Purchase and Sale Agreements – By State

Each state has unique rules for real estate purchase agreements. You may need to include certain disclosures and contract terms. Use a state-specific purchase and sale agreement template to follow state laws.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

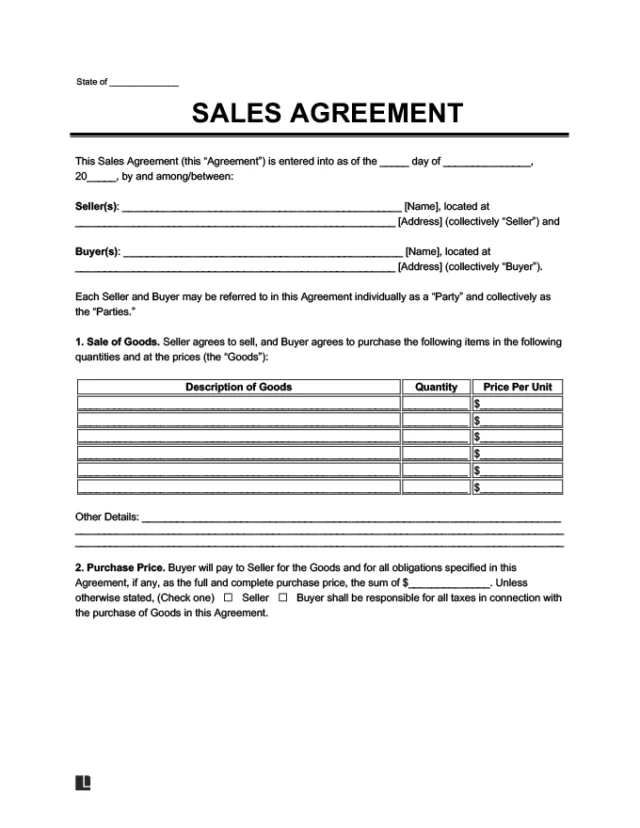

Types of Purchase Agreements

Sales and purchase agreements aren’t just for real estate. Legal Templates offers forms for businesses, farms, land, assets, stocks, and commercial sales. Our various templates help you start negotiations and get your terms in writing.

Need a purchase agreement in Spanish? Use our contrato de compraventa.

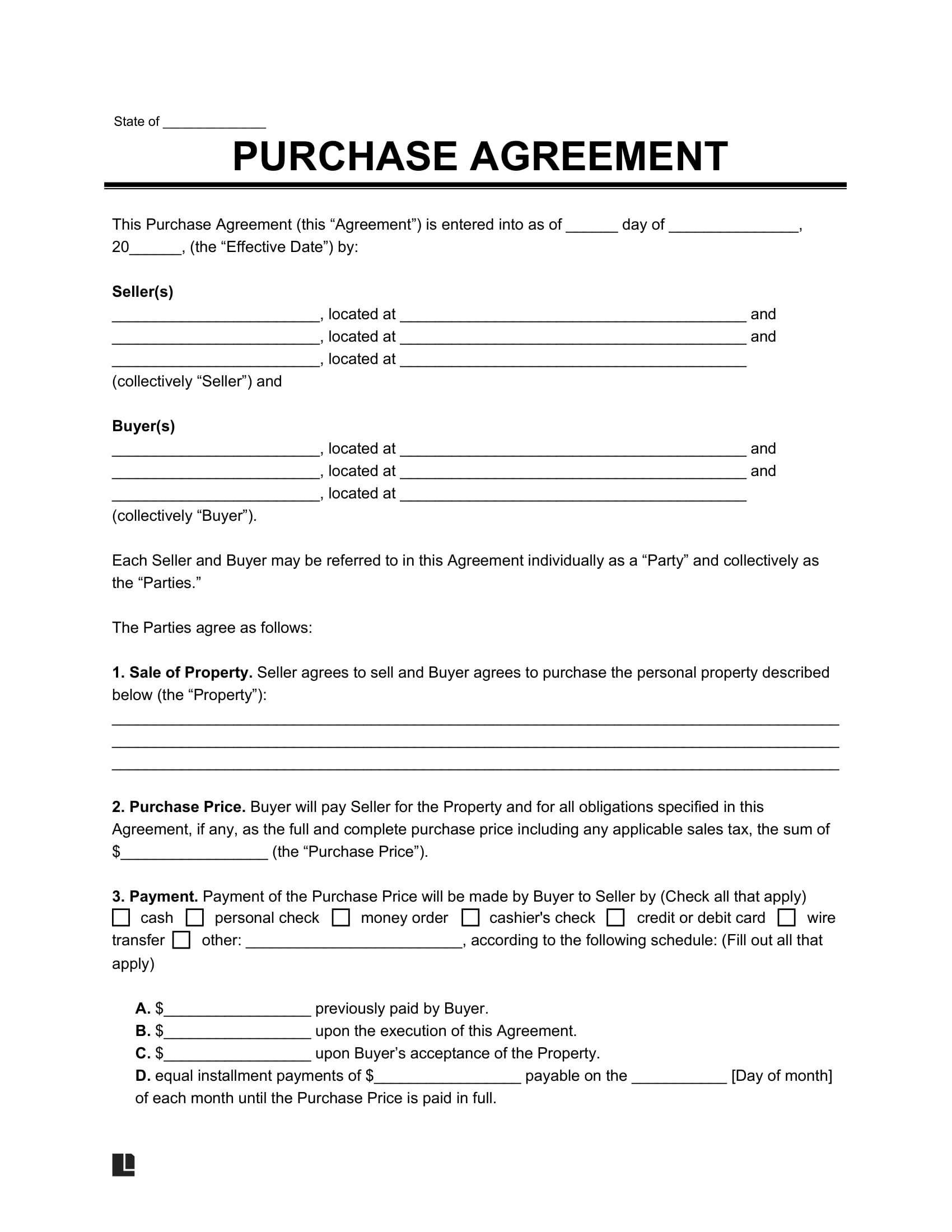

What Is a Purchase and Sale Agreement?

