What Is a Prenuptial Agreement (Prenup)?

A prenuptial agreement, often called a prenup, is a legal contract that couples create before marriage. It outlines how finances, property, and debts will be handled during the marriage and if the relationship ends.

A prenup helps both partners protect their individual assets, clarify responsibility for existing debts, and set expectations for things like spousal support. It’s useful when one or both people are bringing significant wealth, children from a prior relationship, or business interests into the marriage.

Creating a prenup doesn’t mean you expect to get divorced—it means you’re entering your marriage with financial clarity and mutual understanding. For many couples, it’s a smart way to have an honest conversation and plan together.

Does a Prenup Override a Will?

A prenuptial agreement can impact estate planning, but does not automatically override a will. While a prenup may waive spousal inheritance rights, wills dictate asset distribution after death. To avoid conflicts, ensure both documents align and comply with state laws.

State-Specific Prenuptial Agreements

Prenuptial agreements must follow specific rules that differ from state to state. Our state-specific guides explain the local laws and enforceability rules in simple terms. These guides make it easy to understand the key steps, so you can confidently create a prenuptial agreement that follows your state’s requirements using our easy-to-use document editor.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Can I Write My Own Prenuptial Agreement?

While it’s legally possible to write your own prenup, it’s important to do so carefully. For the agreement to be enforceable, it must meet specific legal requirements. Although you can research your state’s rules, it’s often wise to talk with an attorney to ensure the prenup is valid and tailored to your needs.

Many states share common requirements for a valid prenup, which may require that parties:

- create a written contract (rather than an oral one)

- sign the agreement without being pressured

- share all their debts and assets

- have the right to independent legal representation

- receive time to consider the agreement

- avoid illegal terms (e.g., decisions about child visitation)

- ensure the agreement doesn’t unfairly favor one party

- sign the document and get it notarized if needed

- finalize the agreement before marriage

When writing your own prenuptial agreement, our guided prenup builder helps simplify this process. You answer a few questions, and we handle the formatting and legal language so you can focus on the decisions that matter.

Prenup Requirements

Many states have their own version of a law called the Uniform Premarital Agreement Act (UPAA), which sets rules for making and enforcing prenups. Some states don’t use this law and instead follow their own rules.

Can I Get a Prenuptial Agreement After Marriage?

You cannot get a prenup after marriage, as this document is for couples to sign before they marry. However, you can get a postnuptial agreement or a postnup.

A postnup is like a prenup. It explains how a couple’s assets, debts, and spousal support will be handled if they separate or divorce. However, a postnup is entered into after a couple is already married.

Couples may enter a postnup because they didn’t sign a prenup and want to establish financial expectations. They may also enter this document after they marry to:

- address changes in family dynamics

- improve marital stability

- resolve issues that have come up

- acknowledge changes in financial circumstances

Prenups vs. Postnups

A key difference between prenups and postnups is that courts tend to examine postnups more closely. This is because its creation may be influenced by marital tensions, while a couple usually creates a prenup when they’re on equal footing.

Prenuptial Agreement Checklist

When writing a prenup, both parties must provide certain details to ensure the document they create is comprehensive and legally binding. Here are some key details to supply to make the writing process as seamless as possible.

Partners’ Personal Details

Each partner must include the following personal details:

- full legal names and addresses

- details of any previous marriages (including divorce decrees or annulments)

- whether the parties have children from previous relationships

- whether the parties have children together

Financial Information Disclosures

Both parties must make full and accurate financial disclosure. Full transparency ensures that the agreement is fair, valid, and enforceable, which can prevent future disputes and ensure that each party is fully aware of the other’s financial situation.

Here’s some information that each party must disclose and attach to the prenup:

- assets owned (bank accounts, properties, vehicles, etc.)

- liabilities (credit card debt, student loans, mortgages, etc.)

- sources and amounts of income

- retirement accounts, pensions, and investment portfolios

- business interests or ownership

- life and health insurance policies

Decisions to Make in the Prenup

Once you’ve collected the basic information, the next step is to talk with your partner about the important choices that will shape your prenup. This is a chance to work together and think about each other’s needs and goals. Consider these key decisions to create a fair and thoughtful agreement.

Property Ownership

Consider the property that each party owned before marriage and determine how you want to treat it. Couples can choose to treat property owned before marriage as one of the following:

- each party’s separate property

- each party’s separate property (with some exceptions)

- both parties’ shared marital property

Similarly, you and your partner can decide on how you want to treat property acquired after marriage. You can treat it the same way you treat property acquired before marriage or assign a different treatment.

Furthermore, you can discuss dividing marital property if the marriage ends. Decide if you want to do it according to your state’s laws or by a percentage to which you and your partner agree.

