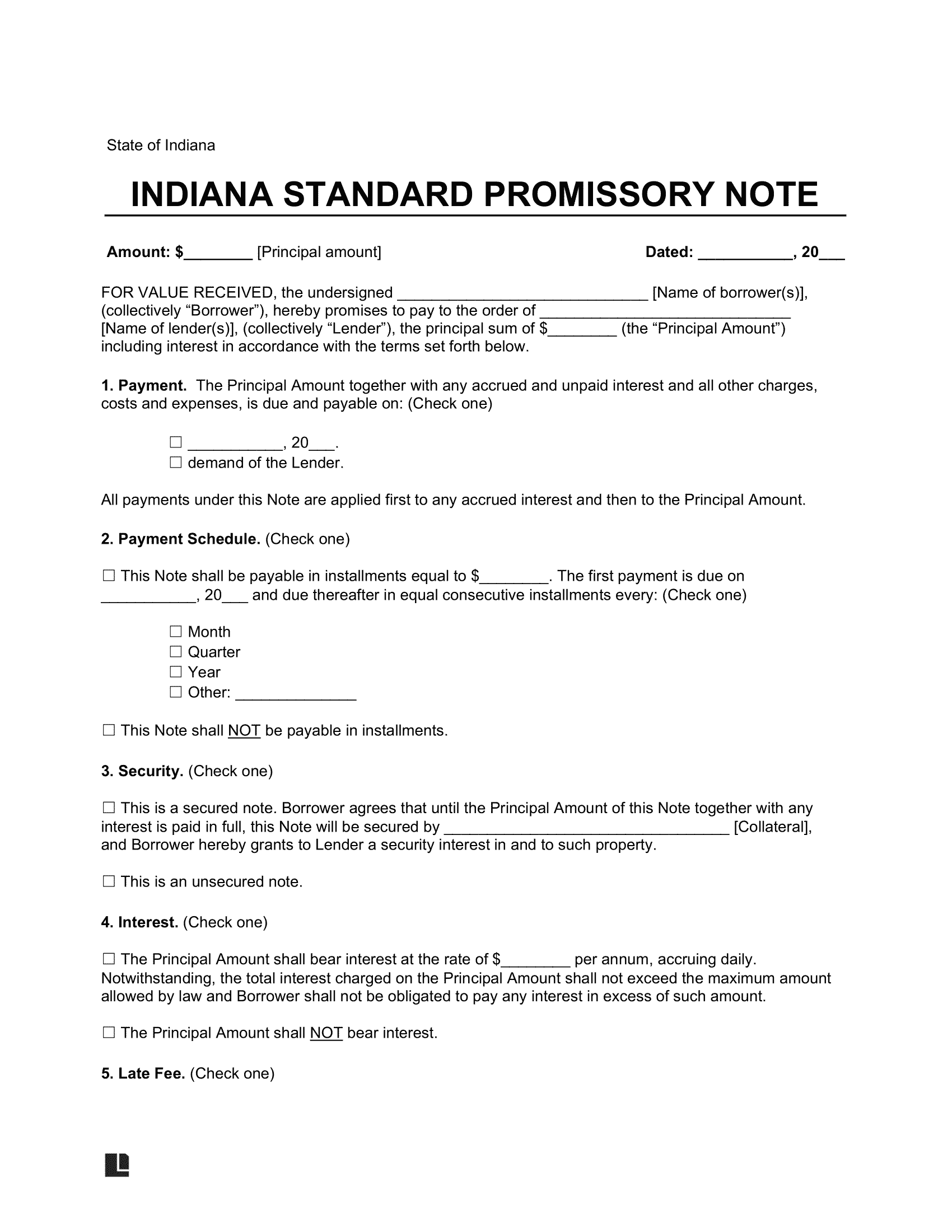

An Indiana promissory note is a legal agreement between a lender and borrower for a loan. It outlines the amount borrowed, interest rates, late fees, and repayment schedule.

It contains specific terms for loan repayment and may require a co-signer for borrowers with low income or poor credit. A promissory note is a legally binding document that protects both parties in the lending process.

Laws: Title 24, Art. 4.5, Ch. 3 governs the creation and implementation of promissory notes.

Statute of Limitations: Six years. (IC 34-11-2-.9)

By Type

Secured

Use a valuable asset as security to obtain a loan.

Unsecured

Use good credit or personal connections as a guarantee to obtain a collateral-free loan.

Usury Laws and Interest Rates

Promissory notes must comply with Indiana’s usury laws, which you can find in the Indiana Code at IC 24-4.5-3-201:

- For Unsupervised Loan (IC 24-4.5-3-201(1)): 25% per annum

- For Supervised Loans (IC 24-4.5-3-508(2)): 15%-36% depending on the loan amount.

- For Monetary Judgments Based on Contract (IC 24-4.6-1-101): Not to exceed 8% per annum

- For Monetary Judgements in Absence of Agreement (IC 24-4.6-1-102): 8% per annum

- For Monetary Judgements Against State (IC 34-54-8-5): 6% starting on the forty-fifth (45th) day after judgment.