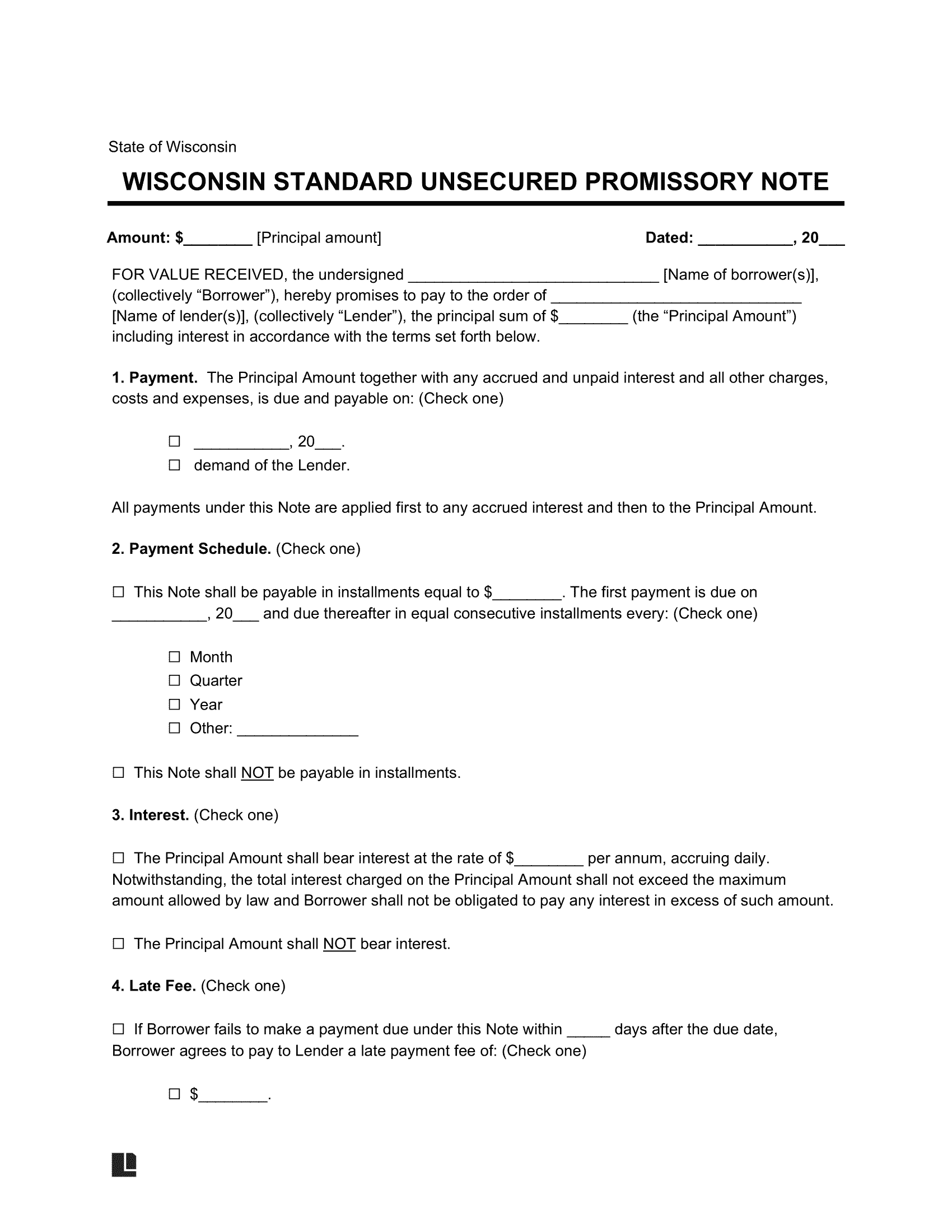

A Wisconsin unsecured promissory note formalizes a loan agreement without requiring the borrower to offer assets as security. Because of the unsecured nature of the arrangement, the lender must exercise due diligence when confirming the borrower’s financial background. They should also have a substantial degree of trust in the borrower’s ability to repay the loan amount.

The lending and borrower parties can reference this document to learn about the loan’s principal amount, applicable interest rate, and repayment terms. It also stipulates any associated late fees or interest rate increases if the borrower doesn’t make their payments on time.