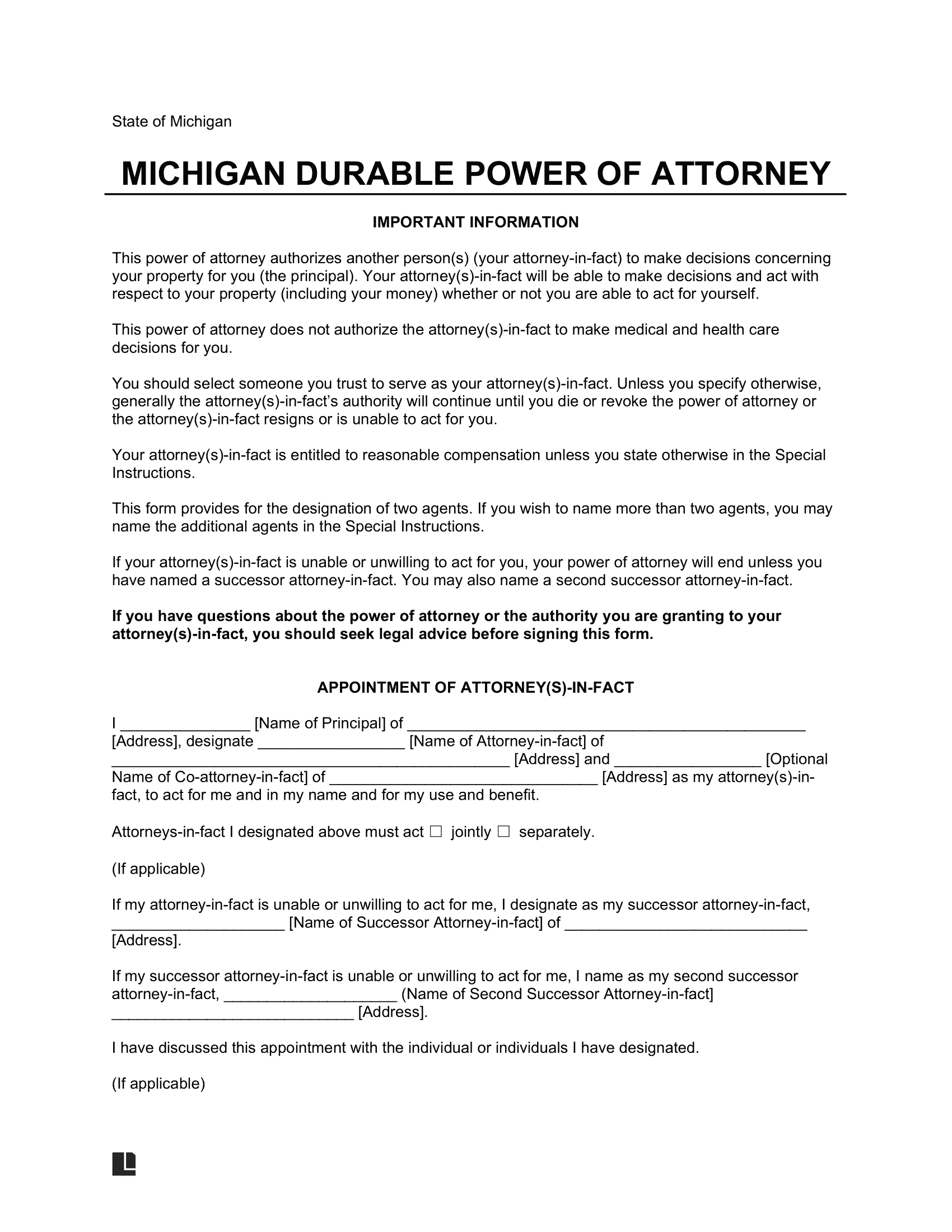

A Michigan durable power of attorney form is a document that allows someone (the “attorney-in-fact”) to act on behalf of another person (the “principal”) in certain financial affairs, even if the principal later becomes incapacitated and can’t communicate their wishes.

The principal can choose any competent adult as their agent, but it should ideally be someone they know and trust well. For example, a spouse, adult child, or a close friend could be a sufficient agent if the principal is confident they will act in the principal’s best interest.

Laws

POAs are only durable if you include one of the following statements or a similar phrase:

“This power of attorney is not affected by the principal’s subsequent disability or incapacity, or by the lapse of time.” or “This power of attorney is effective upon the disability or incapacity of the principal.”

- Statute: Michigan Comp. Laws §§ 700.5501-700.5520.

- Presumed Durable: No (§ 700.5501(1)).

- Signing Requirements: Must be dated and signed voluntarily by the principal or a notary public representing the principal (§ 700.5501(2)).

- Agent Acknowledgment: The attorney-in-fact must also sign an acknowledgment of their responsibilities before exercising their authority (§ 700.5501(4)).

- Notarization: A notary public must acknowledge the principal’s signature. Two witnesses can replace a notary public, but neither can be the attorney-in-fact.

- Statutory Form: No.

Specific Powers and Limitations

Restrictions on Gifts

The attorney-in-fact shall not make a gift of any or all of the principal’s property unless the DPOA gives explicit permission or the court issues a judicial order (§ 700.5501(3)(d)).

Agent’s Authority Limitations

Any act an attorney-in-fact completes when the principal is incapacitated or disabled has the same effects as if the principal were competent and not disabled (§ 700.5502).

The attorney-in-fact must follow these rules to adhere to state regulations:

- Act in the principal’s best interest.

- Follow the principal’s instructions.

- Inform the principal of the actions they take.

- Maintain records and provide an accounting of the actions they take upon the principal’s request.

Relation to Court-Appointed Fiduciary

The attorney-in-fact is accountable to any fiduciary that a court of the principal’s domicile appoints as an estate guardian or conservator (§ 700.5503).

Safekeeping and Registration

Keep a copy of your DPOA for yourself as the principal and issue a copy to your attorney-in-fact. Think about whether you want any third parties, like credit unions or banks, to have a copy on file. When they have a file on hand, they can more efficiently know the extent of your attorney-in-fact’s permissions.

If you gave your attorney-in-fact control over real estate-related decisions, you must record your document with your county’s Register of Deeds.

Additional Resources

- Michigan Office of Retirement Services: Lists information for individuals retiring or close to retirement.

- Michigan Legal Help: Provides tools and information for people to navigate their legal problems.

- State Bar of Michigan: Offers lawyer referral services and a Modest Means Program to help moderate-income people find legal services.

Related Forms

Revocation of Power of Attorney

Signing Requirements: Two witnesses or notary public (recommended).

Medical Power of Attorney

Signing Requirements: Two witnesses.

Minor (Child) Power of Attorney

Signing Requirements: Two witnesses or a notary public.