What Is a Warranty Deed?

A warranty deed is a legal document that facilitates the transfer of ownership of property. The seller (the “grantor“) uses it to promise the buyer (the “grantee“) that they have the right to transfer the piece of real property. This document also states that the property has no undisclosed liens.

A warranty deed doesn’t prove ownership on its own. Instead, it lets the grantor swear that they own the property and will defend the grantee against future claims. Even with a signed affidavit of title, the grantor may not be aware of legal claims against the property’s title.

Without this deed, the grantee has no recourse if they discover title defects later. With one, they can seek remedies if the grantor makes false promises.

Recording a warranty deed isn’t necessary, but it’s recommended. Recordation with the county recorder’s office establishes public notice of the ownership and protects the buyer’s rights against other potential owners of the property.

Is a Warranty Deed the Same as a Title?

No. A warranty deed is a physical document that transfers the title, while the title is the legal concept of ownership.

General Warranty Deed vs. Special Warranty Deed

A general warranty deed guarantees that the title to the property is warranted against all possible defects (even defects a grantor isn’t responsible for causing).

It offers more protection to the grantee by guaranteeing the entire property history, including the time before and after the grantor owned the property. It’s typically used when a grantee pays for a property because it provides the maximum legal protection.

A general warranty deed is the standard choice for real estate transactions. It transfers ownership of real property from one party to another, accompanied by warranties that the property is free from encumbrances.

A special warranty deed (or a limited warranty deed) guarantees against defects to a property’s title for the period when the grantor owned it. It’s useful when the seller doesn’t want legal responsibility for claims against the title before or after the time when they owned the property.

