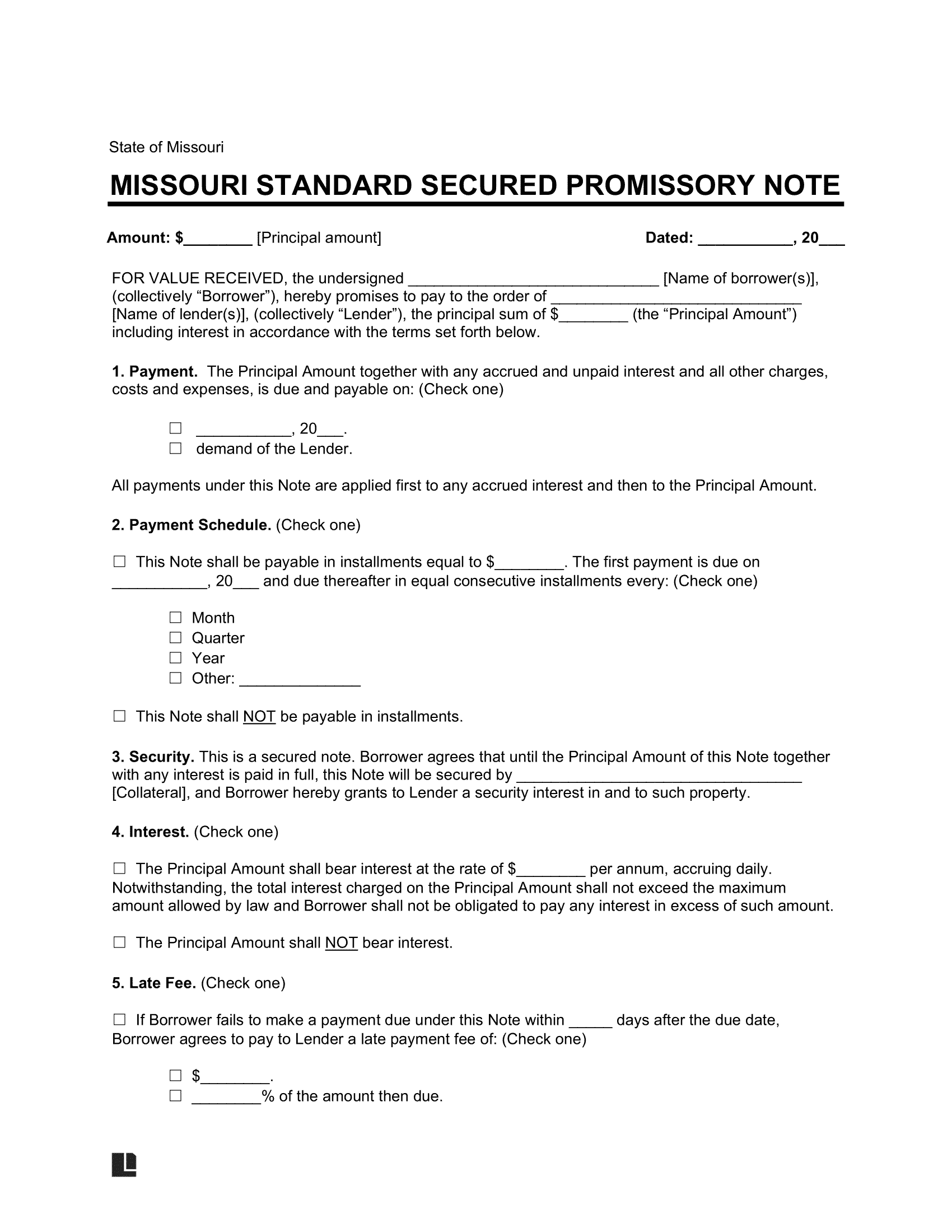

A Missouri secured promissory note is a legal agreement between a lender and a borrower. It establishes the terms of a loan, including the payment plan, due date, and interest rate. The borrower is required to put up something of value as collateral, known as the “security,” to protect the lender in case of default.

If the borrower fails to repay per the contract terms, the lender has the right to declare the remaining balances immediately due, including the borrower’s security. The lender can either keep the security until the borrower pays off their obligation in full or accept the security as payment and consider the debt settled.