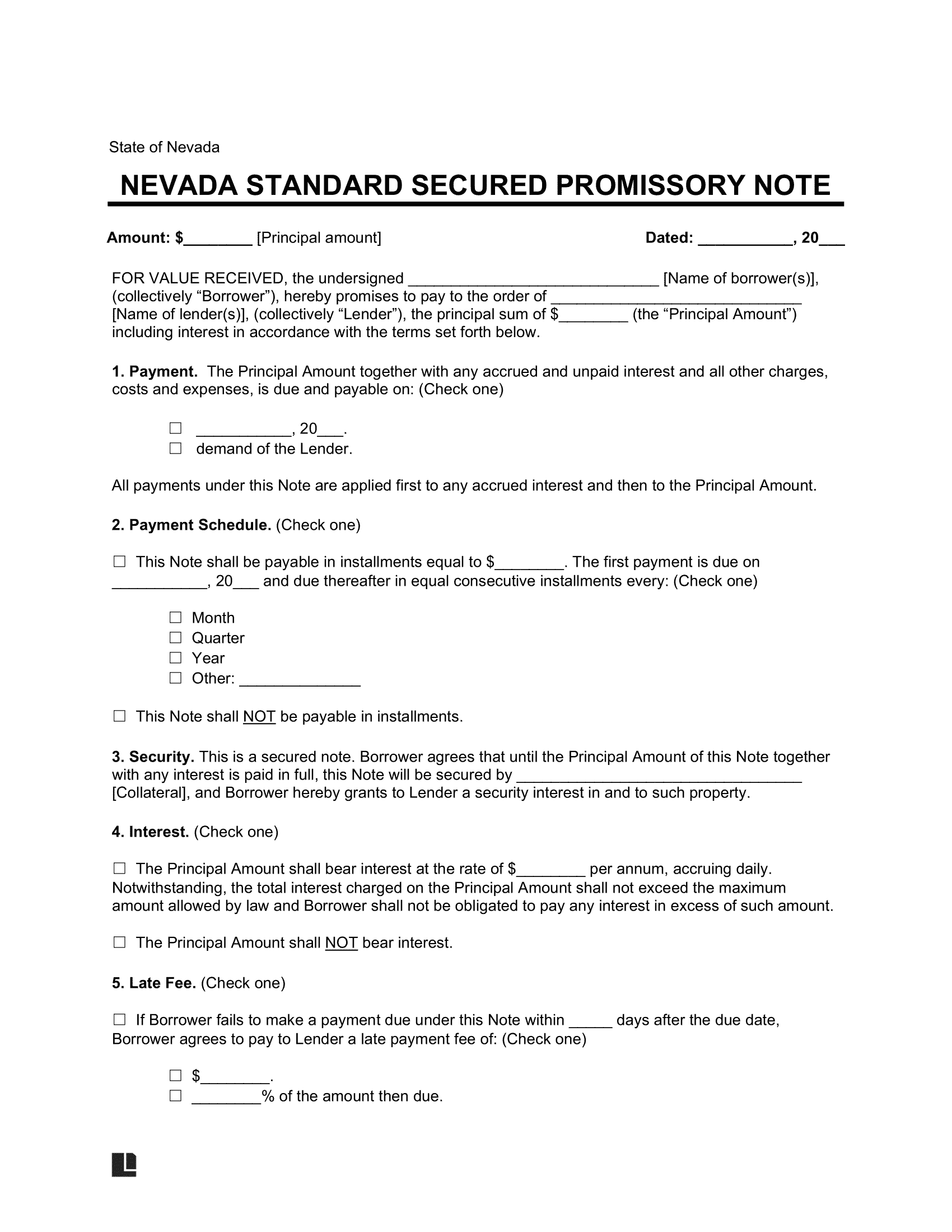

A Nevada secured promissory note is a document that legally binds the borrower to surrender collateral—like stocks, vehicles, or real estate—if they fail to repay the loan as agreed. This collateral should ideally match the loan’s value. Upon default, the borrower forfeits this security and may owe additional amounts if the collateral’s value falls short of the loan plus interest, which can be higher if specified.

In Nevada, any interest rate is permissible with a written agreement (§ 99.050). The note outlines repayment terms, including consequences for late payments or default, ensuring clarity in the money-lending process.