What Is a Tennessee Power of Attorney?

A Tennessee power of attorney (POA) is a legal document that appoints an agent to make decisions on your behalf. This contract identifies the principal who creates it and the agent who acts on their behalf. A POA protects your wishes and outlines the agent’s powers.

Use Legal Templates’ free Tennessee power of attorney templates for a state-compliant agreement. Our customizable forms make it easy to select and limit your agent’s authorities.

Types of Powers of Attorney in Tennessee

Tennessee recognizes various types of powers of attorney, so you can create an arrangement that meets your needs. Consider the different options for a Tennessee POA to find the one that works for you.

Durable vs. Non-Durable

POAs can operate as durable or non-durable contracts. In a durable power of attorney, the agent retains their abilities after the principal has become incapacitated. A non-durable agreement ends the agent’s authority at the principal’s incapacity. Under TN Code § 34-6-102, the POA must include a statement to extend agent authority after the incapacity of the principal.

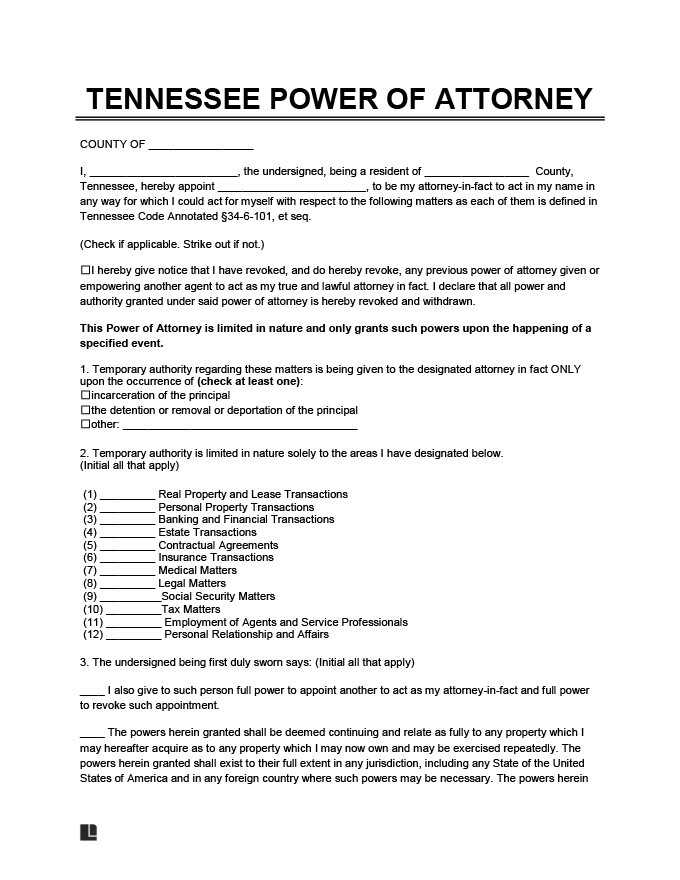

Financial

A Tennessee financial power of attorney gives your agent the authority over your monetary assets. According to TN Code § 34-6-109, you can provide your agent with access to the following:

- Bank and investment accounts

- Real and personal property

- Tax returns

- Loans

Medical

A medical POA, referred to as a durable power of attorney for health care, defines your agent’s ability to handle medical decisions. With this form, you can select which powers your agent exercises related to your health care. Per TN Code §§ 34-6-201 — 34-6-218, a power of attorney for health care gives your agent the following authorities:

- Access to medical records

- Authority to consent to or refuse treatment

- Ability to admit or discharge the principal from medical facilities

- Power to hire or fire caretakers

Combine an advance directive and living will with the POA for health care to communicate your preferences for end-of-life care.

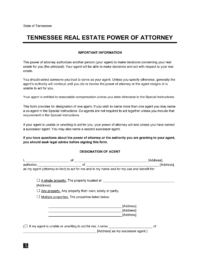

Durable (Financial)

Use so the agent's authority to act does not expire if the principal becomes incapacitated.

Signing Requirements: No laws.

Medical

Give doctors and caregivers legal instructions on how to manage your care should you become incapacitated (legally unable to make your own decisions).

Signing Requirements: Notary public or at two witnesses (§ 34-6-203(a)(3)).

Limited (Special)

Use so the affairs an agent is authorized to manage are restricted to those specified in the document.

Signing Requirements: No laws.

Non-Durable (General)

Enable a trusted agent to manage financial decisions on behalf of the principal.

Signing Requirements: No laws.

Springing

Comes in effect at a future time and only when a specific event occurs. In essence, the document “springs” into action.

Signing Requirements: No laws.

Vehicle (Form RV-F1311401)

Give a proxy or agent authority to manage a principal's vehicle-related affairs on their behalf.

Signing Requirements: Notary public.

Real Estate

Extend powers to a trusted agent so they can buy, sell, and manage your property.

Signing Requirements: Principal only (a notary acknowledgment or two witnesses are recommended).

