What Is a Quitclaim Deed in Texas?

A Texas quitclaim deed is a legal document that allows you to transfer any interest you may have in a property to someone else. It does not promise that you own the property or that the title is clear. It only passes along the rights you currently hold, if any.

Since a quitclaim deed includes no warranties, it differs from a warranty deed, which guarantees ownership and protects the new owner from past title issues. In Texas, a quitclaim deed is often used when the parties involved already have a level of trust, such as family members or former spouses.

Choosing the Right Deed for Your Situation

Quitclaim deeds offer fewer protections than other deed types. If you’re unsure whether a quitclaim is the best fit, check out our guide on the different types of deeds for transferring property to compare your options.

What To Include in a Texas Quitclaim Deed

A Texas quitclaim deed must include specific details to comply with state rules and to ensure the transfer is clear for both parties. The items below help ensure your deed is complete before filing it with the county clerk.

Guarantor and Grantee Information

List the full legal names of the person transferring the property (grantor) and the person receiving it (grantee). Texas requires the grantee’s mailing address to appear in the deed or in a separate document that is attached to the deed. Without it, the county clerk may charge a penalty (Texas Property Code § 11.003).

Ownership Type

Describe how the property is owned, like by one person, spouses, or a business. This helps avoid confusion about who is transferring the property.

Effective Date

Include the date the quitclaim deed should take effect. This is usually the day the grantor signs the document.

Money Exchanged

State whether any money, known as consideration, is being exchanged. If the transfer is a gift, list a small, symbolic amount, such as $10.

If You're Gifting the Property

Under the Texas Property Code § 13.001(b), a quitclaim deed doesn’t protect the new owner. If you gift the property, any hidden debts, liens, or ownership claims from the past can still be enforced against the new owner.

Exceptions or Conditions

If the grantor retains certain rights, such as the right to use the property for a specified period, list those terms clearly in the deed. Also state whether the transfer is subject to any other restrictions, such as easements or right-of-ways.

Homestead Status

Note whether the property is the grantor’s homestead. Texas has strong homestead protections, and stating this up front can help you avoid questions later.

Additional Documents

Depending on your situation, you may need to include a few extra documents with your quitclaim deed:

- Certified English Translation: If the deed is signed outside of the United States, Texas requires a certified English translation to be attached (Texas Property Code § 11.002).

- Court Judgement Showing Ownership: If a court awarded the property to you, add a copy of the judgment to show that you have the right to transfer it (Texas Property Code § 11.0052).

- Mortgage Reminder: A quitclaim deed does not transfer a mortgage. The loan stays in the grantor’s name until the lender updates it or it is paid off. Make sure to contact the lender if the mortgage also needs to be transferred.

What to Know About Using Quitclaim Deeds in Texas

Quitclaim deeds offer no guarantees about ownership, and many Texas title insurance companies will not insure properties transferred this way. If you need a document that still avoids warranties but is more widely accepted by insurers, consider using a deed without warranty instead.

Texas Quitclaim Deed Rules & Legal Requirements

Texas has several important rules that must be followed to make a quitclaim valid. Here are the key requirements to know before you file:

Signing and Notarization Rules for a Quitclaim Deed in Texas

To be valid, a Texas quitclaim deed must be properly signed and notarized:

- The grantor must sign the deed in front of a notary or two witnesses (Texas Property Code § 12.001). The guarantee does not have to sign the deed.

- The signatures must be original or formally acknowledged by a notary (Texas Property Code § 12.0011).

- Electronic signatures are allowed, but the notary must print the deed, add their official seal, and include a certification stating that the electronic signatures are genuine (Texas Property Code § 12.0013).

Community Property Considerations

Texas is a community property state, which means both spouses generally own property acquired during a marriage.

When transferring real estate:

- Clearly state whether the property is separate property or community property for legal and tax purposes

- If the property is community property, the spouse may need to sign the deed or provide written consent

Clarifying ownership helps prevent disputes later, especially during divorce or estate planning.

