What Is a Colorado Quitclaim Deed?

A Colorado quitclaim deed is a document used to transfer property from one person to another without any warranties as to the owner’s title or ownership. This deed is common when transferring property between family members or changing the deed to add or remove a party.

A quitclaim deed in Colorado is permanent, meaning it doesn’t expire. Once it’s signed and executed, it transfers the property and remains valid unless it’s proven to be fraudulent or otherwise unenforceable.

What to Include in a Colorado Quitclaim Deed

One of the most important Colorado quitclaim deed requirements is the inclusion of the word “quitclaims” in your document. CO Rev Stat § 38-30-113(d) requires the use of the word “quitclaims” instead of “conveys,” as “quitclaims” shows a conveyance of property without promises or warranties regarding the property or its title. Other essential elements for your Colorado quitclaim deed include the following:

- Grantor’s name and street address

- Grantee’s name and street address

- Legal address of the grantee (per CO Rev Stat § 38-35-109)

- Legal description of the property for sale

- Appurtenances (fixtures) that come with the property

- The county where the property for sale is located

- Consideration paid for property ownership

- Date of the agreement

When providing the legal description, you can use one of the four methods outlined by the Colorado Department of Local Affairs:

- United States Governmental Survey System (also known as the “rectangular survey system”)

- Metes and bounds

- Lot and block system (also known as the “recorded plat system”)

- Colorado Coordinate System

According to CO Rev Stat § 38-30-107, any deed is deemed to convey the property’s full interest unless the grantor explicitly indicates that it is for a portion of the property. So, if your quitclaim transfer is for a partial interest in a real estate property, be sure to indicate the form and value of that interest.

