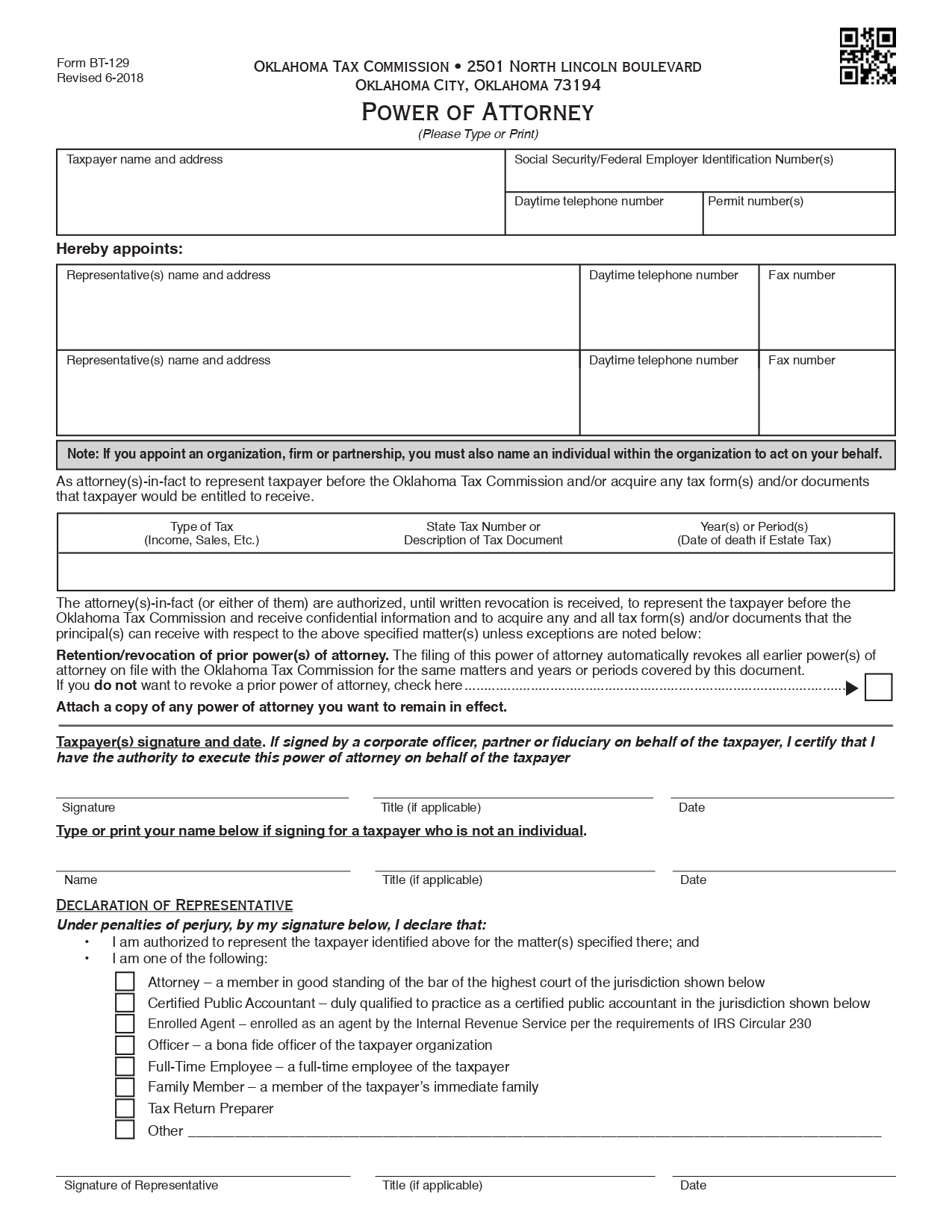

An Oklahoma tax power of attorney, Form BT-129, or “Oklahoma Tax Commission Power of Attorney,” is a legal form that enables individuals or entities to appoint a representative to handle their tax affairs with the Oklahoma Tax Commission. This form grants the representative or attorney-in-fact, commonly a certified public accountant, attorney, or similar tax expert, specific or comprehensive authority over the taxpayer’s tax-related matters. It’s permissible, though less common, for the taxpayer to designate a full-time employee, a trusted colleague, or a family member for this role.

This power extends to businesses, organizations, estates, or trusts, with the stipulation that the individual signatories must have appropriate authority in their respective entities. The appointment of a new representative via Form BT-129 automatically revokes all previously filed power(s) of attorney for the same tax matters and years unless the taxpayer specifically indicates their wish not to revoke.

Signing Requirements — Taxpayer and representative signatures only.

Law — Okla. Stat. tit. 15 § 1018.