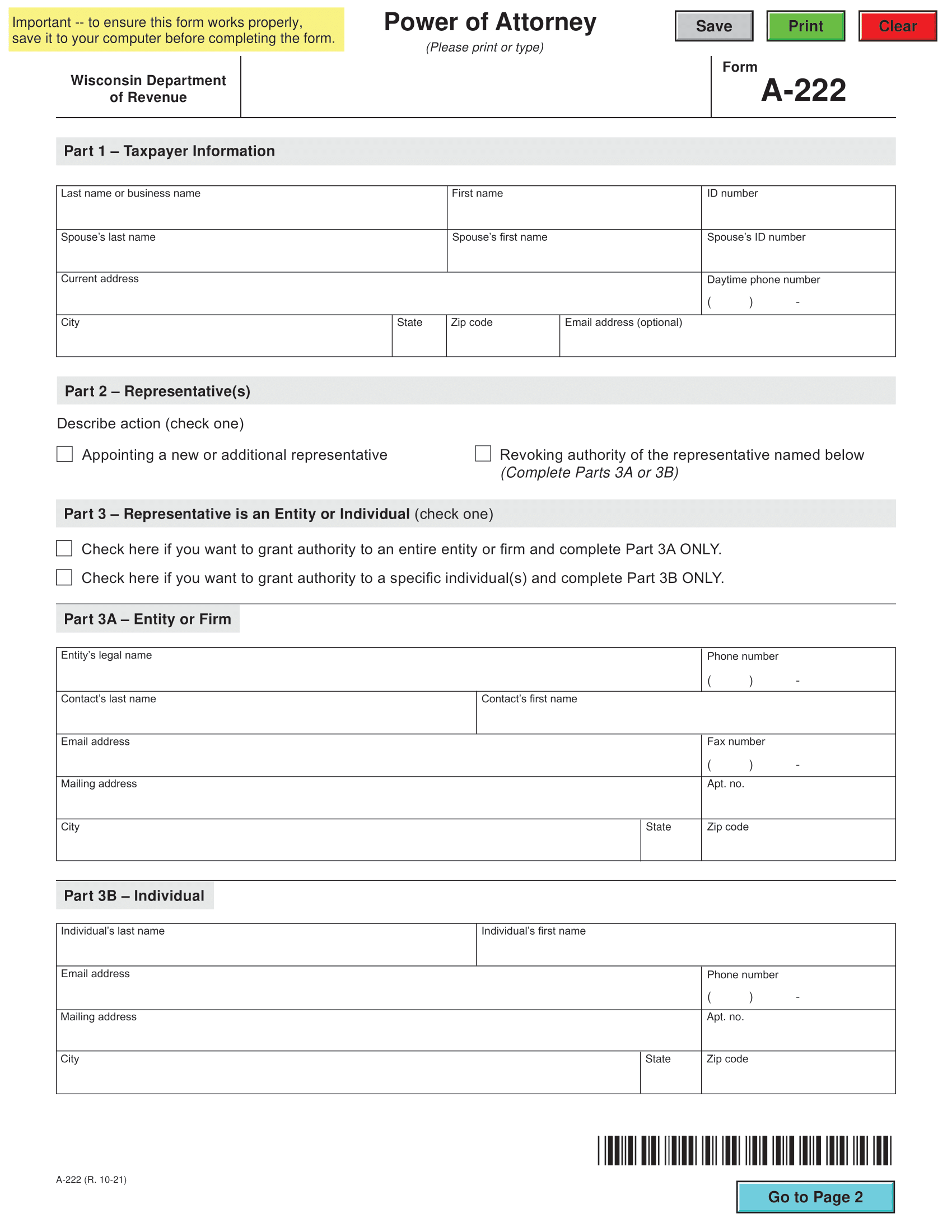

A Wisconsin tax power of attorney form, or Form A-222, is a legal document that lets a taxpayer (the “principal”) choose an individual (the “representative”) to perform tax-related activities on their behalf with the Wisconsin Department of Revenue. While the principal can choose any representative, they can benefit from selecting a qualified tax attorney or CPA to avoid severe legal repercussions from improper representation.

When deciding what powers to grant, the taxpayer can give full authority over their taxes, meaning the representative can perform any tax-related functions the principal would complete themselves. If the principal wants to limit the representative’s authority, they can specify their restrictions in Form A-222.