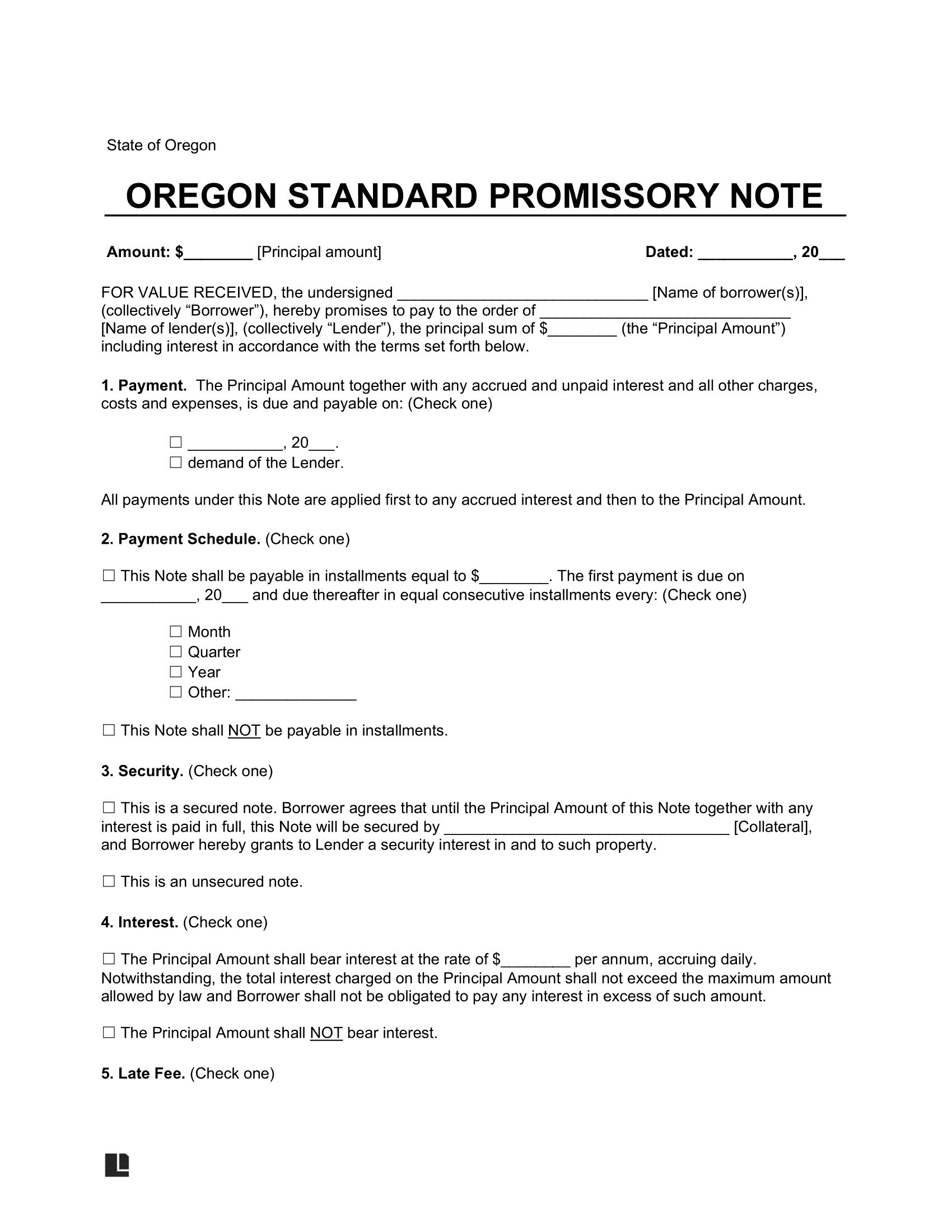

An Oregon promissory note is a legal document co-signed by a lender and borrower outlining the terms of a loan, including repayment schedule, interest rate, and collateral status (secured or unsecured). It specifies the amount borrowed, interest, late fees, and payment allocation.

Laws: Promissory notes fall under Chapter 82: Interest; Repayment Restrictions.

Statute of Limitations: Six years (ORS 73.0118).

By Type

Secured

Guarantees upfront collateral to protect the lender in case of borrower default.

Unsecured

Eliminates the need for borrowers to supply collateral to lenders.

Usury Laws and Interest Rates

The promissory note must adhere to Oregon’s usury laws as outlined in Chapter 82 of the Oregon Revised Statutes:

- With Contract (ORS 82.010(1)): No limit specified. Depending on the rate agreed upon.

- Without Contract (ORS 82.010(1)): 9%.

- Loans of $50,000 or less (ORS 82.010(3)(a)): 12% or 5% above the 90-day commercial paper discount rate at the Federal Reserve Bank, whichever is higher.

- For Monetary Judgments (ORS 82.010(2)): 9% or the contract rate of the note. For judgments involving medical and nursing malpractice, the maximum annual rate of interest is the lesser of 5% or 3% above the Federal Reserve Bank rate in the district where the injuries occurred.

- For Agreements Allowing Early Repayment: Language must comply with ORS § 82.160 or ORS § 82.170 and be incorporated.