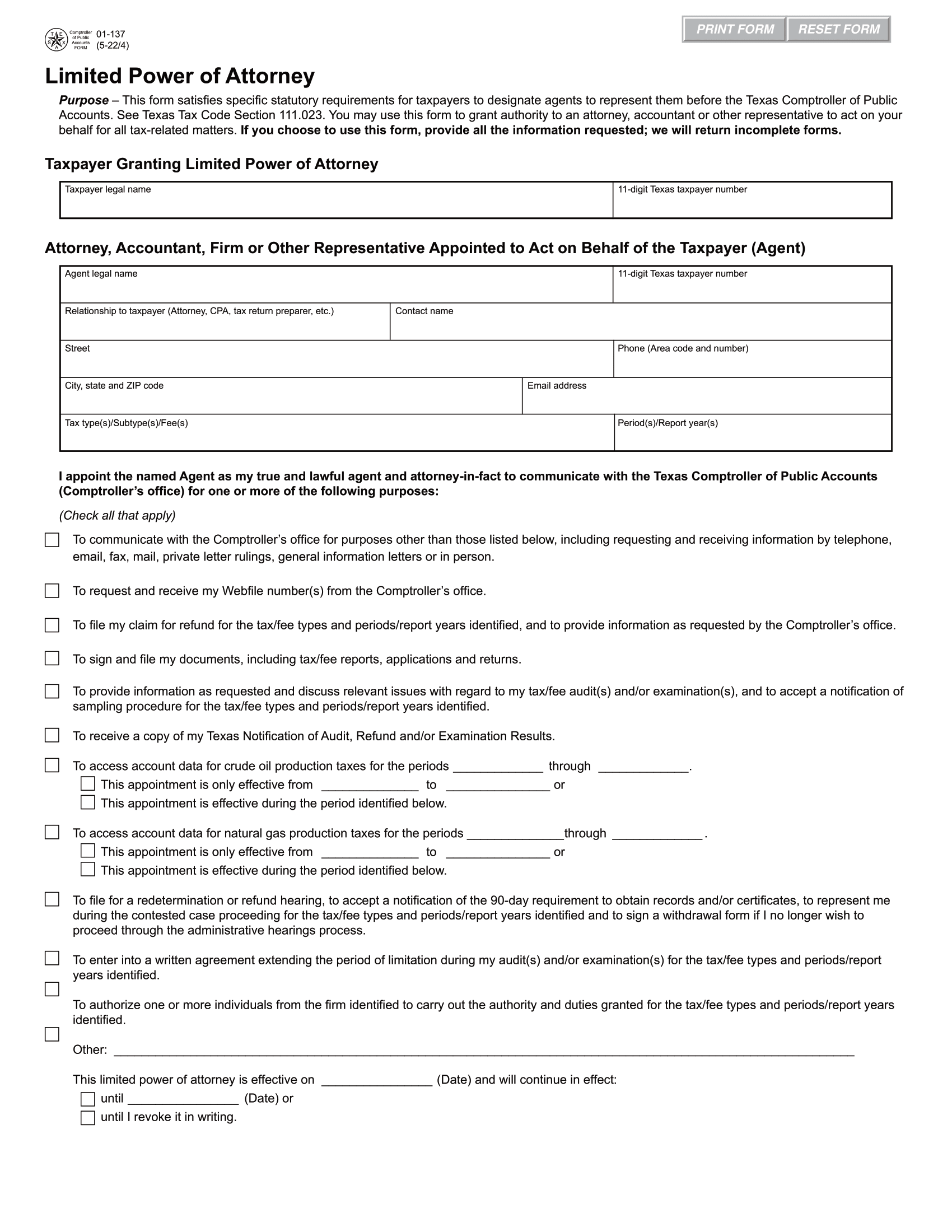

A Texas tax power of attorney form (Form 01-137) is a legal document that lets a taxpayer grant power to a representative who can handle their tax-related matters with the Texas Comptroller of Public Accounts. When given authority, the representative can prepare, sign, and file tax documents, receive confidential information, and collect refunds.

The taxpayer should choose a representative who is knowledgeable about taxes and readily available to conduct the necessary tasks. Once the taxpayer signs this Limited Power of Attorney form, it goes to the comptroller’s office for approval. The taxpayer indicates the effective date and whether the power of attorney continues until a specific date or until they revoke it in writing.