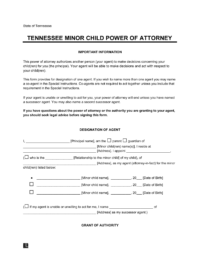

Minor (Child)

Nominate a trusted third party (agent) to assume parental responsibility for a limited period.

Signing Requirements: Notary public or two witnesses.

Revocation

Rescind any authority you've bestowed upon an appointed representative.

Signing Requirements: Two witnesses or a notary public is recommended.

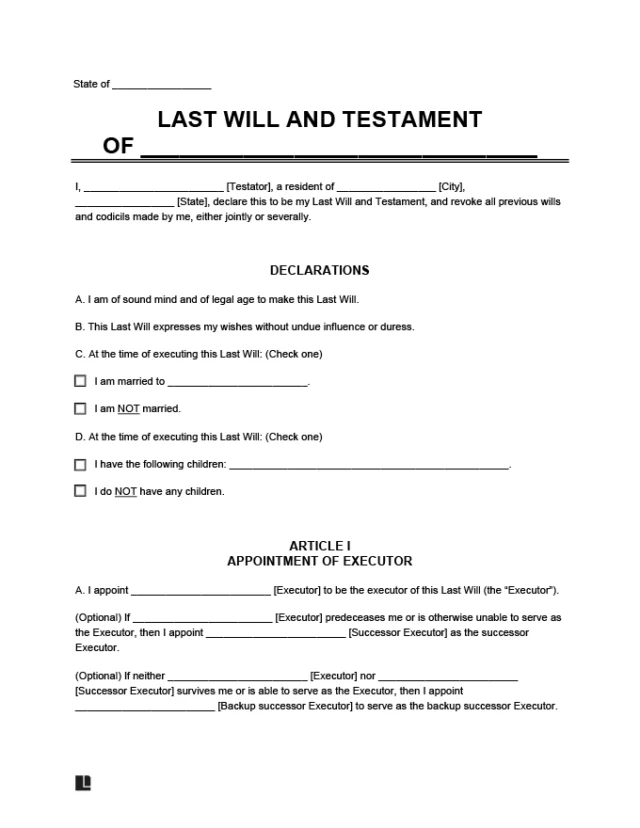

How to Write a Tennessee Power of Attorney

A Tennessee POA requires the proper details, terms, and sections. Create an effective power of attorney with the following steps:

- Identify the principal and agent: Record the full legal name and address of the principal, agent, and any successor agents.

- Grant general authority: General authorities include access to real property, bank accounts, medical records, and insurance benefits.

- Decide on additional powers: Even if you give someone power of attorney, TN Code § 34-6-108 prevents them from doing specific tasks unless you explicitly allow them to do so. For example, they can’t change survivorship designations without explicit permission.

- Set the effective date: Determine the effective date of your power of attorney. You can make it effective immediately, at the principal’s incapacitation, or on a specific event.

- Select the durability: Include a statement to determine whether the agent maintains powers after your incapacitation. If no statement is given, the POA is presumed to be non-durable.

- Record the final details: Include whether a representative will sign on the principal’s behalf or if a third party prepared the document.

- Sign and file: Finalize your document by signing and meeting notarization or witness requirements.

Tennessee Power of Attorney Legal Requirements and Considerations

Tennessee laws offer guidance for making your power of attorney binding and effective. Consider the requirements for notarization, filing, and revocation to ensure a secure agreement.

Notarization

Tennessee statutes don’t include any formal laws requiring notarization for general POAs. However, notarization is recommended to improve the validity of your document. Legal or financial institutions may request a notarized POA to verify the agreement. Medical POAs must be notarized or have two witnesses per TN Code § 34-6-203(a)(3).

Filing

A general Tennessee POA does not require filing, but it may be necessary in some instances. If the agent plans on making real estate transactions, the POA must be filed with the Register of Deeds in the county where the property is located. It’s also common for medical and financial institutions to request a copy to verify the agent’s authority.

Revocation

Your Tennessee power of attorney can be ended with a written notice or according to its terms. Under TN Code § 34-6-105, actions taken in good faith before the agent becomes aware of the revocation remain valid. A Tennessee power of attorney terminates under the following conditions:

- Principal’s death or incapacitation: In a durable agreement, the principal’s death ends the agent’s authority. A non-durable POA ends at the time of the principal’s incapacitation.

- Revocation notice: Both the agent and principal can end the POA at any time by delivering a written notice of revocation to the other party.

- Termination date: When creating your agreement, you can include an end date in the terms to set the end of your agent’s ability.

- Fulfills its purpose: Some POAs serve a specific purpose, such as a single transaction or medical treatment. For these agreements, the terms can include the automatic end of the agent’s authority upon fulfillment of its purpose.

- Dissolution or annulment of marriage: TN Code § 34-6-207 states that the dissolution or annulment terminates a health care POA if the principal’s spouse is the agent, unless the document expressly states otherwise.