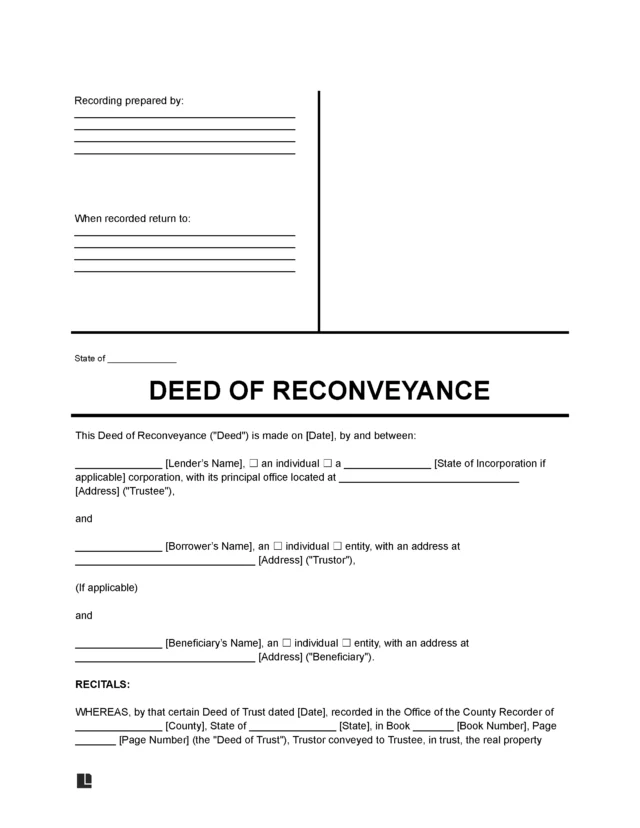

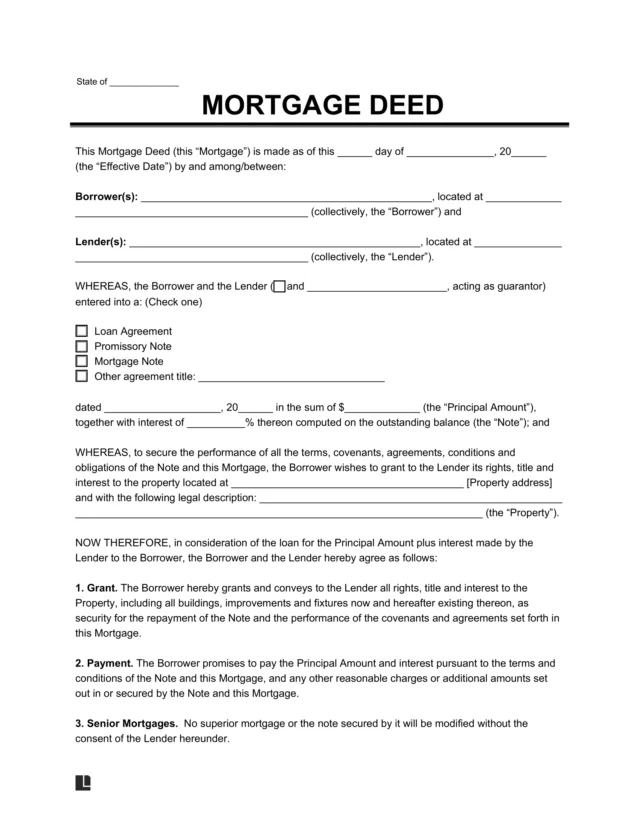

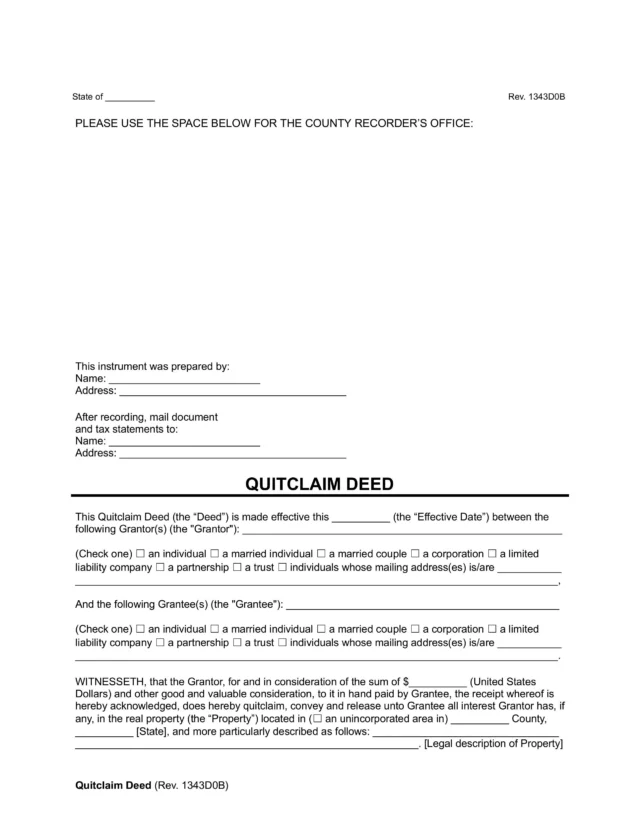

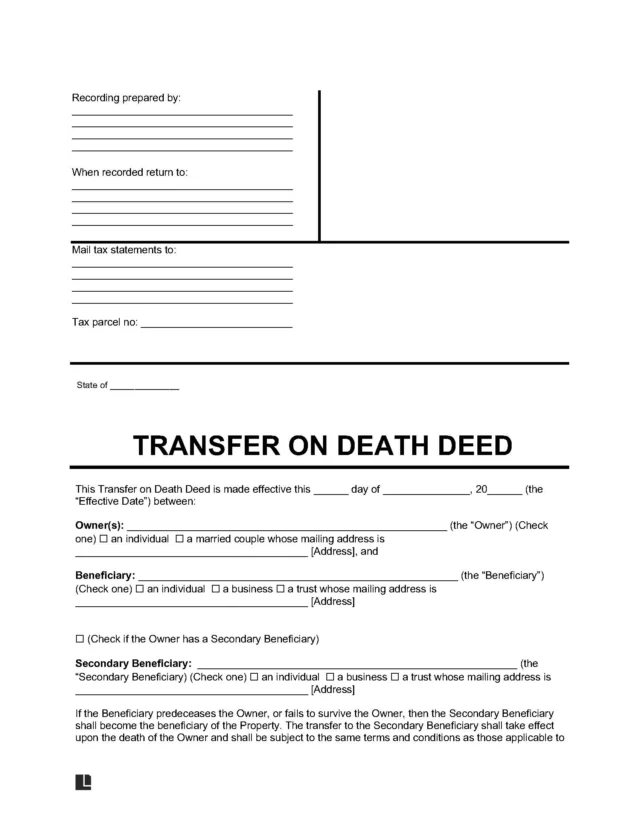

Other Types of Deeds

If you want to explore other ways to transfer property ownership, read our guide on the different types of deeds.

