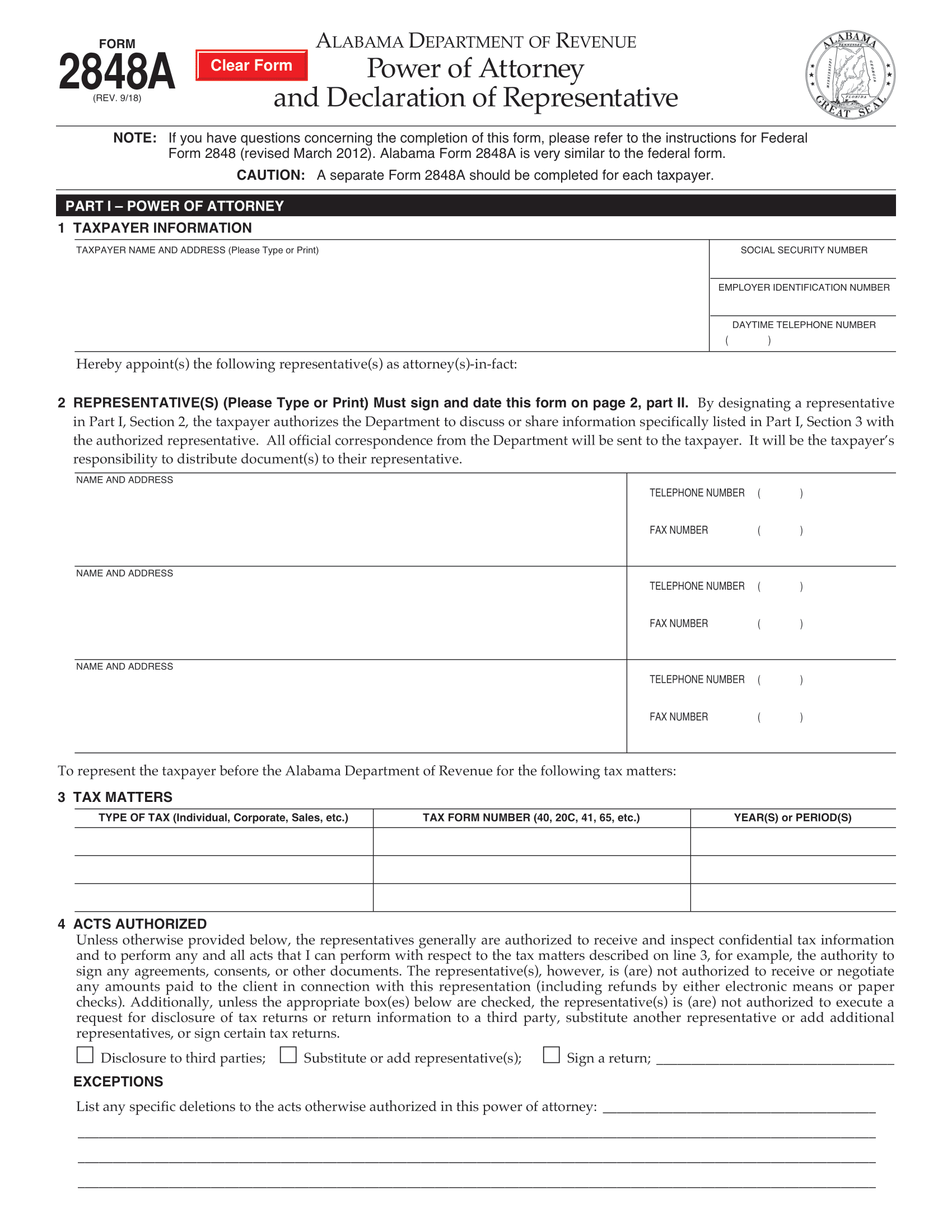

An Alabama tax power of attorney form, otherwise known as “Form 2848A,” is a legal document that enables an individual, known as the “principal,” to designate another person or entity as their agent to manage specific financial matters with the Alabama Department of Revenue.

This form doesn’t require notarization and allows for the appointment of up to three representatives, who must fall under the designated categories specified in Part II of the document. The filer should understand that they carry full responsibility for the agent’s actions and any consequences arising from non-payment or other related issues, thereby absolving the selected agent of any liability.