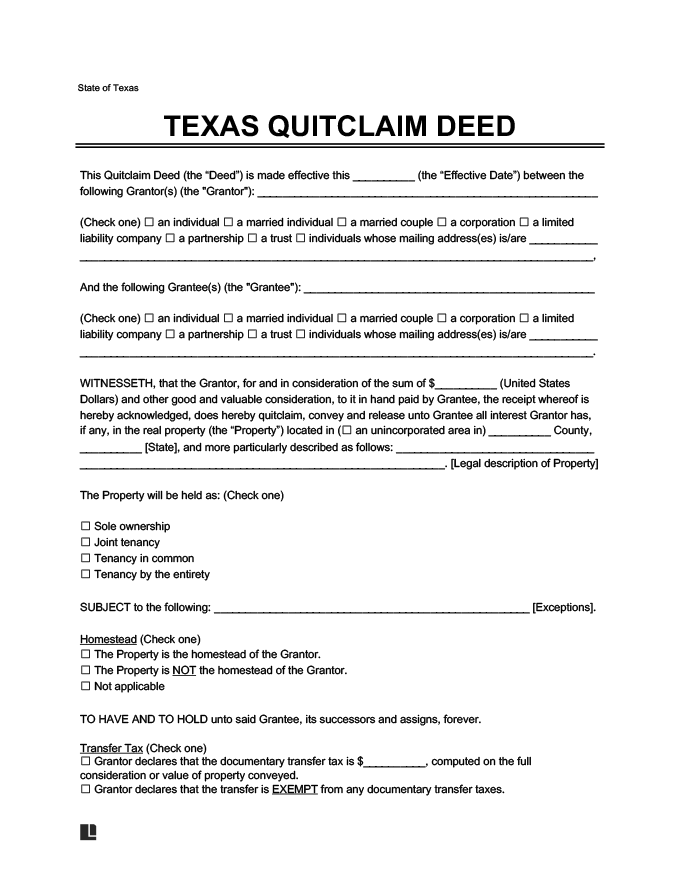

Sample Texas Quitclaim Deed Form

You can view a sample Texas quitclaim deed form below to see what details to include and avoid common filing mistakes. Use our questionnaire to quickly customize and generate a free Texas quitclaim deed in PDF or Word format that fits your situation.

How To File a Quitclaim Deed in Texas

Follow the steps below to complete and record your deed correctly.

Step 1 – Get the Current Deed

Start by locating the most recent deed for the property. This document helps confirm ownership and provides the legal description you’ll need for the new deed. If you don’t have a copy, contact the county clerk in the county where your property is located.

Step 2 – Fill Out the Texas Quitclaim Deed Form

Before you fill out your form, make sure you have all the key details required for a Texas quitclaim deed, such as the information of both parties and the property description. Once ready, you can use Legal Templates’s simple questionnaire that guides you through the process and helps you complete your form in minutes. Once completed, download and save your form as a PDF or Word file.

Step 3: Sign the Deed in Front of a Notary

Sign the deed in front of a notary or two witnesses so it can be recorded (Texas Property Code § 12.001). Texas law requires the grantor’s signature to be officially verified before the document can be filed. After signing, make sure the notary completes their portion of the form.

Step 4: File the Deed With the County Clerk

Once signed, file the deed with the county clerk in the county where the property is. The clerk will record the deed, update the public records, and return a stamped copy for your records (Texas Property Code § 11.001).

Texas Quitclaim Deed Costs and Fees

Filing a quitclaim deed in Texas is usually affordable because the state does not charge transfer or gift taxes. You may still have filing fees and possible federal obligations.

Filing Fees

Texas counties charge a small fee to record a quitclaim deed. Most counties follow the rates listed in Texas Local Government Code § 118.011:

- $25 for the first page

- $4 for each additional page

Your county clerk can confirm the exact total based on the number of pages in your deed.

Taxes and Other Costs

While Texas does not impose additional state taxes on property transfers, there are a few federal tax obligations to consider:

- Federal Gift Tax: If the property is given as a gift, the grantor may need to report it to the IRS using Form 709.

- Federal Capital Gains Tax: If the new owner sells the property later for more than its adjusted basis, federal capital gains tax may apply.

For most people, filing the deed only involves paying the county recording fee, with no state-level taxes required.

What Happens After You File a Quitclaim Deed in Texas?

Once your quitclaim deed is filed and recorded with the county clerk, it becomes part of the public record. Texas law also sets rules for how the deed affects the buyers, creditors, and ownership claims.

Four-Year Rule for Recorded Quitclaim Deeds

Under Texas Property Code § 13.006, two scenarios become true four years after the deed is recorded:

- The deed can no longer be used to challenge whether a later buyer or lender acted in good faith.

- The deed no longer counts as notice of any unrecorded claims, liens, or past transfers.

The rule helps resolve older title issues and provides future buyers and creditors with more confidence in the property records.

Quitclaim Deeds and Adverse Possession

Texas also limits the use of quitclaim deeds in adverse possession cases. Under Texas Civil Practice and Remedies Code § 16.025(b), a person cannot use a quitclaim deed to support a five-year adverse possession claim. This means a quitclaim deed alone is not enough to gain ownership through possession.

Can You Reverse a Quitclaim Deed in Texas?

A quitclaim deed can be reversed, but only in certain situations:

- Both Parties Agree: The grantee can transfer the property back by signing a new deed.

- Fraud or Pressure: A court may cancel the deed if it was signed under duress, incapacity, or due to an apparent mistake.

- County-Ordered Changes: A judge can reverse ownership during legal cases such as divorce, probate, or bankruptcy.

Reversal does not happen automatically. A new deed or a court order is usually required to undo the transfer.