What Is a Connecticut Promissory Note?

A Connecticut promissory note is a legal document that serves as evidence of the debt and defines the parties’ obligations regarding loan repayment. It includes the names and addresses of both the lender and borrower, the amount borrowed, the interest rate, the repayment schedule, and penalties for missed payments.

Once both parties have signed, the document becomes legally binding and validates the terms outlined within. If the borrower fails to fulfill their repayment duties, the lender has the right to pursue legal action to recover the owed amount.

Laws: Various state laws govern promissory notes, like Title 42a. Uniform Commercial Code, with several chapters related to commercial transactions, including Article 3, which addresses negotiable instruments.

Statute of Limitations: Six years (§ 42a-3-118).

Types of Connecticut Promissory Notes: Secured vs. Unsecured

Connecticut allows for both secured promissory notes, which use collateral as a safeguard, and unsecured notes, which do not require backing assets.

Secured Connecticut Promissory Note

Provides the lender with assurance in the transaction by securing a home, vehicle, or another valuable asset in case of default.

Unsecured Connecticut Promissory Note

As it lacks collateral, the lender faces the risk of financial loss in the event of default.

Usury Laws and Interest Rates in Connecticut

Promissory notes must adhere to the state’s usury laws outlined in the General Statutes of Connecticut Chapter 673.

- With a Contract (Excluding Pawnbrokers) (§ 37-4): Not greater than 12% per annum.

- Without a Contract (§ 37-1): 8% per year.

- For Loans (Pawnbrokers Only) (§ 21-44): For loans of $15 or less: 5% per month; for loans between $15 – $50: 3% per month; for loans over $50: 2% per month.

- For Damages in Civil Actions/Arbitration (§ 37-3a(a)): Not more than 10% per year.

- For Damages in Negligence Actions (§ 37-3b(a)): 10% per year.

- For Hospital Services Debt (§ 37-3a(b)): Not more than 5% per year, but awarding interest is in the court’s discretion.

- For Income Tax Refund Anticipation Loans (§ 42-480(d)): 60% for the first 21 days; 20% after 21 days and ending on the date of the payment.

- For Community Residential Facilities Loans (§ 17a-220(9)): 6%.

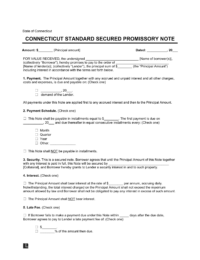

Sample Connecticut Promissory Note

Below, you can see what a Connecticut promissory note looks like. You can customize this template using our document editor and then download in PDF or Word format.