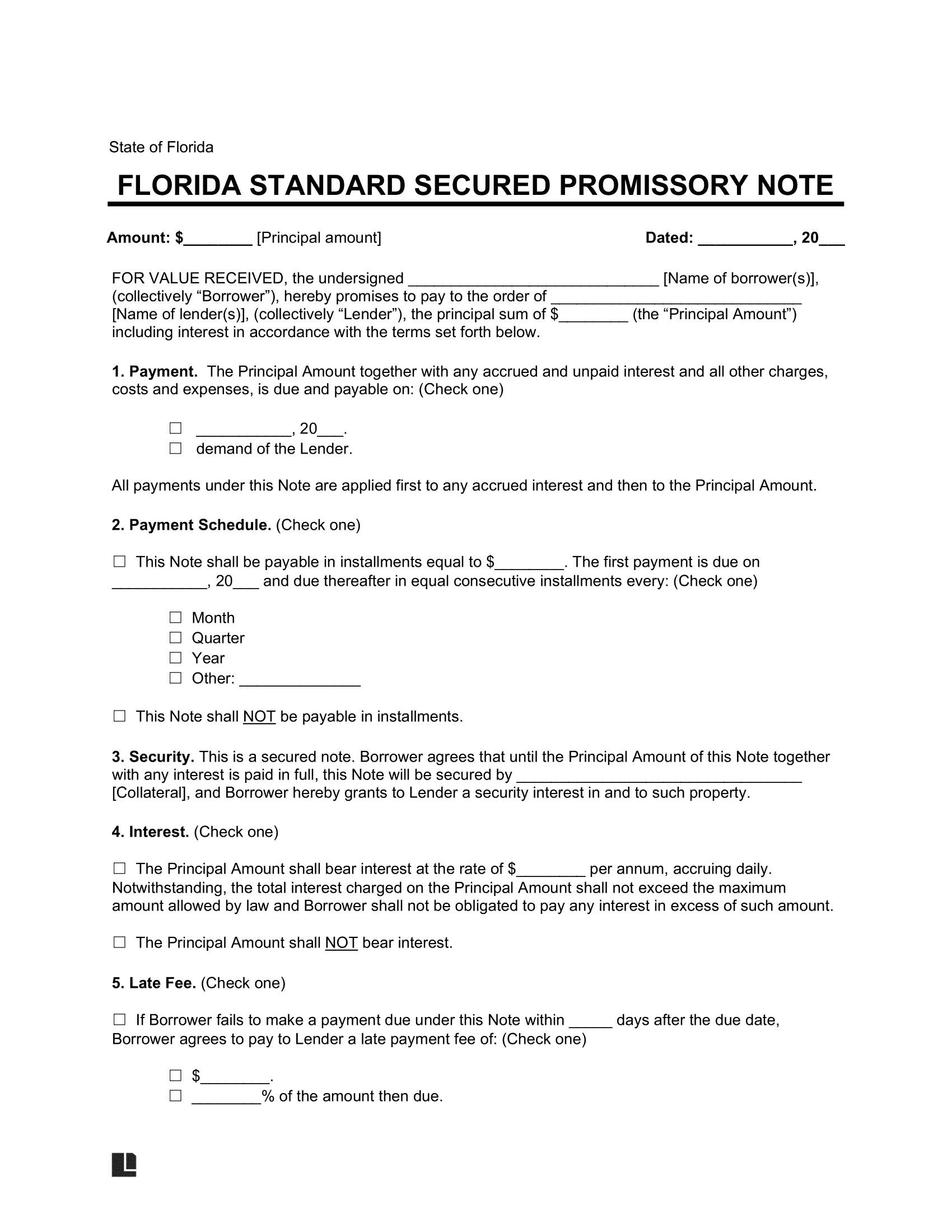

A Florida secured promissory note establishes a binding agreement between two parties to ensure the repayment of a loaned amount to the lender. Key aspects negotiated include the total balance, final payment deadline, accepted payment methods, late penalties, and collateral selection.

The borrower can offer assets like their home, vehicles, or other valuable possessions as security in case of default. Failure to meet repayment obligations results in the forfeiture of the collateral to the lender.