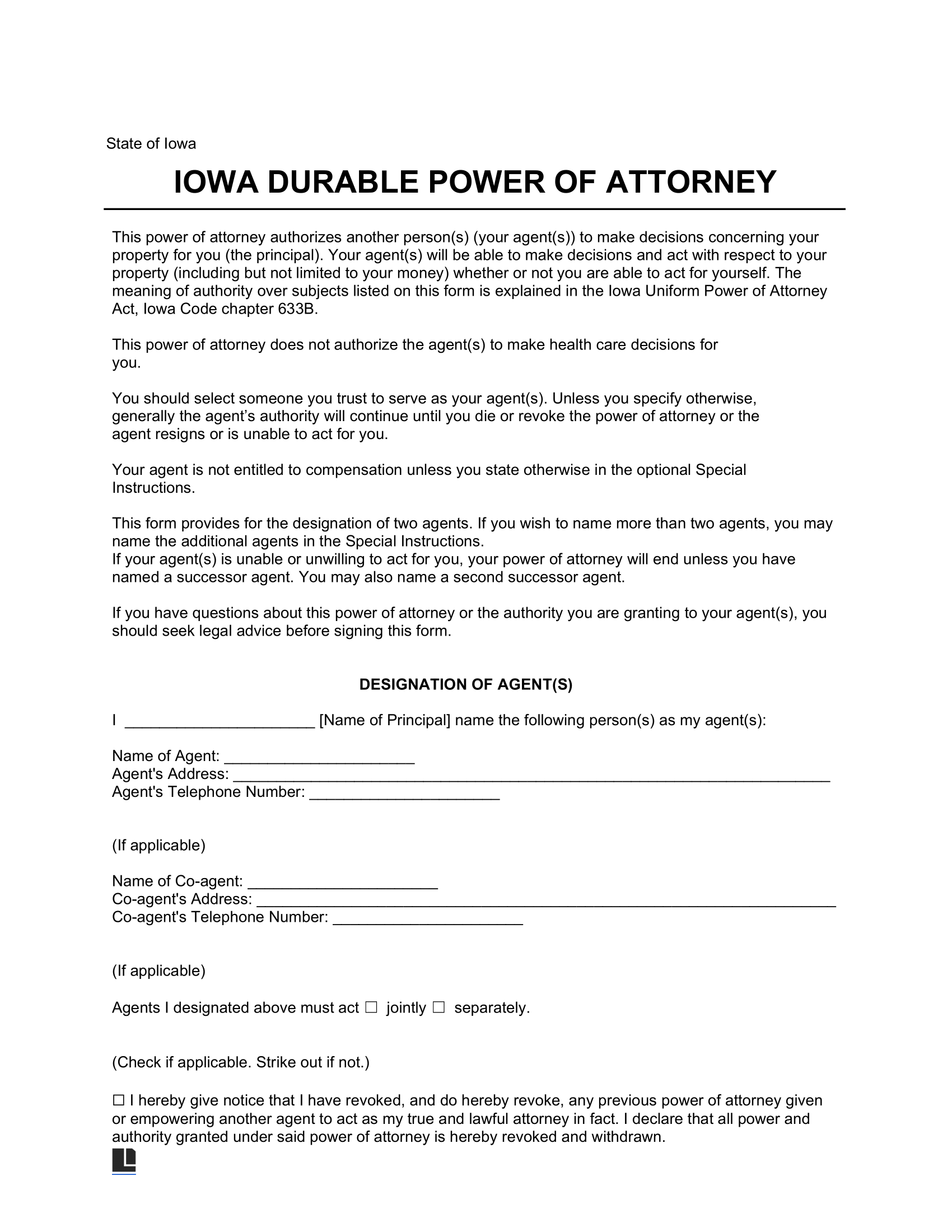

An Iowa durable power of attorney form allows an individual—also known as a “principal”—to grant specific powers to a trusted person—an “agent” or “attorney-in-fact”—to handle specific financial matters on their behalf: depositing their checks at the bank, filing their taxes, or even conducting real estate transactions for them.

A Durable POA stays in effect even if the principal becomes incapacitated and legally unable to make their own decisions, and it can also be used by someone who anticipates being away or unable to manage their finances in the future.

Laws

In Iowa, power of attorney forms are durable by default.

