A New Mexico durable (statutory) power of attorney is a legal document that allows an individual (the “principal”) to appoint another person (the “agent”) to manage their financial decisions and affairs while they are alive.

As per state law, the agent, often a spouse or family member named as a beneficiary in the principal’s last will and testament, gains immediate authority upon signing the document. The agent is required to present the document whenever utilizing the granted powers.

Laws

In New Mexico, power of attorney forms are durable by default.

- Relevant Laws: §§ 45-5B-101 — 45-5B-403 (Uniform Power of Attorney Act).

- Presumed Durable: Yes. § 45-5B-104.

- Signing: Signature required.

- Notarization: A signature is considered authentic if signed in front of and acknowledged by a notary public or other authorized official. § 45-5B-105.

- Statutory Form: Yes — § 45-5B-301.

Definitions

Durable – “Durable”, with respect to a power of attorney, means not terminated by the principal’s incapacity (§ 45-5B-102(B)).

Power of Attorney – “Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term “power of attorney” is used (§ 45-5B-102(G)).

Specific Powers and Limitations

Restrictions on Gifts and Transfers

Types of Gifts:

- Outright gifts to individuals: New Mexico allows reasonable gifts to family members and charitable organizations, as long as they are consistent with your past giving patterns and don’t deplete your estate to the point where you cannot maintain your standard of living.

- Outright gifts of principal’s property: The amount per donee is capped at the annual limits set by the federal gift tax exclusion, without requiring the application of the gift tax exclusion under section 2503(b). Additionally, with the principal’s spouse’s consent, the limit can be extended to twice the annual federal gift tax exclusion limit pursuant to section 2513 of the IRC. (§45-5B-217(B)(1))

- Consent to splitting gifts made by the principal’s spouse: The agent can also consent to split gifts made by the principal’s spouse, aligning with the aggregate annual gift tax exclusions for both spouses.

- Gift for the benefit of a person: A gift “for the benefit of” a person is broadly defined to include contributions to trusts, accounts under the Uniform Transfers to Minors Act, and Section 529 tuition savings or prepaid tuition plans (§ 45-5B-217).

Considerations:

- The agent is permitted to make gifts from the principal’s property only if such actions align with the principal’s known objectives or, if unknown, the principal’s best interest.

- The principal’s history of gift-giving should be considered in the agent’s decisions.

- The determination of the principal’s best interest should consider the value and nature of the property, the principal’s needs and obligations, tax minimization strategies, eligibility for benefits, and the principal’s history of gift-giving.

- This approach emphasizes the importance of acting in alignment with the principal’s intentions and welfare, guided by a comprehensive evaluation of relevant factors.

Agent’s Authority Limitations

Someone who is not a family member, partner, or child cannot use the principal’s belongings for their own benefit or to help someone they are responsible for supporting unless you have specifically allowed them to do so in writing (§ 45-5B-301).

Agent Liability

If an agent breaks the rules of the Uniform Power of Attorney Act, they must pay back the principal or the principal’s future beneficiaries (§ 45-5B-117). This includes:

- The amount needed to make the principal’s property value as it would have been if the agent hadn’t violated the rules.

- Legal fees incurred by the principal’s beneficiaries in order to correct the actions of the agent.

Agent Exoneration

A provision can exist in the document to protect the agent from being liable or blamed for not fulfilling their duties (§ 45-5B-115). However, this protection doesn’t apply if:

- The agent acted dishonestly, had bad intentions, or acted recklessly in the performance of their duties.

- The agent took advantage of or exploited a special relationship to shield themselves from liability.

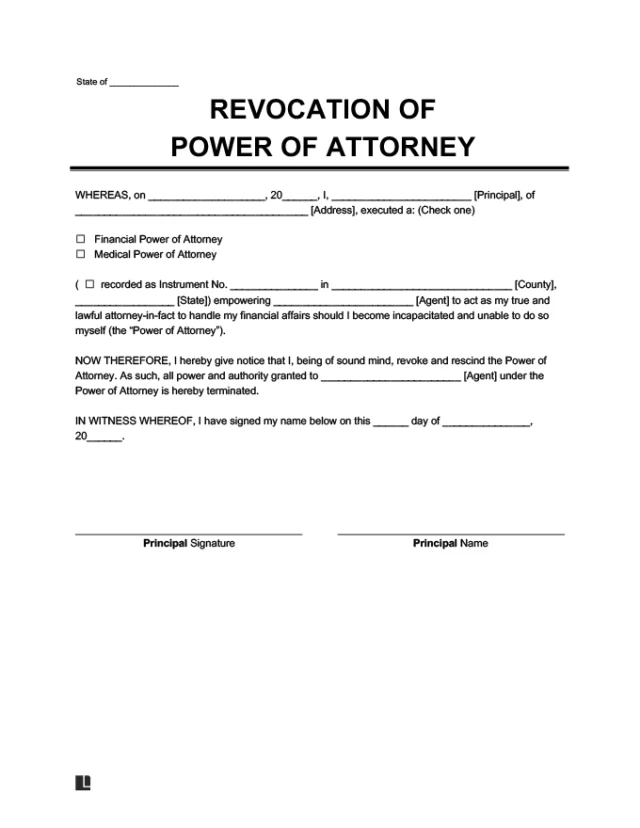

Revocation and Termination

Representation under a power of attorney must cease upon knowledge of any event that terminates the power of attorney or the agent’s authority. Such terminating events include:

- Death of the principal.

- Revocation of the power of attorney or the agent’s authority by the principal.

- Occurrence of a termination event specified within the power of attorney.

- Complete fulfillment of the power of attorney’s purpose.

- Initiation of legal proceedings for divorce or legal separation if the agent is married to the principal, except where the power of attorney specifies that such proceedings do not affect the agent’s authority.

Safekeeping and Registration

New Mexico does not have a statewide registry for powers of attorney. It’s important to keep the original signed document in a safe place and provide copies to your agent, financial institutions you do business with, and trusted family members.

Additional Resources

- New Mexico State Bar Association: Resource for Power of Attorney information.