Business Ownership

Determine if either party owns a business before marriage. If someone does, decide how you will divide any valuation increases if the marriage ends. You can assign valuation increases to the business owner, share them equally, or divide them by a predetermined percentage.

As you write your prenup, consider what will happen if a partner starts or acquires a business while married. The prenup can state that valuation increases will go to the first or second party. It can also declare that the parties will share valuation increases equally or divide them by percentage.

Debts & Taxes

Before couples marry, they may bring debt into the marriage from school, business ventures, or other situations. A prenup can address whether debt acquired before marriage will:

- remain each party’s separate debt

- remain each party’s separate debt (with some exceptions)

- become both parties’ shared marital debt

During a marriage, either partner might take on new debt due to unexpected costs or new opportunities that require money they don’t have right away. A prenup can outline how to handle debt taken on during the marriage. It can also decide whether to divide the debt according to state law or by a specific percentage if the marriage ends.

You can also use a prenup to specify whether you and your partner will file income tax returns together or separately. Filing jointly vs. separately can impact your tax liability and overall financial situation, so it’s best to speak to an accountant or tax expert for guidance on this prenup element.

Housing Arrangements

Ensure you discuss housing arrangements while you and your partner are on good terms. Determine a realistic plan for dividing the marital home if the marriage ends. You can agree that it will become the first party’s separate property, the second party’s separate property, or both parties’ shared marital property.

If the home becomes both parties’ shared marital property, you can specify whether one party is allowed to remain there and for how long after you separate.

Household Expenses

While you and your spouse live together, it’s important to navigate household expenses. You can use your prenup to specify how you’ll share household expenses. Depending on your financial situation, you may decide that the first or second party will pay for all expenses. Alternatively, you can decide that the parties will pay for the expenses equally or each party will pay for specific expenses.

Spousal Support

If your marriage ends, consider whether one party will have a better financial situation than the other. If this is the case, you may want to specify spousal support in your prenup. Declare which party is responsible for paying spousal support or whether both parties will waive their rights.

If you determine one party must pay spousal support, specify the duration. If you plan on indefinite spousal support, record this provision.

The IRS also provides guidance on how spousal support (alimony) may affect your taxes.

Disability & Death

Within a prenup, you can specify if you want one party to support the other if they become disabled. You can also include provisions regarding property upon one party’s death. For example, you can clarify whether the surviving party can keep living in the marital home or inherit the personal property of the deceased spouse.

While it’s difficult to consider situations like disability or death, addressing these matters in advance can bring peace of mind during challenging times.

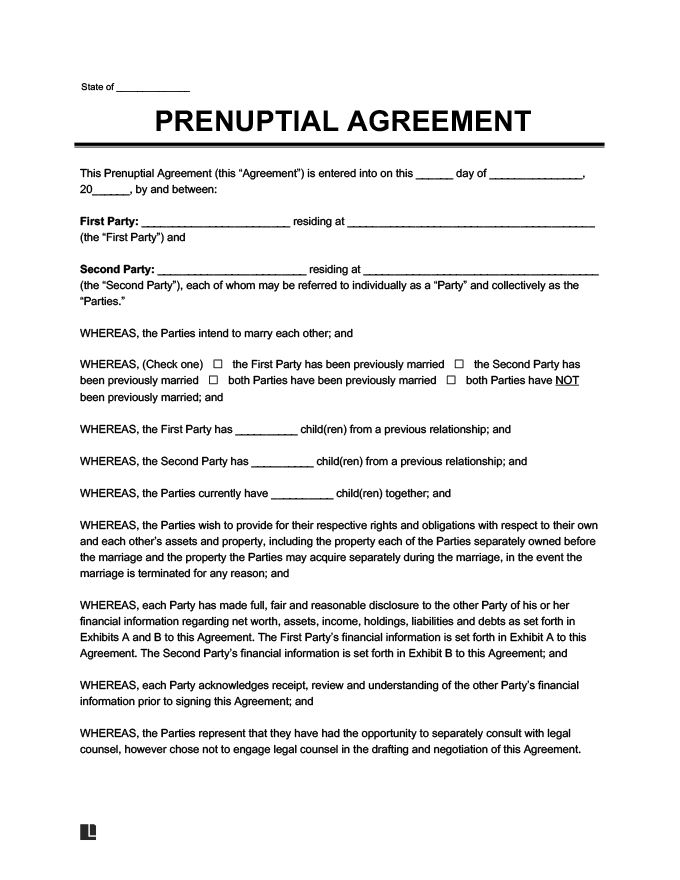

Sample Prenuptial Agreement

Below, you can view a sample prenup agreement. Our document editor lets you create a custom prenup in minutes—then download it as a PDF for your records or to review with an attorney.