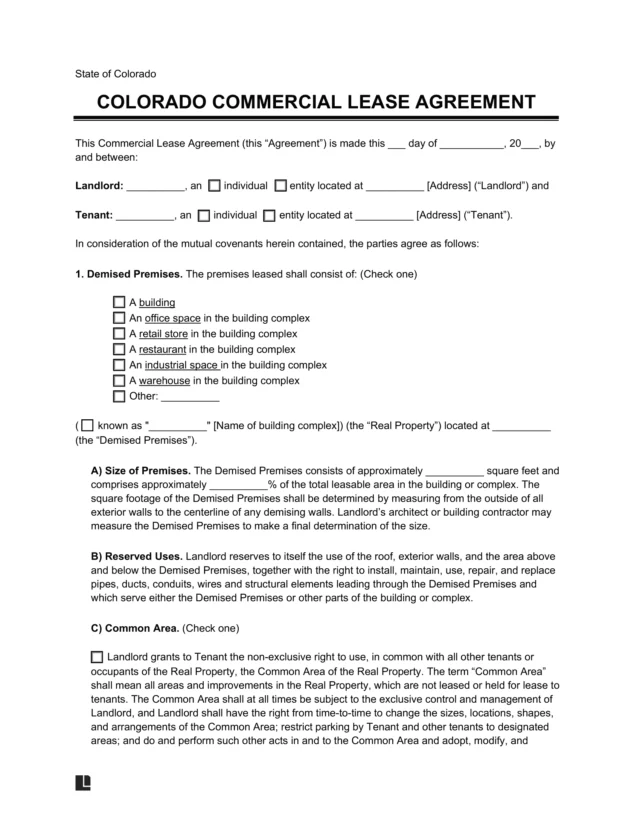

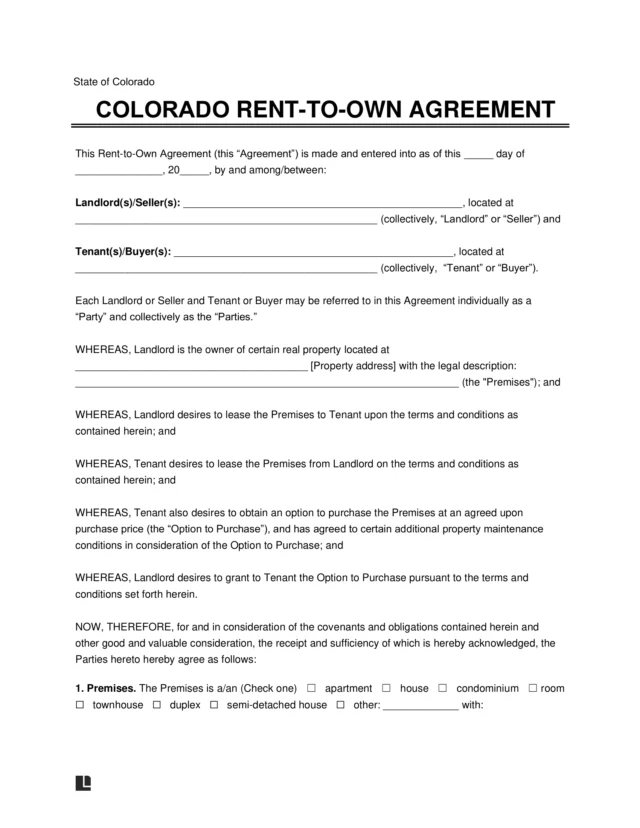

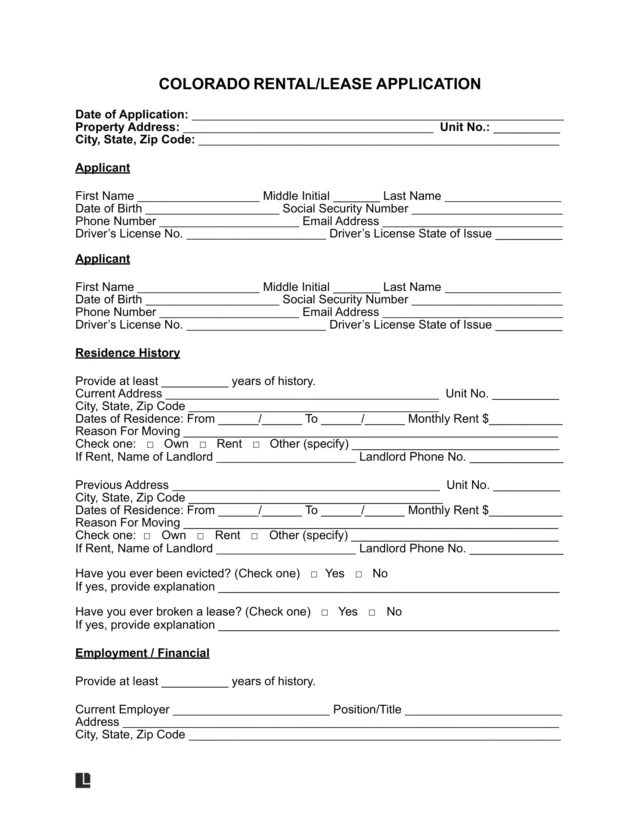

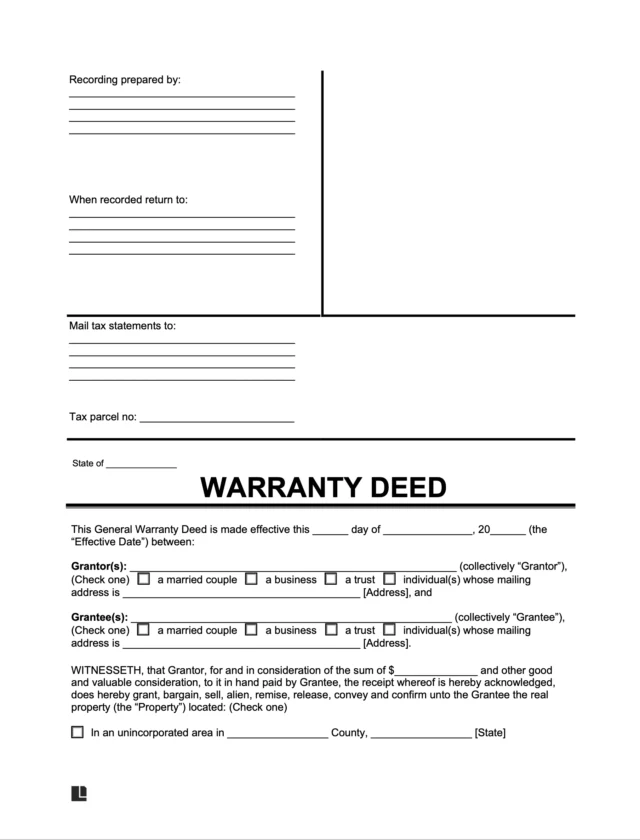

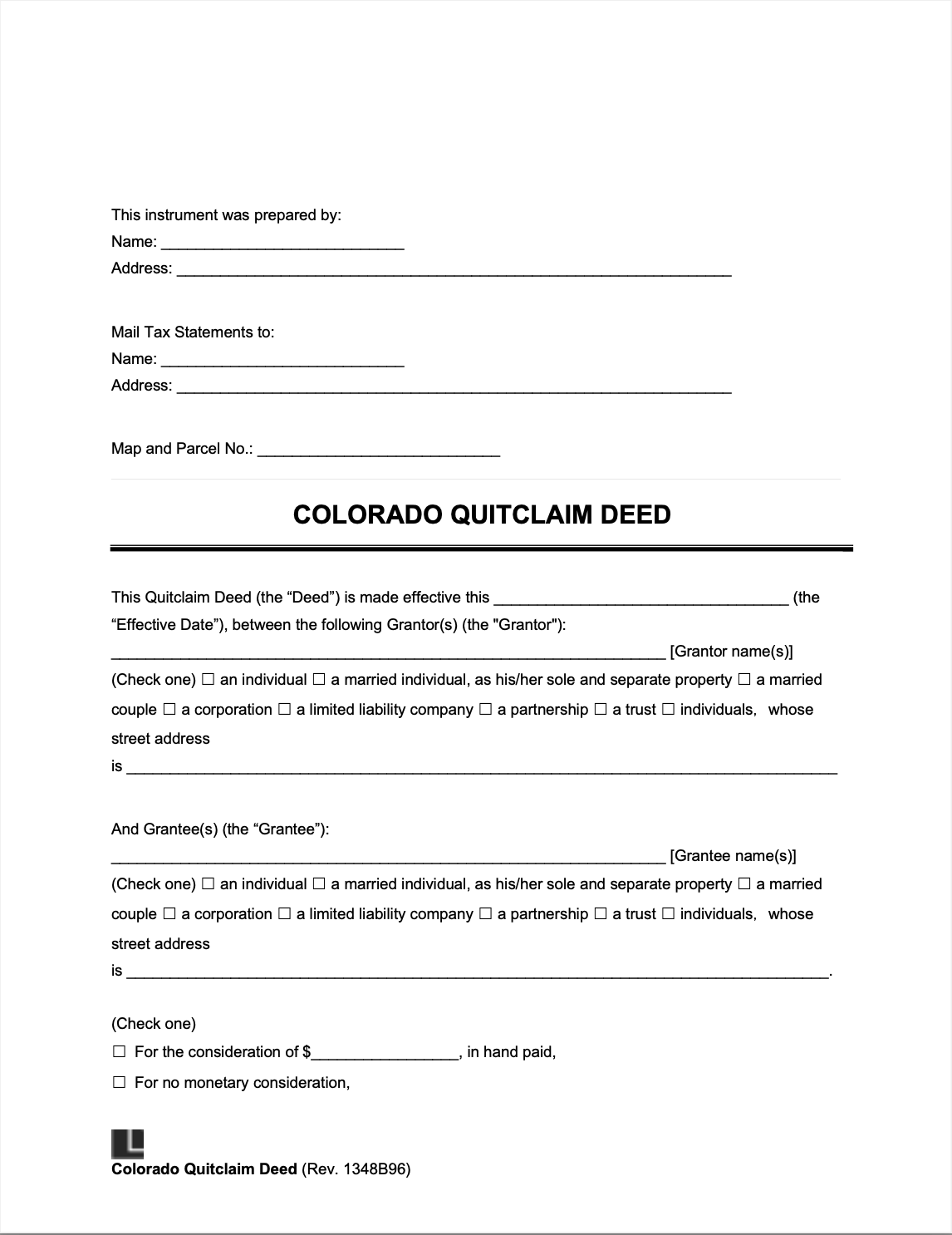

Sample Colorado Quitclaim Deed

Take a look at a Colorado quitclaim deed sample below to get a better idea of its format. Customize yours with your property’s and parties’ details using our guided form, then download it as a PDF or Word document.

Formatting Requirements for Quitclaim Deeds in Colorado

Colorado quitclaim deeds must adhere to specific formatting standards to be considered valid. Per CO Rev Stat § 30-10-406, every page of the deed must have a top margin of at least one inch and side and bottom margins of at least half an inch. A county clerk can refuse a document that does not meet these requirements.

