An Idaho promissory note outlines the terms of a loan agreement between a lender and a borrower, defining the amount borrowed, the interest rate, and the repayment schedule. If either party fails to uphold their obligations, the other party may seek legal remedies, such as suing for repayment or foreclosure on collateral.

In order to protect the lender in case of borrower default, the lender may require collateral, referred to as “security,” such as real estate or personal property, which they can seize in the event of default. However, if the property’s value falls short of covering the loan amount, the borrower remains responsible for the remaining balance.

Laws: Promissory notes must adhere to the legal requirements and regulations outlined in Idaho Statutes Title 28, Chapter 9.

Statute of Limitations: Five years (§ 5-216).

By Type

Secured

Includes provisions for lender security to compensate them in the event of a default on the loan balance.

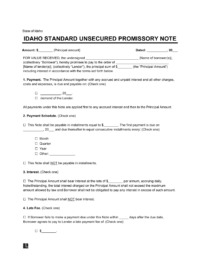

Unsecured

Lacks collateral, increasing the risk for the lender in the transaction in the event of borrower default.

Usury Laws and Interest Rates

Promissory notes must comply with state usury laws defined by Title 28, Chapter 22 of the Idaho Statutes.

- In General (§ 28-22-104(1)): 12%, unless a written agreement specifies a different rate (in which case the interest cannot surpass the contract rate).

- For Money Judgments (§ 28-22-104(2)): 5% in addition to the 12-month weekly average base rate established by the Idaho State Treasurer.