A purchase and sale agreement outlines the terms of property sale between a buyer and a seller. It’s most common in residential real estate transactions, but you may use it to transact other property.

The buyer (or the buyer’s real estate agent) fills out the document and uses it to negotiate the terms with the seller. Once both parties agree on a sales price and other details, they sign the contract to lock in the terms. Often, the buyer will pay an earnest money deposit to signal their commitment. From there, the parties can proceed with the next phases in the contract, including home inspections.

Our purchase agreement template records all the details so you can make a real estate sale possible. It outlines each party’s rights and duties and explains the steps necessary to complete the deal.

Before Purchasing a Property

Fill out a residential purchase letter of intent to establish interest before buying a property.

How to Write a Purchase and Sale Agreement

Writing a sales and purchase agreement (SPA) in real estate helps define the transaction terms and reduces misunderstandings between the buyer and seller. Learn how to write a purchase and sale agreement below.

Step 1 – Name the Parties

Name the buyer and seller, providing both parties’ addresses. Include the names and addresses of any additional buyers and sellers.

You should also specify whether the seller is a foreign person. If they are, the buyer may be required to withhold up to 15% of the purchase price for withholding taxes.

While you’re inputting these initial details, confirm that the seller has the right to sell the property. You can gather important documentation about the property’s legal status for clarification:

- Different types of deeds, including a warranty deed or a quitclaim deed

- Title report

- Property survey

- Zoning and land use restrictions

You can work with a title company, which will perform a professional title search to verify the seller’s legal capacity to sell the property.

Step 2 – Describe the Property

Describe the real property that the buyer will receive in the sale. Give the property address and legal description. You can locate the legal description on the property’s deed, mortgage documents, title insurance policy, or property tax statements. It should follow this format:

[Lot Numbers]

[Additional Details associated with the Lot Numbers]

[Block Number]

[Subdivision or Survey Name]

[City]

[County/Parish]

[State]

Also, note if any personal property will be included in the sale. This may include appliances like washers, dryers, ovens, and dishwashers.

A standard purchase and sale agreement will include all fixtures unless stated otherwise, so be sure to list any fixtures excluded from the sale.

Step 3 – Make the Appropriate Disclosures

Sellers must provide buyers with all disclosures mandated by federal, state, and local laws. The disclosures reveal issues with the property’s condition or enjoyment and ensure the buyer has all the information they need to make an informed purchase decision. Common disclosures include the lead-based paint disclosure and the property disclosure statement.

Be wary if you live in a caveat emptor or “buyer beware” state, as sellers may not have to disclose certain property issues. It may be up to the buyer to conduct their due diligence. Even in caveat emptor states, sellers may not conceal known defective conditions or make misrepresentations regarding the property.

Amendments & Addenda

If you write a property purchase agreement and later discover required disclosures are missing, you can use an addendum to a purchase agreement to add them. Additionally, you can use an amendment to a purchase agreement to update existing terms to reflect the most current information.

Step 4 – Provide the Purchase Price and Details

Note the total purchase price and specify the payment method the buyer will use. Also, specify the amount of the earnest money deposit that the buyer must pay upon signing. It’s typically anywhere between 1% and 3% of the purchase price and indicates that the buyer is serious about following through on the purchase.

Payment Options

If the buyer can’t pay with cash upfront, the parties may use a loan agreement or payment plan. If the buyer knows the seller well, a promissory note may suffice.

Step 5 – Discuss the Assumption of Loans & Leases

A real estate purchase contract dictates sale terms, but it also handles the assumption of existing loans and leases. If the property currently has a lease agreement with a tenant, it will be transferred to the buyer unless otherwise stated. You can also choose whether the seller’s existing mortgage will be transferred to the buyer.

Step 6 – Highlight Contingencies

It can be difficult for a buyer to fulfill their end of a real estate purchase agreement if they don’t first complete specific actions, like selling their current property or acquiring financing. You can use your purchase agreement to highlight contingencies, assuring the buyer that the sale will only proceed if certain conditions are met first.

Satisfaction of Mortgage

In some cases, the purchase and sales agreement might involve the buyer’s assumption of the seller’s existing mortgage. If this applies, you must include provisions regarding the satisfaction of mortgage within the agreed-upon timeline.

Step 7 – Include Other Provisions

Include other provisions, such as:

- What representations and warranties come with the purchase

- Whether there will be a deadline to resolve property condition issues after an inspection

- Who needs to buy title insurance

- When the buyer will take possession of the property

Step 8 – Provide Closing Information

Your real estate purchase contract should outline the necessary closing details, such as the following:

- The date and location it will take place

- The payer of the closing costs

- Whether the buyer will be allowed to delay the closing process

- The required buyer and seller deliverables and supporting documents

Step 9 – Outline Final Details

Include other final details, such as the governing law, dispute resolution method, and effective date of the agreement.

You can include additional provisions in the purchase agreement.

You can include additional provisions in the purchase agreement.

Step 10 – Collect Signatures

Have the buyer and the seller sign the property purchase agreement to make it legally binding. It will only be enforceable if all stated contingencies are satisfied.

Notarization is typically not required, but it can enhance the document’s legitimacy. In some cases, you may need a notary acknowledgment if it’s required by lenders or title companies.

Purchase and Sale Agreement Sample

View our free purchase and sale agreement sample to see how to structure the terms of your real estate transaction. Create your own using Legal Templates’s guided form, then download a copy as a PDF or Word document.