A promissory note release form is a form used when a debt or loan has been paid off and the parties want to formally end the transaction.

What Is a Promissory Note Release Form?

A promissory note release form is issued by the lender to absolve all parties involved in a promissory note from any further obligations, usually after all the terms of the note have been fulfilled.

When the debt is completely paid off with no remaining balances, the release of the promissory note is often referred to as a “release and satisfaction of debt.” However, the lender also has the option to grant a release, known as a “cancellation and release of promissory note,” prior to the full payment, thereby voiding the debt entirely.

Important

A note released before full payment has been made may be considered taxable by the IRS. In that case, the promissory note release form would be needed for your tax returns.

How to Release Someone from a Loan

Both the borrower and the lender should be certain that they are prepared to end the loan before writing a promissory note release form. Once the release has been signed and issued, the note is terminated, whether the loan is fulfilled or not.

Step 1: Verify Fulfillment

The lender should confirm that the full amount of the original note has been paid. This includes all interest, late fees, and other outstanding fees.

If the note was secured by collateral, any liens or discharges of security must be executed first. If the note involved a UCC filing or other government filing, be sure all government release requirements have been met.

Step 2: Write the Release Form

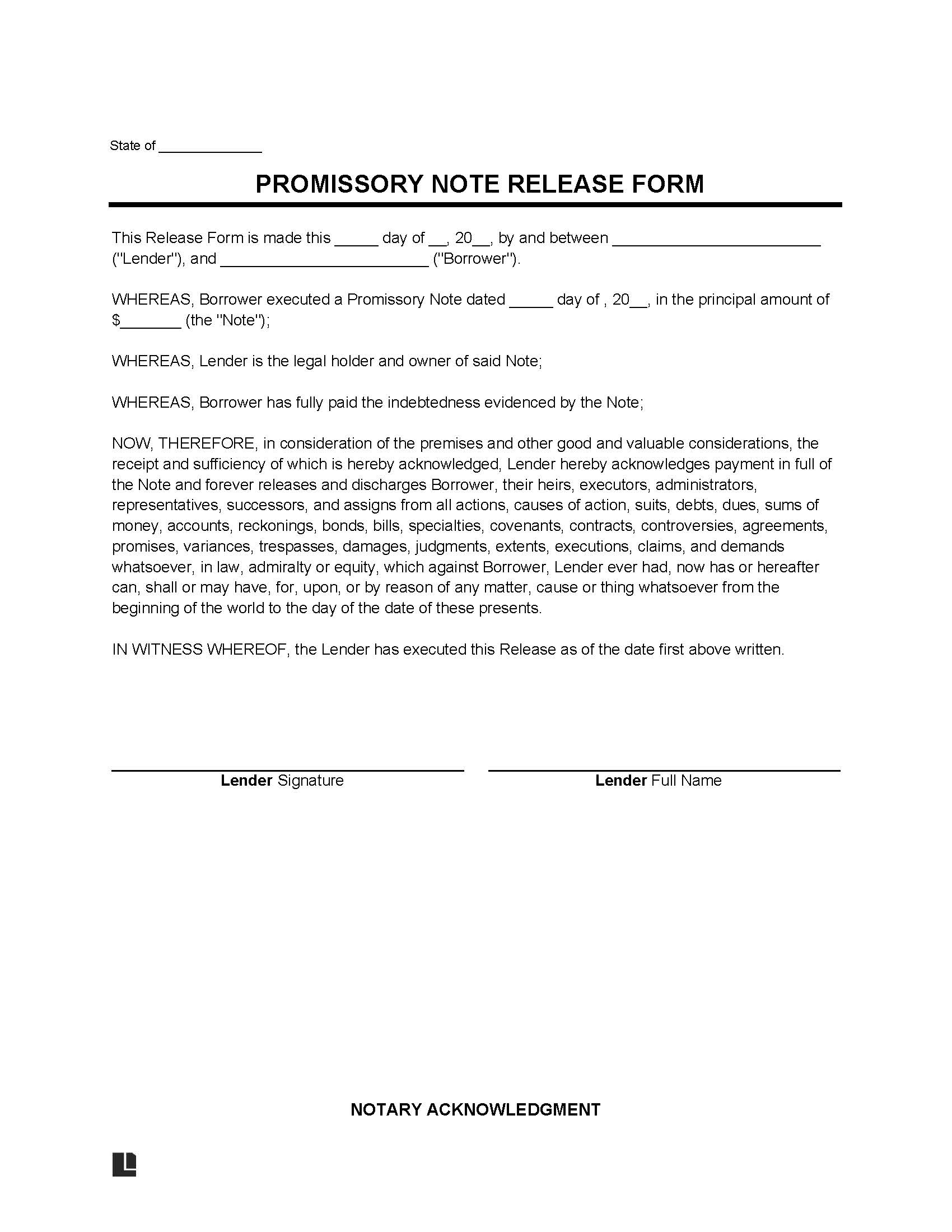

The release form, usually drafted by the lender, must contain the following:

- Names and contact information of both parties;

- Original loan amount;

- Effective date;

- Signature of the lender.

Attach the original note and other released liens (if any) to the release form. The lender must void the note by writing or stamping CANCELLED or PAID IN FULL on the original.

What if I don’t have a copy of the original note?

If there is no original note nor a copy of it, you should restate the terms of the original note on the release form.

Step 3: Send to Borrower

The lender sends the completed release form along with the original promissory note (and other documents, if applicable) back to the borrower.

Registered mail is recommended so that the lender has a delivery receipt.

Step 4: Store Securely

The borrower should make copies of the original release form and store them in a safe place, ideally in a security box at a bank or a safe at home. Apart from the borrower, the lender and other involved parties should also keep multiple copies.

Financial experts and business attorneys recommend keeping the promissory note release form for at least seven years after receipt, the same amount of time as other financial documents.

Tips for Releasing a Promissory Note

- If the borrower repays the loan completely, but the lender refuses to release the borrower, the borrower should obtain legal advice.

- If there are liens attached to the original promissory note, the borrower should contact the primary lien holder to ensure all payments have been received and all outstanding liens have been removed.

- The promissory note does not get automatically released upon the borrower’s death. It must be paid by the borrower’s estate administrator or beneficiary. Similarly, in the event of the lender’s death, the release requires the signature of the lender’s estate administrator.

- A few states, such as Florida, require a promissory note release form to be recorded in the county where the note was recorded. Check with your county’s recorders’ office if you are unsure.

- A promissory note release form does not need to be notarized. However, high-value notes and releases (such as those involving real estate) may be notarized to ensure the validity of the signatures.

Promissory Note Release Sample

You can download below the Word and PDF versions of the promissory note release and customize the sample to your needs.