How to Fill Out a Warranty Deed

Filling out a warranty deed properly helps you transfer property smoothly. Learn how to fill out a warranty deed below, using Legal Templates’s form to guide you through the process.

Step 1 – Specify the Type of Warranty Deed

Our warranty deed template allows you to choose from two main types: general or special warranty deeds. Select a general warranty deed for optimal protection, or choose a special warranty deed if you only want to protect against title defects that arose during the grantor’s ownership period.

Step 2 – Name the Grantor

Name the grantor, noting whether they’re a married couple, individual, business, or trust. Provide a single mailing address where the grantor can receive notifications.

Clarify whether the grantor is the one preparing the deed. It’s common for the grantor to be the deed preparer, but you can list another person or entity’s name if someone else will write it.

Step 3 – Identify the Grantee

Name the person who will receive the title, identifying them by name and listing their mailing address. Indicate whether the recorded deed should be returned to the grantee. You can name someone else if you want the recorded deed to be returned to another individual.

Warranty deeds can transfer ownership to multiple new owners, referred to as joint tenants. Specify the portion that each joint tenant will own (if applicable).

Step 4 – Describe the Property

Describe the property that will be transferred under the warranty deed. Offer a legal description, which can take one of three forms:

- Metes and bounds

- The lot and block system

- The rectangular survey system

You should also provide an official street address. If the property is located in an unincorporated area, it won’t have a street address. Instead, you can simply specify the county and state in which the property is located.

Step 5 – Note Exceptions to Encumbrances

The deed type will specify the period it covers, but it’s up to you to note any exceptions. For example, a warranty deed may contain the following exceptions:

- Easement: A party who is not the grantee will reserve the right to keep using part of the property.

- Life estate interest: The grantor retains legal ownership of the property until after they die for tax purposes.

- Mineral rights: A party who is not the grantee reserves any remaining interests in the property’s subsurface oil, gas, or other mineral rights.

A warranty deed can contain up to six key promises or covenants that the grantor makes to the grantee. You can decide if any of these promises will be excluded from the warranty deed:

- Covenant of seisin

- Covenant of the right to convey

- Covenant against encumbrances

- Covenant of warranty

- Covenant of quiet enjoyment

- Covenant of further assurances

Step 6 – Declare the Amount Paid & Tax Information

Provide the amount to be paid for the property, if any. If the property is being gifted, you can list a nominal amount as a placeholder for the actual value.

You should also provide information about transfer taxes. Some states require a transfer tax, while others don’t. Even if your state requires it, you may be eligible for an exemption, such as if the transfer is occurring between a parent and a child.

Be sure to provide the property’s parcel number (which you can get from the property’s tax statement) so that the appropriate county can easily refer to it if needed.

Step 7 – Sign the Document

Have the grantor sign the document. Follow the signing requirements for your state and county, as some areas require grantors to sign before one or more subscribing witnesses or a notary public.

Most states don’t require the grantee’s signature, but if you’re unsure, you can have them sign it just in case.

Does a Warranty Deed Need to Be Notarized?

Most states require a warranty deed to be notarized for added authenticity. If you’re unsure of your jurisdiction’s requirements, check with your local county recorder’s office.

Sample Warranty Deed

If you’re wondering what a warranty deed looks like, you can view a blank warranty deed form below. It shows you the different fields and gives you an idea of what information you’ll need to provide to create your own. When you’re ready, you can use Legal Templates’s guided questionnaire to write a customized warranty deed form. We’ll make it ready to download in minutes in PDF or Word format.