- Statute: § 633B.101 (Uniform Power of Attorney Act).

- Presumed Durable: Yes — durability presumed (§ 633B.104).

- Signing Requirements: The signature of the principal is required.

- Notarization: A notary public (or other individual authorized by law to take acknowledgments) must acknowledge the principal’s signature. The signature of the agent should be notarized if they sign the Agent Certification form, which is optional (§ 633B.105, § 633B.302).

- Statutory Form: Yes (§ 633B.301).

Definitions

Durable – “With respect to a power of attorney, means not terminated by the principal’s

incapacity.” (§633B.102(3))

Power of Attorney – “A writing that grants authority to an agent to act in the place of the principal, whether or not the term “power of attorney” is used.” (§633B.102(9))

Specific Powers and Limitations

When creating an Iowa durable power of attorney, it is essential to understand the specific powers you can grant to your agent and the limitations on those powers.

Restrictions on Gifts and Transfers

According to § 633B.217, certain restrictions apply to the agent’s authority concerning gifts.

Types of Gifts

- Gifts to individuals: The agent can give gifts to others, but the amount cannot surpass the limit in Section 2503(b) of the Internal Revenue Code. Unless your DPOA allows, they cannot give gifts exceeding the estate’s remaining value after your death.

- Gifts to charitable organizations: If specifically authorized, the agent may make gifts to charitable organizations.

- Transfers to trusts: If such transfers are specifically authorized, the agent may transfer the principal’s property into a trust. The trust must be revocable by the principal unless the document authorizes explicitly an irrevocable trust.

- Other gifts: The DPOA can allow the agent to make various gifts, including fulfilling pledges made to organizations, making gifts to the principal’s family members, and preparing necessary documents for gift transactions. Additionally, the attorney-in-fact can perform any other acts deemed necessary to complete a gift on behalf of the principal.

Considerations

- The agent’s authority to make gifts must be expressly authorized in the document.

- The agent may gift the principal’s property only as the agent determines it is consistent with the principal’s objectives if known by the agent and, if unknown, as the agent determines it is consistent with the principal’s best interest based on all relevant factors.

- The agent must consider the following factors when making gifts:

- The value and nature of the property

- The principal’s foreseeable obligations and maintenance needs

- The potential tax implications include income, estate, inheritance, generation-skipping transfer, and gift taxes.

- Eligibility for a benefit, a program, or assistance under a statute, rule, or regulation.

Agent’s Authority

It’s important to note that an agent’s authority is limited to what is expressly granted in the document. Some of the things an agent can do include creating or amending trust documents, making gifts, and delegating authority.

The agent’s powers also extend to any property the principal owns or acquires, regardless of location. However, an agent cannot create an interest in the principal’s property for themselves or someone they owe a legal obligation of support.

Safekeeping and Registration

Iowa does not have a statewide registry for durable powers of attorney. Therefore, the principal must keep the original document in a safe, accessible location and inform trusted individuals, such as family members or an attorney, of its location.

Additional Resources

- Iowa State Bar Association – A voluntary organization of lawyers that aims to promote the practice of law and improve the administration of justice.

- Iowa Legal Aid – Non-profit organization that provides free legal information and services to low-income individuals and families.

- Legal Aid Society of Story County – A non-profit organization that provides free legal services to low-income individuals and families in the Story County area.

- Iowa Attorney General – Chief legal officer of the state responsible for providing legal advice and representation to the state government and its agencies.

Related Forms

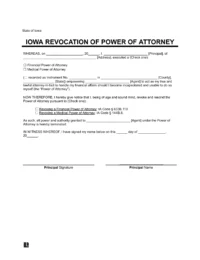

Revocation of Power of Attorney

Signing Requirements: Two witnesses or notary public (recommended).

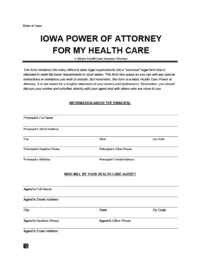

Medical Power of Attorney

Signing Requirements: Two witnesses or notary public.

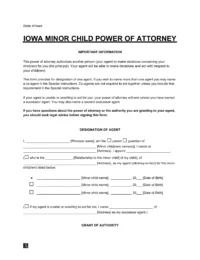

Minor (Child) Power of Attorney

Signing Requirements: Notary public.