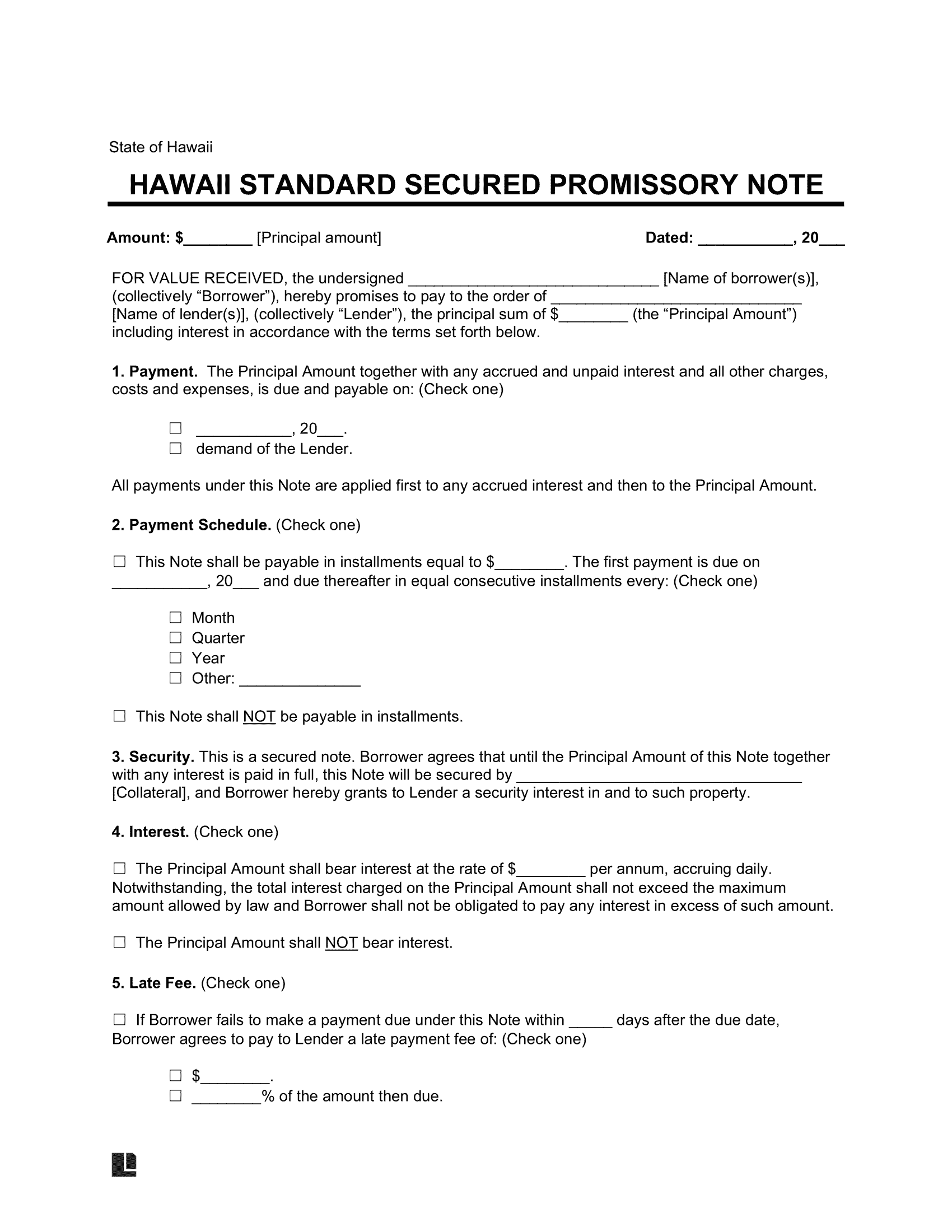

A Hawaii secured promissory note functions as a legal instrument facilitating money lending, compelling the borrower to repay the loan on time or risk losing pledged property or assets to the lender. To secure the loan, the borrower must offer valuable items as collateral, such as personal belongings, real estate, machinery, savings, or investments.

In case of default, lenders have several recourse options: they can retain the collateral until full payment, accept the collateral as repayment, or sell it to recover the outstanding balance. The borrower remains responsible for any remaining debt after the sale.