The document must also be legible and easy to copy or record digitally. This typically means using white paper with dark print or text large enough to be easily readable.

How to File a Quitclaim Deed in Colorado

Filing a quitclaim deed in Colorado requires gathering the necessary documents, signing them in the presence of a notary, and submitting the paperwork to the correct county office. Following each step carefully helps ensure your transfer is valid and properly recorded. See how filing a Colorado quitclaim deed works below.

Step 1 – Secure the Original Deed

To complete a quitclaim deed, you must obtain a copy of the original deed for the property or property interest you plan to convey. The document contains the legal property description you need.

As the property owner, you may already have this document in your possession. However, if you are unable to locate it, you can request a copy from your county recorder’s office.

Step 2 – Fill Out the Quitclaim Deed Form

Complete your Colorado quitclaim deed form to transfer interest in a property without warranties. You can use Legal Templates’s guided form to ensure you get all of the elements correct.

Step 3 – Sign the Quitclaim Deed in Front of a Notary

Per CO Rev Stat § 38-35-104, the grantor must sign the completed quitclaim deed before a notary public or other authorized officer. No additional witnesses are required, and the grantee does not have to sign.

Step 4 – Complete a Real Property Transfer Declaration Form

Complete a Real Property Transfer Declaration (TD-1000) in accordance with CO Rev Stat § 39-14-102. This document includes critical property value information for tax assessments by the Colorado Department of Revenue.

Step 5 – File the Form and Pay the Fees

As mandated by CO Rev Stat § 38-35-106, submit your Colorado quitclaim deed, real property transfer declaration, and appropriate fees and taxes to the county clerk and recorder for the county in which the real property is located.

You will also be required to pay recording fees and a documentary fee tax, as applicable. Tax rates depend on the consideration you receive for the property transfer and whether your deed is exempt.

How Much Does a Quitclaim Deed Cost in Colorado?

Knowing the recording fees and potential taxes tied to a Colorado quitclaim deed can help you plan ahead, meet state requirements, and avoid unexpected costs during your property transfer.

As of July 1, 2025, Colorado counties must use a flat fee per document. This fee is $43 regardless of the document’s length (HB24-1269). The $43 fee is broken down into the following three elements: $40 for the document, $2 for taking and certifying each affidavit, and $1 for each certificate and seal (CO Rev Stat § 30-1-103).

Taxes Associated With Colorado Quitclaim Deeds

Transferring a property via a Colorado quitclaim deed may include tax payments to the state and federal governments, as follows:

1. Documentary Fee

The state imposes a transfer tax called a documentary fee for any deeds registered with the county clerk and recorder (CO Rev Stat § 39-13-102).

The grantee or buyer who receives the quitclaimed property pays the documentary fee. For deeds with consideration over $500, the fee is $0.01 for every $100 or fraction thereof.

You can pay the fee to the county clerk and recorder in the county where the property is located. If the property is located in multiple counties, you can pay it in one transaction. The county clerks and recorders of the counties will divide the fee based on the ratio of the property located in each county.

The following exemptions apply to documentary fees in real estate transfers, per CO Rev Stat § 39-13-104:

- Deeds conveyed to or from the US, State of Colorado, or any agency or political subdivision thereof.

- Deeds conveying property as a gift.

- Deeds confirming or correcting a previously recorded deed.

- Deeds conveying title to cemetery lots.

- Deeds transferring property for consideration of less than $500.

- Deeds conveying future interest in the property.

- Deeds transferring title due to the grantor’s death.

2. US Gift Tax (Form 709)

The state does not charge a gift tax. Federal gift tax for real estate transfers is imposed only on taxes over the exemption amount dictated by the Internal Revenue Service (IRS).

The amount changes annually, so check the IRS website before you file your annual income tax. The gift tax is paid by the grantor who gifted the property, using Form 709.

3. Capital Gains Tax

The state charges capital gains tax on taxable income from certain real estate sales. The flat capital gains tax is 4.4%, which is the same as the Colorado income tax rate, but this rate may change from year to year. The grantor who gained income from the real estate transfer is in charge of paying the tax.

Your transfer may also be subject to federal capital gains tax. Requirements and rates for state and federal capital gains taxes differ. Tax rates are also subject to change periodically, so check with a tax professional or real estate attorney when filing your annual income taxes.