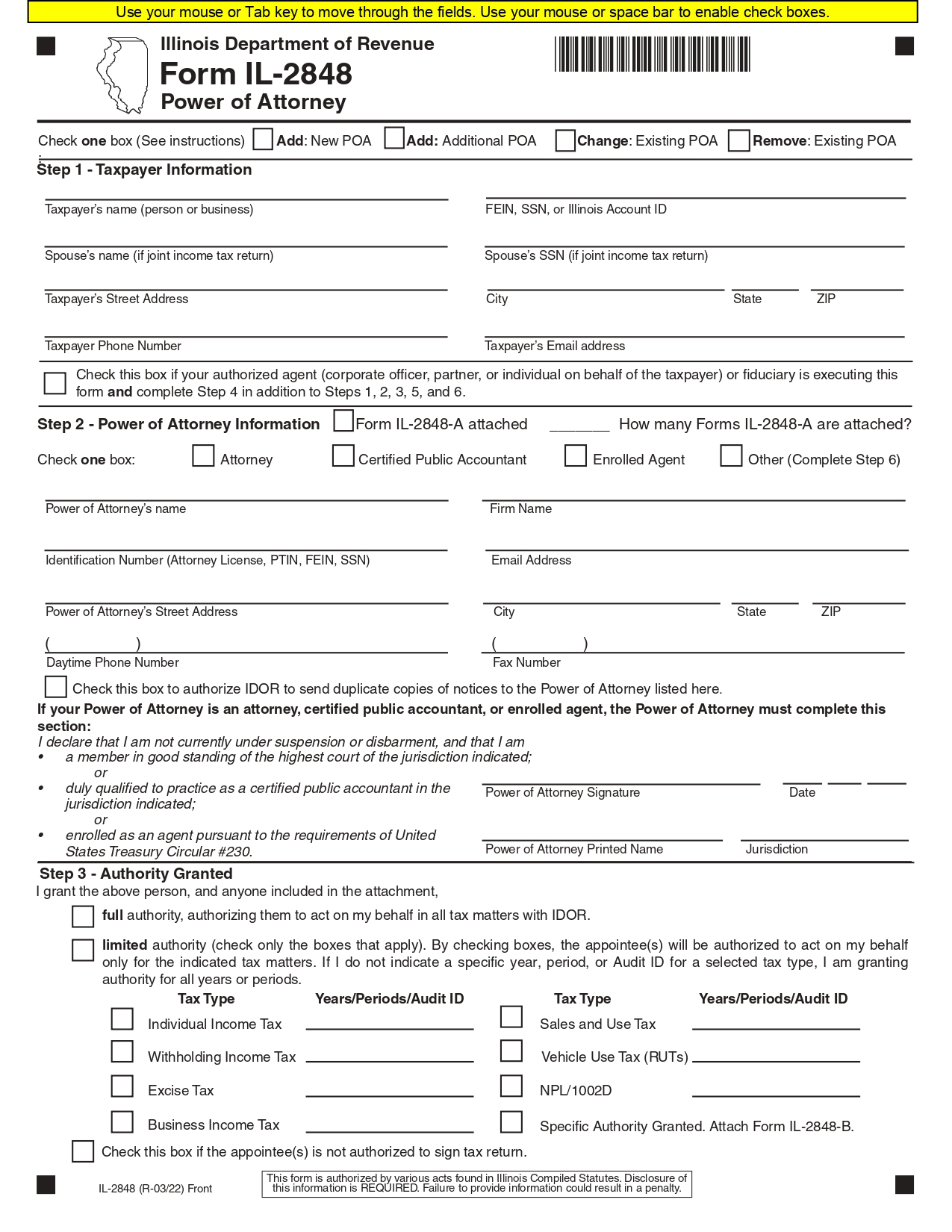

Illinois tax power of attorney form, otherwise known as “Form IL-2848,” is a legal document that allows an individual to delegate a representative to manage their tax matters with the Illinois Department of Revenue.

The authorized representative can access tax information, file taxes, endorse payments, receive and open correspondence from the government, and dispute assessments.

This form can also be used to modify or terminate a previously established power of attorney.

Signing Requirements — Both the principal and attorney-in-fact must sign. It must be witnessed or notarized if the representative is not an attorney, certified accountant, or enrolled agent.

Statute — 755 ILCS 45/Art. II