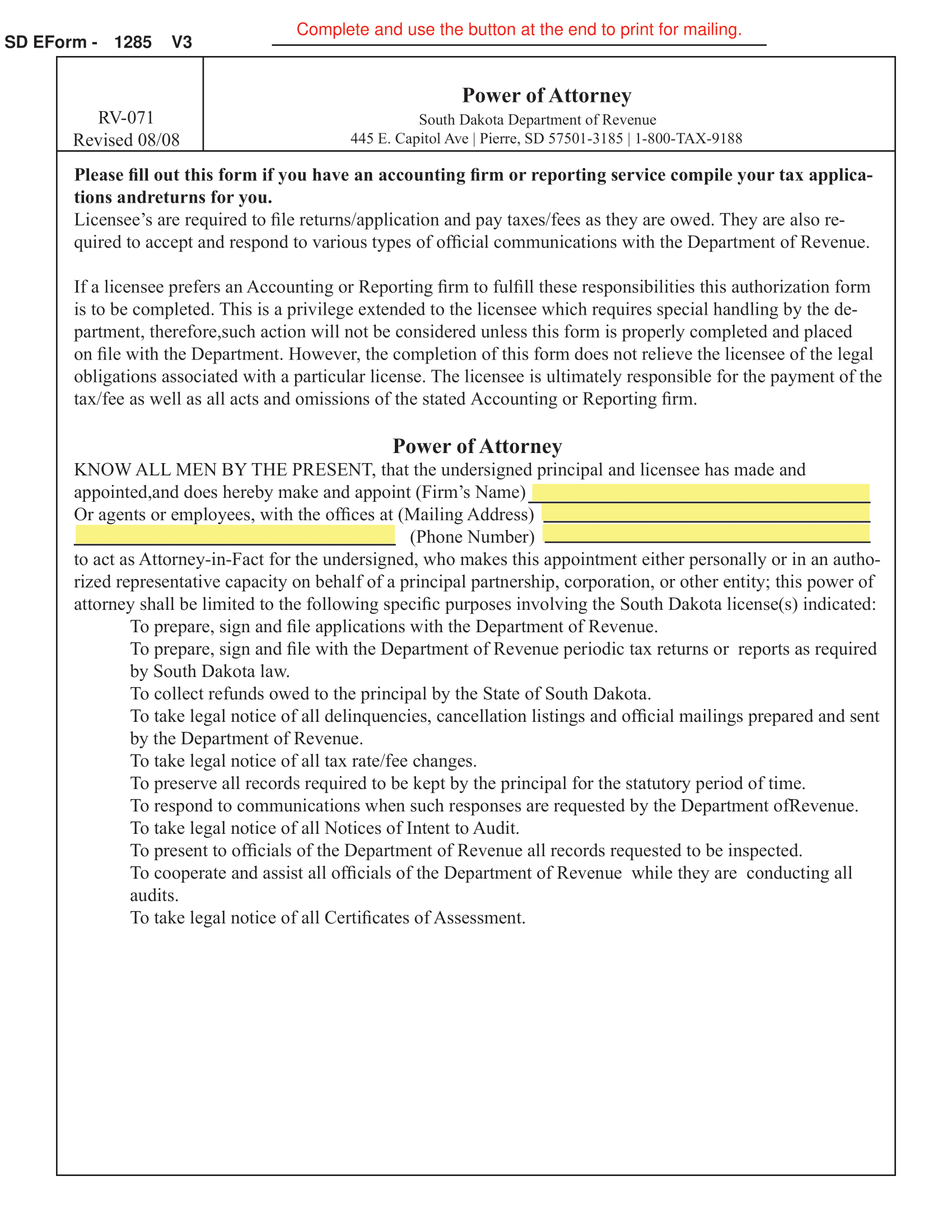

A South Dakota tax power of attorney form (Form RV-071) is a legal document a principal drafts to let a representative (also referred to as an “attorney-in-fact”) act on their behalf for tax matters before the South Dakota Department of Revenue. Since South Dakota does not levy a state income tax, this form is for other licensing taxes.

It remains effective until the principal properly files a revocation with the Department of Revenue.

Signing Requirements — Principal, attorney-in-fact, and notary public.

Statute — SD Codified Laws § 59-12-38.